I stumbled across a Gavekal Research Daily Comment over the weekend with a really interesting table that I thought we could discuss today.

Gavekal Research, if you don’t know it, is a financial research firm that provides analysis and insights on global economies, markets and industries. It was founded in 1999 by Charles Gave, Anatole Kaletsky, and Louis-Vincent Gave, and is headquartered in Hong Kong.

It is, the internet tells me, known for its holistic approach to analysis. Holistic is one of those corporate buzzwords that I never really know what it meant.

Again the internet is our friend: in the context of financial analysis, holistic analysis refers to considering a wide range of factors, such as economic, political, and behavioural, in order to gain a full understanding of market developments.

It is a way of looking at the big picture rather than just focusing on specific details or individual factors.

Why didn’t they just say “big picture”? Such is the equivocal financial world in which we live.

In any case, Louis-Vincent’s Gave’s report is a compelling one.

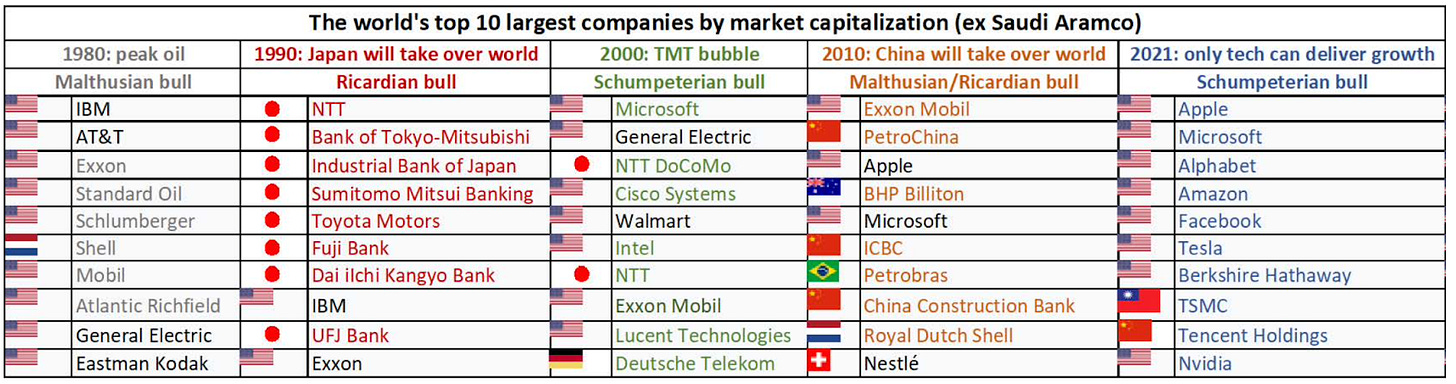

He describes how, roughly every decade or so, financial markets fall in love with a new narrative. This is something we have observed many times in the column. The 1970s were all about precious metals and energy. The 1980s went to Japan. The 1990s saw tech stocks take over and the 2000s were all about natural resources and extraordinary growth in China. The 2010s were all about tech.

So what about the 2020s. What are they all about?

What does the next decade have in store for investors?

Gave suggests that there are three narratives each with a core idea: “The opening of new markets to capitalism (Ricardian growth), technological breakthroughs (Schumpeterian growth), or the fear that in the coming years there will not be enough for everyone (the Malthusian constraint).”

Each time the narrative is persuasive and rooted in some truth, which is why it takes hold, but by the end of the cycle, valuations reach such extremes that they no longer make sense, a bear market sets in and a new narrative takes over.

Asset allocation is everything, I have often argued - and it has been repeatedly proven that being int he right sector is more important than individual stock selection. All you have to do is shift from narrative to narrative. A lot easier said than done of course.

But here is Gave’s humdinger of a table.

You can see how clearly the narrative has shifted with each decade. By the end of the 1970s six of the world’s largest ten companies were oil companies. By the end of the next decade, just one of them was.

By the end of the 1980s, eight of the world’s largest ten companies were Japanese. By the end of the following decade, just two of them were.

At the turn of the century, seven of the world’s largest ten companies were tech related. By the end of the following decade, just two were.

At the end of the noughties, seven of the world’s largest companies were natural resource companies. By the end of the following decade, not one was.

2022 seems to have marked the turning point. The Covid rallies in tech were the final spike in an amazing bull market.

These are all huge companies that make the foundation on which portfolios are built. But how many of 2021’s top ten will be there in ten years' time? Not more than two or three I wouldn’t have thought.

You have to hand it to Microsoft. It’s been there three decades running. Perhaps that’s because, in a way, as much as it is a tech stock it is also a patent holding company. Apple has also made that list twice.

So mighty are these companies and so entrenched in their monopolies, it is very hard to envisage them not being so mighty in ten years' time. But this is the world of tech. New inventions can come along that quickly make old monopolies redundant.

In that regard, I’ve just been playing with a new Open AI chat bot that my son, who is at University in Bristol, put me on to and it’s extraordinary. It can write essays. It wrote a biog that I am now going to use on my site - and it’s a better biog than I’ve ever had.

What the impact of it might be on, say, Google, who knows?

The investment landscape has changed for good

Gave says waiting for the Fed to cut rates and being long the likes of Nvidia or Alphabet makes “about as much sense as sitting in Tokyo in 1992 waiting for the Bank of Japan to cut rates in order to buy Industrial Bank of Japan.”

In short, we are in a transitioning phase. What does the next decade have in store for us?

Elsewhere Howard Marks of Oaktree Capital also argues that we are in a “Sea Change” - only the third we have seen in his career. That the model of success for the previous cycle is not going to work this time around. He suggests that the high leverage, asset owning, low-interest rate, low yield, low inflation models of the last cycle are behind us. The general landscape is much less optimistic.

He suggests that stimulative rates are not coming anytime soon and that the base rate will remain in the 2-4% range. We are now in a full-return world, not a low-return world, and investors can get good returns from credit yield instruments - high-yielding bonds and so on.

What worked before will not work now. What works now might be something that hasn’t worked for a long time.

Commodities could be winners

Gave meanwhile suggests emerging markets and commodities. Even with a China slowdown/lockdown, the Fed tightening and a surging US dollar, the S&P Goldman Sachs Commodities Index (S&P GCSI) has still returned 27%.

This will be an even better story when these forces reverse - when China opens up, the Fed stops tightening and the US dollar rolls over.

The GSCI has returned 27% mostly on the back of energy. Metals have been a rather different story. But with those three reversals in place - weak dollar, no more tightening and China open - the stage is set for metals.

What do you think the next decade’s narrative is going to be? It’s there percolating somewhere. Malthusian, Ricardian or Schumpterian?

Check out special report on helium, if you haven’t already, and Dr John’s latest on bonds. Both for paying subscribers, there is lots of valuable info to be had.

If you are interested in buying gold bullion, my current recommended bullion dealer in the UK is The Pure Gold Company, whether you are taking delivery or storing online. Premiums are low, quality of service is high. You can deal with a human being. I have an affiliation deals with them.

Have you got you Kisses on a Postcard CDs yet?

This article first appeared at Moneyweek.

What does the next decade have in store?