Comstock Lode: Right Place, Right Time?

With undervalued assets and recycling and fuels businesses with enormous growth potential, this $70m company could be poised for a breakout.

Note: Somebody is impersonating me on Substack again. If they solicit you to chat on WhatsApp, Telegram or anywhere, it is not me. Beware.

Right, let’s crack on.

WARNING: This is a high-risk, speculative, illiquid small cap. It has fallen by 98% before. It can do so again. For experienced investors only. If of interest, only risk a tiny percentage of your portfolio.

Ten days ago and back in March, I looked at this rather unusual recycling company, Comstock Lode (AMEX: LODE). It had its earnings call last week. I thought I should just update readers on what I saw as the main points.

Remember: this is a $70 million market cap company, which has:

260 acres of Nevada real estate - data-centre country worth $50m - which it is selling.

A 17% stake in 2,500 acres of similar land nearby, worth another $50m.

A twelve square-mile mining property, which, historically, has produced between seven and eight million ounces of gold and 225 million ounces of silver. There are 600,000 proven ounces of gold and six million ounces of silver. At $50/oz for the gold and $3/oz for the silver, this is also worth $50 million.

A developing solar panel recycling business, Comstock Metals. The demo facility is recycling 135,000 panels a year. Next it plans to build three recycling facilities in Nevada at a cost of $36 million. Between them, by 2030, they will be able to process ten million panels per year - 300,000 tonnes. For every tonne it processes, it makes $600, with an 85% margin. So, assuming flawless execution, that’s $180 million in annual earnings. To build the three facilities will cost $36 million. They still need financing (let alone building), and that will either come from debt or equity (there are multiple solutions). .

A fuels business, Comstock Fuels, which processes waste wood—forestry residue, sawmill waste—and crops into fuels, specifically sustainable aviation fuel, renewable diesel, ethanol, and petrol, with industry-leading yields. As well as building its own refineries, it will licence its technology globally.

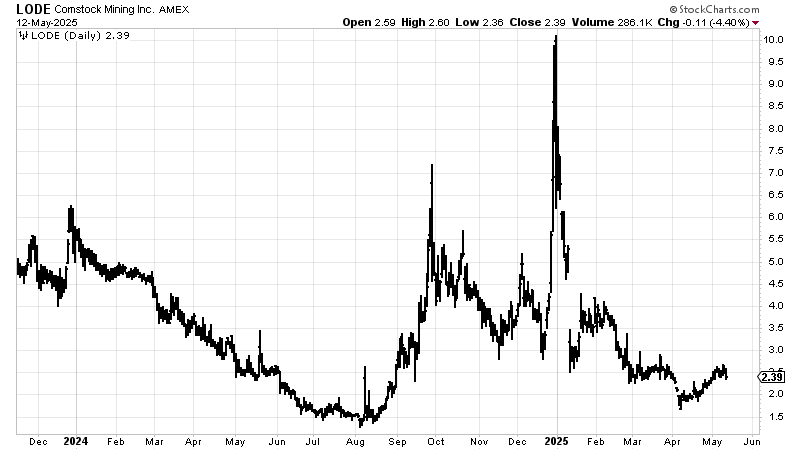

Here’s the chart. Volatile.

So what did I learn from last week’s earnings call? Has my opinion of this company changed?

Here are my main takeaways.