Oil and Gas: The Next Big Rotation

Oil Stocks Are Where Gold Miners Were 18 Months Ago. Special Report.

Good Sunday morning to you,

I am convinced that oil and gas are going to be a big theme this year, and you want to have a position. Oil is SO cheap relative to other commodities, metals especially - it is at multi-year extremes - and if the Noughties are any guide, gold tends to move first and then oil plays catch up.

Some headline thoughts:

U.S. shale oil production turned negative year-over-year in October 2025.

Production decline rates more generally are accelerating

The IEA, in its latest World Energy Outlook (Nov 2025), has now quietly abandoned its core argument that oil demand would peak, reversing years of predictions, and accepted that demand will grow - we have been saying since before this letter began, oil demand is only going to increase. What’s more, it’s likely that current demand has been undercounted.

Energy stocks now account for just 2.5% of the S&P500 against a historical “norm” of 15%

The last time sentiment was this bearish was 2003-4. We all know what happened next.

Regarding supply, the Venezuelan situation complicates things, of course, but getting those enormous reserves producing to their maximum is not going to happen in the short term. That scenario is years away. Note: the oil price has crept up a little since the Maduro kidnapping.

I think, loosely speaking, oil stocks are where gold miners were 18 months ago. You want to have a position.

The Dolce Far Niente (do nothing) approach to investing in this sector is to buy SPOG (LSE.SPG) in the UK or IEO (NYSE:IEO) in the US. These ETFs track the North American oil and gas producers. There is no need to take the risk of tinycaps yet with midcaps are offering such value.

We also have a couple of oil plays in this year’s tax loss trades, which are starting to work very well (more on that very soon - but a couple of 30% gains already).

But with all the above in mind, I asked resident oil expert Dr John to come and write something for us today.

Dr. John has been analyzing and investing in oil and gas equities for decades and knows the sector as well as anyone. Today, he walks us through his current portfolio - explaining why Canadian heavy oil producers have crushed their U.S. counterparts. He explains why the major ETFs have structural flaws - and what to do about it.

Some of his companies are offering yields above 8%, so you can be paid to wait.

Plus he names names. He identifies the companies where he sees the best risk/reward in the space.

Enjoy!

All the best

Dominic

When I was a young investor, I read that one only needed to buy a few shares in a sector to get a reasonable exposure to it.

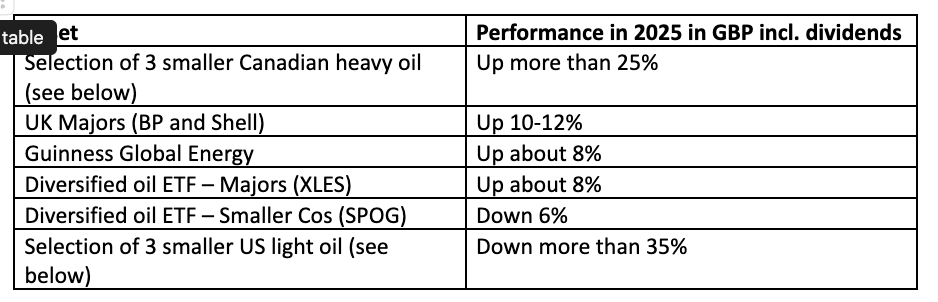

But have a look at this table of the performance of shares I owned at the start of 2025 in the oil and gas space, in sterling terms:

That’s a divergence of more than 50% between shares in companies that fundamentally do the same thing. The majors all performed similarly but the juniors’ variation was amazing. (DF note: the same thing happened with gold stocks).

My oil and gas portfolio overall was up about 12% - being mostly allocated to the giants represented by BP (LSE:BP), Shell (LSE:SHEL), Guinness Global Energy (in the UK the ISIN is GB00B56FW078) and the Invesco Energy S&P US Select Sector UCITS ETF (LSE: XLES): all up by about by around 8-12% including dividends.

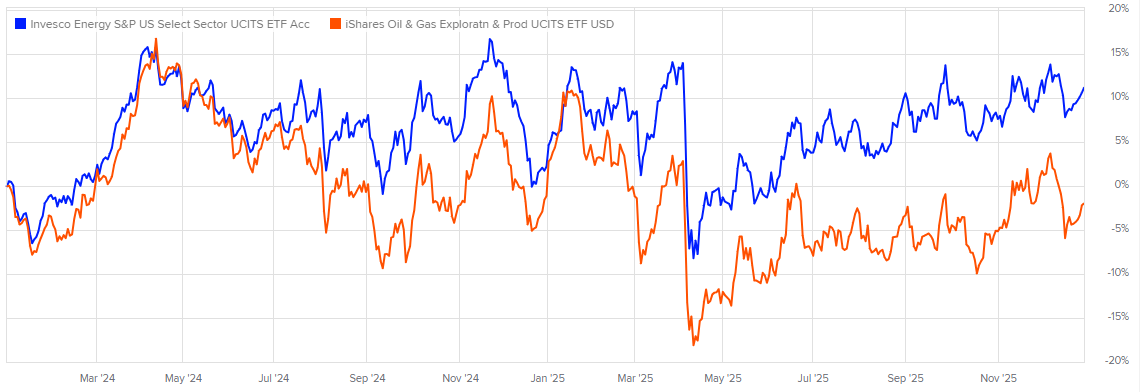

The iShares Oil & Gas Exploration & Production ETF (LSE:SPOG) as a representative of the smaller end of the investable universe was down about 6% in Sterling terms (roughly flat in dollars).

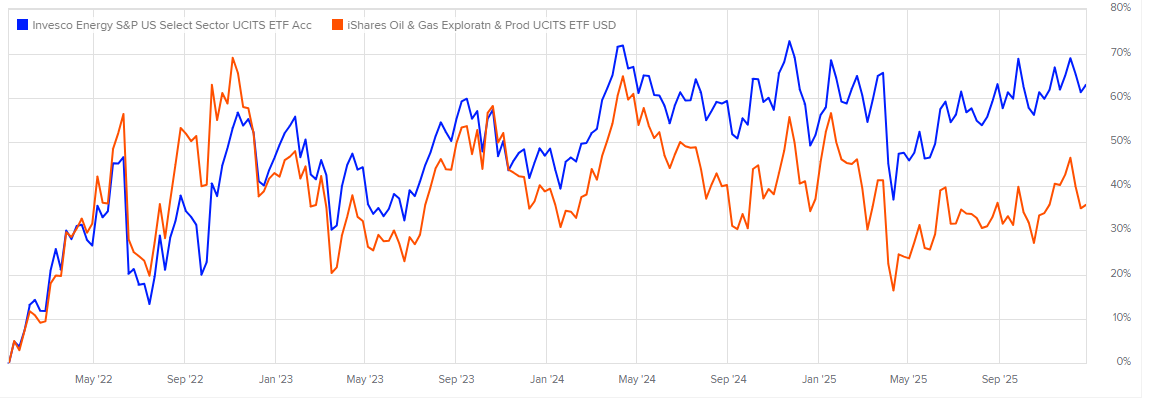

This underperformance of smaller companies becomes dramatic over longer time periods:

This chart also hides a more complex story of out- and under-performance. SPOG has, I think, three main failings: an over-exposure to American (and not Canadian) Oil and Gas companies, too much weighting towards the larger companies (i.e. the larger smaller companies, if that makes sense), and an over-exposure to oil (as opposed to gas). However, there isn’t a vast choice out there, ETF-wise, especially in the smaller company space, and for example the iShares S&P/TSX Capped Energy Index ETF (TSX: XEG) has over 61% of its investments in the top three companies (it’s 30% for SPOG). IMHO neither allocation is ideal.

Despite lack of choice, over-concentration in oil and rather unbalanced allocations, I see no need to change my and Dominic’s long-standing feeling that the vast majority of one’s oil and gas investment should be in these types of collective investments and major companies. You can buy and wait, the underlying companies won’t go bust or be taken over, and they’ll take advantage of prices low and high in terms of acquisitions and disposals.

But what about investing in individual companies?