Navigating the Ups and Downs of Uranium

Understanding the Dynamics of a Hot Sector.

Uranium attracts a lot of hot money. By investing in uranium, you somehow feel a bit contrarian, which adds to its appeal. As my buddy Charlie Morris puts it, it’s a “bulletin board favourite”.

It has always been this way. Uranium is either in a hot, rampant bull market, crashing, or dead.

There's a compelling underlying story: the world needs nuclear power, yet it hasn't invested enough in uranium, there are supply shortages and these are made even worse by the fact that the world’s largest producer, Kazakhstan, surrounded by Russia, is struggling to get its production to market. Given that Kazakhstan produces over 40% of global supply, this is significant.

Last month the world's leading uranium miner, Kazatomprom, warned that it will not meet its production targets due to construction delays and challenges related to the availability of sulfuric acid, which is used to extract the metal from ore.

Meanwhile, North America's largest producer, Cameco (NYSE:CCJ), sold off after its earnings report last week. Although earnings were up, the company missed production targets (which had already been downgraded). Moreover, to fulfil contracts for which production falls short, the company purchases on the spot market. This year, it predicts it will buy around 2 million pounds (at a spot price of $80/lb, this totals $160 million).

That should be all good for the spot price, which is why I recommend owning the metal and not the miners, most of which will never see any production in our lifetime, despite what they tell you. But the spot price also sold off this week, albeit briefly. What gives?

Back to Cameco for moment. There are not many genuine uranium producers out there, so Cameco attracts disproportionate investment as a result. Its prominence in the various ETFs also contributes. However, it was trading at 10 times sales. That's fine for a tech stock, but not for a miner. Too much hot money.

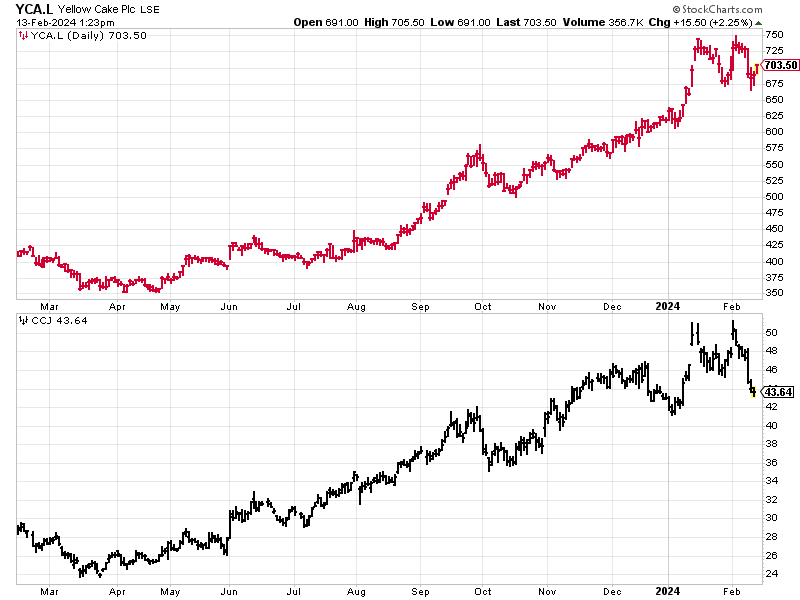

With the Cameco sell-off, the company put in an almighty double top. My pick, Yellowcake (YCA.L), did the same. (Yellowcake is in red, Cameco in black).

I did not like that price action. At all. Even if the fundamental uranium story remains compelling, there is also a lot of hype. Hot money abandons ship even quicker than it boards.