Gold had an epic bull market in the noughties - I still remember the key numbers like it was yesterday.

There was the low in 1999 at $250/oz, marked for all eternity by Chancellor of the Exchequer, Gordon Brown, as he sold off two-thirds of British gold at the bottom of the market, when there were no compelling need to sell.

That low was re-tested in 2001 and we got a classic double bottom, followed by eight years of bull market, which ended, after a big wobble in 2006, in 2008 at $1,030/oz.

Then the Global Financial Crisis came along. Gold plummeted along with everything else. An unstoppable rebound lasting three more years followed. First, the gold price broke out to new highs, and on it marched until it eventually peaked in 2011, with the Greek debt crisis, at $1,920/oz.

Then came the bear market. Five brutal years of pain. It went all the way back to $1,040/oz.

The period between 2018 and 2020 saw gold rally again, heading north of $2,000/oz, albeit briefly.

But here we are in early 2023. And guess what? As I write, gold sits at $1,920/oz - the same price as it was back in 2011. Markets remember prices.

What’s next for the gold price?

Will it pull back from here? Maybe. Probably.

It has rallied $300/oz in barely two months. It’s overbought. Neither silver nor the miners are leading. That’s usually not a good sign.

Charlie Morris says gold is trading above fair value. Charlie Morris is usually right.

You can get cute and try and trade it, but no one knows what is going to happen. It’s a precious metal and it’s a market. If they can throw you, they will.

But then again, gold usually does well when trust in financial markets is low. I’d say that’s the case now. Do you risk your position in the hope that you can get back in lower? What if it goes up instead?

Or you can take the longer-term view. Like the famed trader, Old Partridge, in Edwin Lefevre’s Reminiscences of a Stock Operator, who never wanted to lose his position in a bull market, a view since echoed by a memed typo, you can just hodl on.

We must each make our own choices, learn from them and live with them.

What happens to the gold price if everyone starts buying?

Here’s a nice little thought experiment.

I’ve heard it before - but I’d forgotten it, and it was brought to my attention again by Winston Miles of Canadian investment house Eight Capital.

There was a presentation by strategist Grant Williams in 2016 called “What If?” when he asked what would happen if pension funds, which currently had a 0.15% weighting to gold, increased that allocation. Miles decided to run that scenario in today’s marketplace.

“According to the OECD’s most recent data, global pension assets are $56 trillion. I could easily see pension funds getting up to 1% of their portfolio in precious metals on average. But let’s be a bit more conservative and go with two-thirds of 1%, or 66bps… which is $373,903,924,800.

“That amount of money … could buy every single company that makes up the Philadelphia Gold and Silver Index… which would set them back a cool $297 billion. Then they could buy every share of GLD, even taking delivery of all that gold if they wanted, as it’s all sitting in a vault somewhere. That would cost another $56 billion. Then with the scraps left over, they could buy every share of the GDX… GDXJ… SIL… AND the SILJ.” (Those are the gold and silver mining ETFs).

In short, there’s a lot of money out there. On a relative basis, there isn’t a lot of trade-able gold, and there aren’t that many gold mining companies. A small shift in the narrative could send the gold and silver markets a long way higher.

“It’s an environment,” says Miles, “where almost no major pensions have a portfolio manager focused on metals and mining. The infrastructure is totally gone. It’s hard to add supply, the mines are old, it takes ten+ years to build new ones, these are really long lead time projects.”

You can conduct the same thought experiments with oil, gas and coal. Very little allocation (largely because of ESG), and very little investment leading to tight supply and long lead times.

You can conduct the same experiments with bitcoin. What happens to the bitcoin price, if bitcoin were to become a core, mainstream portfolio holding?

They all go a lot higher.

You can’t say the same about tech, the S&P 500, or government bonds. They are already owned.

The narratives for gold, fossil fuels or bitcoin may not change, but if they do, look out above.

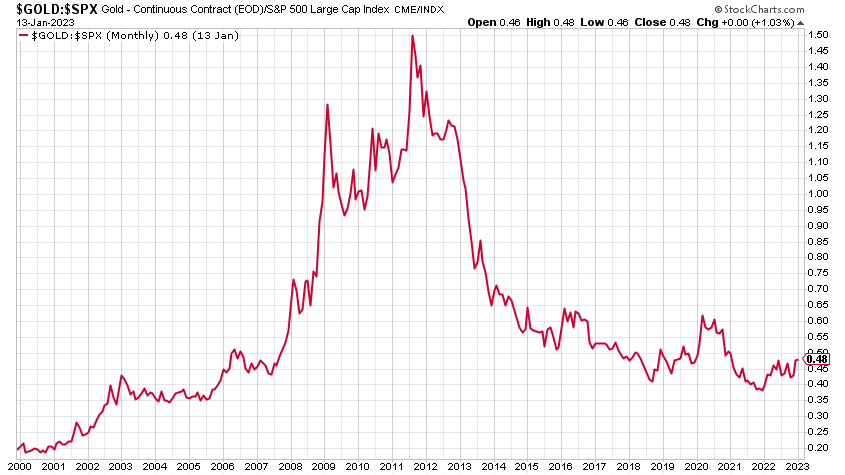

On this note, here is the S&P500 relative to gold since 2000. When the chart is rising, gold is rising relative to the stock market and vice versa.

At $1,920/oz gold is a lot cheaper today, relative to the stock market, than it was when it was $1,920/oz back in 2011. It’s a third of the price.

To get back to those equivalent levels, assuming no change in the price of the S&P500, gold would have to triple. I like the sound of $5,700/oz gold!

Gold and gold miners

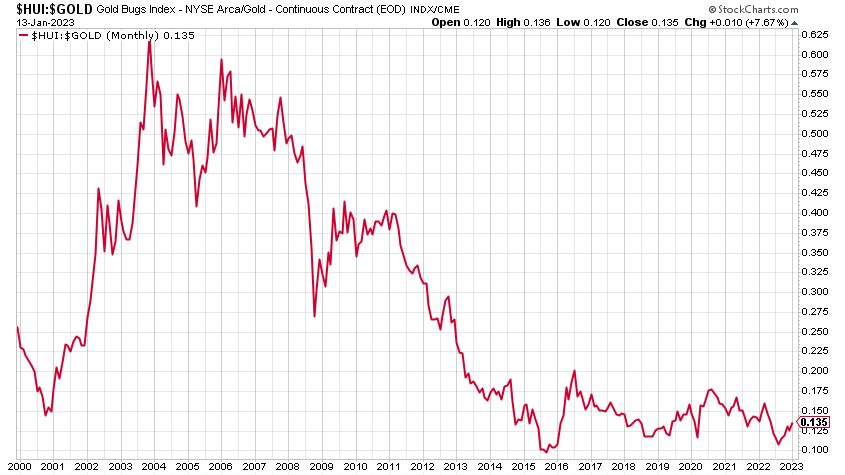

Here are the gold miners relative to gold.

With the plethora of new ways that opened up to get exposure to gold in the 2000s - ETFs, online bullion dealers, CFDs, spread bets and all the rest of it - investors stopped bothering with miners, and who can blame them?

Too much incompetence, too many frauds, too much political and environmental risk - and all the rest of it.

Miners have been falling since 2003. But they stopped falling in 2015. Since then they’ve gone sideways. They are, as the technicians say, “building cause”.

I reckon the low is in. It came in 2015. And we re-tested it last year.

What do you think? Post your comments below.

If you’re buying gold, my current recommended bullion dealer in the UK is The Pure Gold Company, whether you are taking delivery or storing online. Premiums are low, quality of service is high. You can deal with a human being. I have an affiliation deals with them.

If you’re buying bitcoin, be sure to read my special report.

And make your Number One resolution for 2023 to listen to Kisses on a Postcard.

This article first appeared at Moneyweek.

Gold to $5,000? I like the sound of that!