Is that it for the pound, then?

Was that the high?

The budget (or the “spring statement” as they call this one) was the usual.

Tinkering around the edges, political point scoring, sound and fury, no meaningful reform.

Rishi Sunak might have a picture of Nigel Lawson on his wall, but he’s not emulating him. I had a picture of Kenny Dalglish on my wall for most of my childhood. Didn’t make me a good footballer.

Lawson removed a tax with every budget, incrementally simplifying the tax code and lowering taxes over his six years in office.

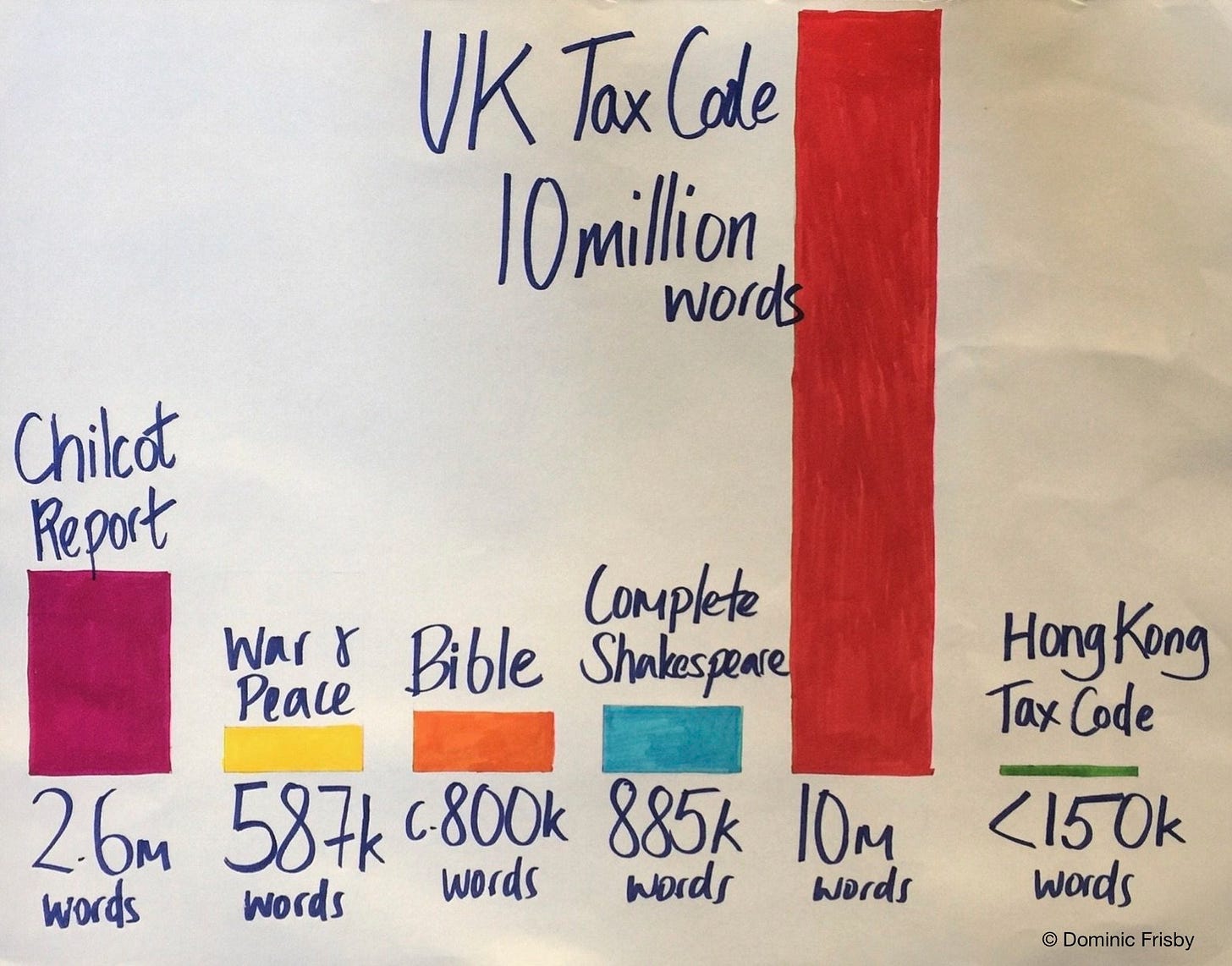

Every chancellor since has incrementally bloated it to the point that we now have a tax code something like ten times the length of all the Harry Potter novels combined.

And so what Dominic Cummings refers to as “the blob” distends...

Here’s a graphic I used in a show at the Edinburgh Festival in 2016. After three years of Philip Hammond and two of Rishi Sunak, I’m sorry to report that that red bar is now that much bigger – while the others remain the same.

Right that’s today’s rant off my chest.

Sorry about that. I hope you don’t mind indulging me.

I wanted to talk about sterling today, the Great British Pound. As regular readers will know, there is a cycle that I have observed, a long-term cycle, and, given the state of the world, and of British finances in particular, I thought it is worth checking back in on.

I’m going to start with a three-year chart to get you up to scratch with the recent action. Here it is. Cable, that is to say, the pound versus the dollar.

You can see the collapse in 2020 with the Corona panic to $1.15; the subsequent bull market, which lasted over a year, topping at $1.42 last summer; and the declines that have followed.

Currently we sit at $1.32 – 10c off the high – and we are in an entrenched downtrend, that looks rather like an expanding funnel. The pattern recognition people would call this a descending, broadening wedge.

This is symptomatic of a leadership that has chosen the Brussels-on-Thames route, rather than the more business-friendly Singapore-on-Thames option.

Assuming that wedge keeps its shape, the projected short-term action would be a rally to the $1.35 area, followed by further declines.

I want now to put this in the context of my longer-term cycle, dubbed, as keener readers will remember, Frisby’s Flux.

The Frisby Flux strikes back

Let me issue the usual disclaimer: cycles are arbitrary patterns put on past events, usually by academics. Real life in real time is often a very different matter. Nevertheless, they can help give you an idea of where we are in the grand scheme of things.

My observation is that every eight years, after a major bear market, the pound hits a tradable low.

We start with 1976, the year of the IMF (International Monetary Fund) crisis. At one point inflation reached 24%. The Labour government borrowed $3.9bn, at the time the largest loan ever requested. From high to low, sterling lost around 40%, reaching $1.60.

But it recovered. By the early 1980s sterling was back above $2.40.

Then came the next bear phase, in which the pound would drop by more than 55% and reach an all-time low against the dollar – $1.04. This was the era of the Falklands War and then the miners' strike.

But on the other side of the trade, the US dollar was showing extraordinary strength – so much so that France, Germany, Japan, the US and the UK eventually colluded to depreciate it. This was the Plaza Accord of 1985. Again sterling would recover – this time to $2.

In 1992, sterling hit another marked low. This was Black Wednesday, when the Bank of England took the UK out of the European Exchange Rate Mechanism (ERM). It fell from $2 to $1.40 – a 30% loss. The killing that George Soros made selling the pound sealed his reputation.

Eight years later, around 2000, as the dotcom bubble collapsed, so the pound lost 20% of its value. Again it recovered. By 2007 it was above $2.10. Can you imagine? The pound above two bucks only 15 years ago.

Then we got the financial crisis of 2008 and the pound lost 35%, hitting a low of $1.36.

The next low came in 2016 with the infamous Flash Crash of 2016, shortly after Theresa May's speech at the Conservative Party Conference. Having been above $1.70 at one point earlier in this cycle, it hit a low of $1.14, according to some measures. The overall drop from high to low was almost 35%.

The subsequent bull market was about the limpest in living memory – I expected much more. The 2016 low was retested in the Corona panic, and then we got that rally above $1.40 which peaked in August.

To cut to the chase…by 2025 the pound will go to parity with the US dollar

Here’s the illustration of everything I’ve just described. Don’t you love charts? They get to the point much quicker.

Now the big question is: was that high at $1.42 last summer the high? Well, in previous articles on this subject I’ve often said we should be looking to get short on strength in the 2022-23 time frame. So last summer is perhaps a bit early.

And it’s worth noting that the pound trades in line with financial assets – no surprise given how geared our economy is to finance – so when you get stock market panics (eg 2008 and 2020) the pound always takes a hit.

The stage is certainly set for another market decline – international conflict, out-of-control inflation, weak, strategy-free leadership, jittery markets – but these circumstances are not unique to the UK. Are we that much weaker than our competitors? I’m not sure.

I would hope for one last hurrah before the declines, but they may already have begun.

Hold on to your gold and your bitcoins! You’ll be glad of them.

By the way, gold might have been a rubbish asset through the past decade, if you measure it in US dollars. But sterling owners of gold will have a very different perspective.

I predict that by 2025 sterling will have hit parity with the US dollar.

This article first appeared at Moneyweek.

PARITY? - I hope you are wrong, would take me more than three years just to mentally adjust to that revelation.

I don't even know what this means.

Commodities (i.e. the stuff we can't exist without), are priced (for now) in $US.

If the $US is falling in value, other countries completing commodity transactions in gold backed securities, and we have the £GB @ parity with the $US..........????

That doesn't look or sound good....

I also hear you on gold / base metals, owning them & the producers, I've only recently begun to listen & take note - lots to learn.

Never been interested in gold - but the situation is changing rapidly. Hence I've landed on a comedian's blog for investment tips and the like.

In the past, the only "precious" metal producers I was interested in, were palladium miners North American Palladium & Stillwater Mining - both pure plays (or as near as you will get) on the metal which is used as a substitute for platinum in North American catalytic converters. I only got interested when the price collapsed during the 2008/09 recession + GM decided to fire sale their inventory - which pushed the price further into the ground.

(A bit like a chancellor who decides to debase the currency / flog the underlying asset at a market low & announce when the sale will occur - just to ensure the lowest possible price is obtained. Was that an inside job? Seriously, when you write it out like that - you have to wonder - did someone have an audit or delivery request?)

These companies no longer exist as independent entities now.

Do you think Impala or Sibanye-Stillwater are worthy of further investigation / consideration, in regard to precious metals in general?

As for crypto, I still don't really understand what it is, the risks (particularly of being cancelled / banned by govts - despite being decentralised), etc etc I think Canada (and their tyrannical leadership) threw up some doubt about the effectiveness / ability to evade govt interference through crypto use. The main takeaway from Canada, WAS however people power - the govt very nearly crashed the banking system & probably trashed its international reputation for decades - but the media managed to brush that one under the carpet - oh look - there's a war over there!