Gold’s Glitter and Bitcoin’s Jitters: Navigating the Bull and Bear Markets of 2025

When will junior mining companies catch up? What to do about bitcoin?

Today I wanted to look at gold and, more specifically, gold mining

I’m also going to give you my thoughts on the latest action in bitcoin, which is going through one of its periodic bone-rattling shake-ups.

Let’s start with gold.

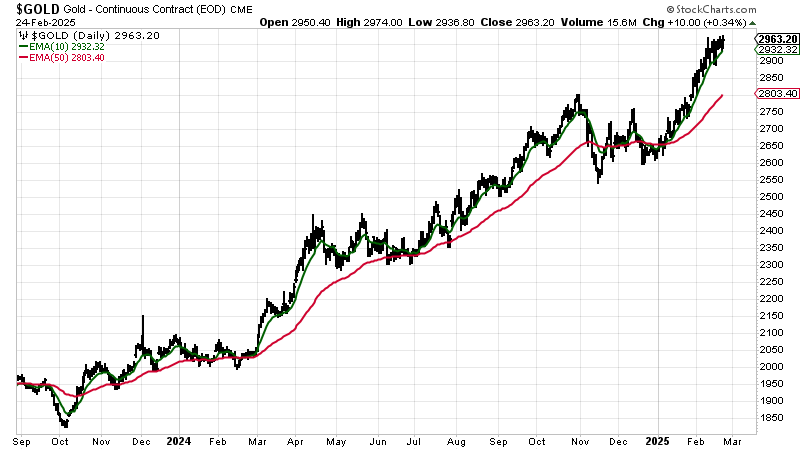

Here’s an 18-month chart, and it is a beautiful thing. Uptrends followed by periods of consolidation followed by uptrends. I’ve also drawn the 10-(green) and 50(red) day moving averages so you can see the direction of the short-term trends. This is what bull markets look like.

The chart is similarly beautiful when measured in pounds.

All that said, we are overbought now and entering a weak time of the year for gold, so don’t be surprised to see a pullback.

If you are buying gold to protect yourself in these uncertain times - and you should if you do not already own some - as always I recommend The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.

Also check out my buddy Charlie Morris’s monthly gold report, Atlas Pulse is, in my view, the best gold newsletter out there. And it’s free. Sign up here.

What About Fort Knox?

It looks as though we are finally going to get the long-awaited audit of Fort Knox. Both President Trump and Elon Musk have said it so and several times. They’ve been making such light of it, one has to assume they know the gold is there. I can’t see how they would have done that if there were any doubts.

Perhaps topping up the stock explains the recent large shipments of gold which have been making their way from London. Perhaps that also explains much of the recent buying—it’s the US buying to replenish their own gold reserves.

There is the possibility Trump and Musk could be taken by surprise, of course.

The short of it: if some of the gold isn’t there, the gold price goes up—potentially a lot. If it is there, it’s business as usual.

For now, I’d say the markets are behaving as though it’s business as usual. They are climbing, and every dip is being bought, largely, it seems, by central banks—especially in Asia—who are diversifying their holdings and de-dollarizing.

There is one theory that needs debunking. US gold is currently marked to market at $42/oz. After the audit, those 8,133 tonnes—assuming they are there and of good delivery quality—could be marked to market at current prices, meaning a significant uplift in the value of holdings.

The theory doing the rounds is that Secretary of the Treasury, Scott Bessent, will use some of the upwards revaluation to monetize the balance sheet—not unlike how Roosevelt did in 1933—to create the funds he needs to buy bitcoin for the strategic reserve.

But Bessent has quite clearly stated that is not his intention.

He has also said they audit the Fort Knox gold every year with the last audit having taken place in September. If so, why have they never published the audit is beyond me, but there must be a reason.

So to gold miners

General consensus is the Trump administration wants lower oil prices and a weaker dollar to make its exports more competitive. A weak dollar, of course, helps the gold price, and thus the gold miners. They sell their product in dollars, and fossil fuels make up a large chunk of their input costs. Low oil prices suit them. They’ll be more profitable.

When gold mining eventually turns up and finds a bull market, some of the smaller companies are going to 5x and 10x. The question is, when? How high does gold have to go before this sector catches a proper bid?

As you know, I focus on junior gold miners. More fool me. These are small companies, often out-and-out explorers, or developing a discovery. Rarely do they have actual production or cash flow.

We’ll look at a three of my picks from the sector, and then we’ll move on to bitcoin.