Calling all bottom-fishers

It's the most wonderful time of the year

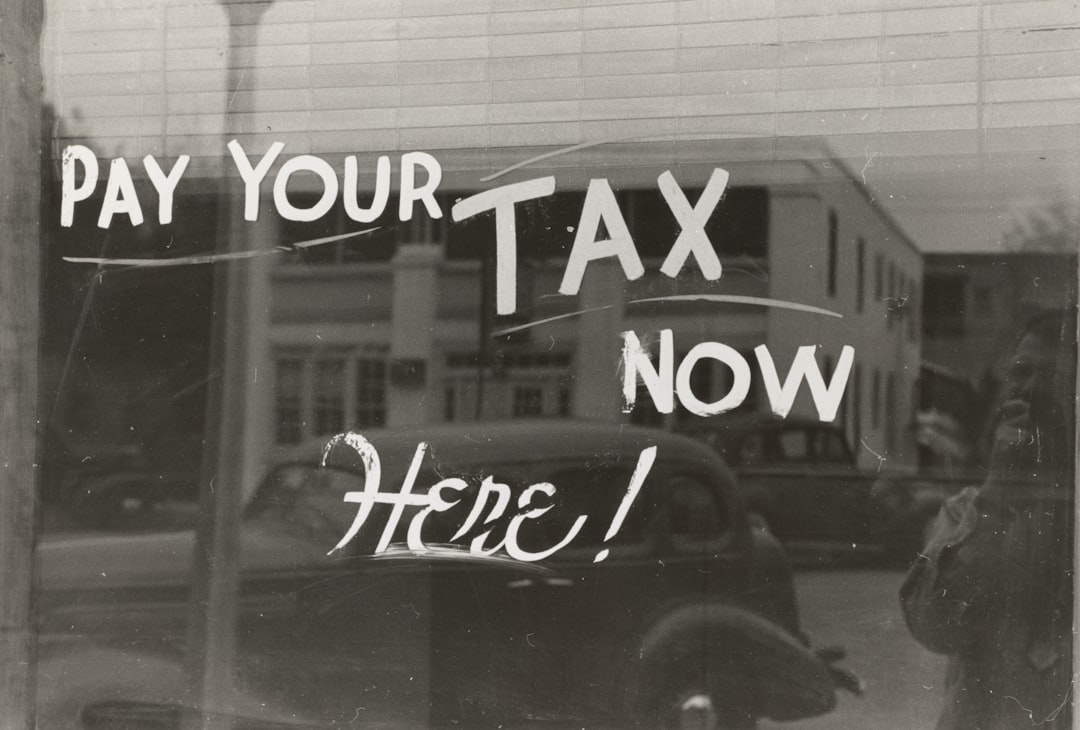

We are now in North American tax-loss selling season. Over the next ten days, in the lead up to Christmas and the end of the North American tax year, many investors, at both the institutional and private level, will be selling losers to realise the tax loss.

Poorly performing companies get beaten up more than they otherwise would so it is often a good time to pick up bargains.

Given that resource stocks have been total dogs since the spring of this year, they are likely to see a lot of selling. My guess is that the selling will climax between December 15 and 22.

It’s a good time to accumulate long-term positions on the cheap in stocks you have been eying up for a while.

But if you speculate in tiny-cap dogs, you can often off-load as soon as the first fortnight in January and realise 50% gains, even doubles sometimes. The usual disclaimers apply: caveat emptor, manage your risk, it doesn’t always work, don’t speculate with money you can’t afford to lose and so on.

Today I update you on companies I have bought in my portfolio and I present a list of ideas for tax-loss selling opportunities. There is lots of quality going on the cheap …