Silver, Mania and the Art of Taking Profits

A silver surge, technical targets, and an update on the tax-loss trades

If you fancy a 2-minute dose of culture this Sunday morning, head over to my comedy Substack and enjoy one of Shakespeare’s greatest meditations about our short time here

Further to this week’s commentary and the launch of BOLD, Interactive Investor now appear to have BOLD listed. I was able to buy some this morning. Most other brokers have been super slow, no doubt living in fear of the regulator (which takes priority over the customer in these dark times).

It’s one thing to get your product onto the London Stock Exchange. It’s another to get brokers to actually make it available. No wonder the UK is so rapidly losing ground to the rest of the world, if compliance won’t even allow a gold-bitcoin ETF with a proven track record over many years and institutional grade custody.

Anyway II are pretty good under the circumstances, it must be said.

It’s difficult to express quite how much the FCA and other Blob bodies like it are holding this country and its people back. As long as they remain, the UK will lose ground. One of the few growth industries we have left is bureaucracy.

Anyway here is this week’s commentary, ICYMI

And I do recommend you to get Charlie Morris, founder of BOLD’s monthly gold report, Atlas Pulse is, in my view, the best gold newsletter out there. Get your copy here. No pay nada.

Silver shining, surging, roaring

Meanwhile, it’s difficult to look beyond silver.

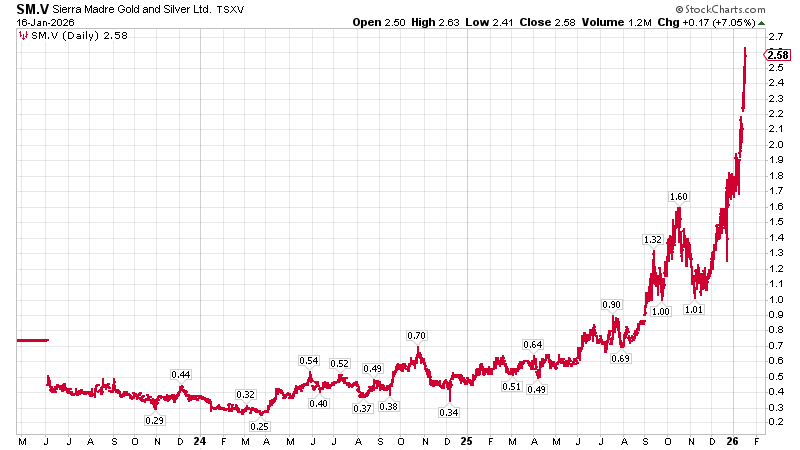

In the welcome insanity of this silver bull market - and at the moment every bullion dealer appears to have sold out of the stuff (I’ll have more on this as Pure Gold Company have been in touch and want to talk about the shortages) - my pick Sierra Madre (SM.V) keeps on giving.

This was a tough hold in the early days. I took flack and lost subscribers for recommending it in the 40-50c range, only to watch it sink below 30c. These things happen in mining bear markets, I’m afraid, and it takes some nerve to buy and then hold.

But I do know some readers managed to pick it up at 25c and, with the stock now at $2.60, they have made ten times their money. Congratulations!

With silver now at $90, that $96 target I’ve been speaking about for some time now, based on silver’s cup-and-handle pattern, looks like it’s going to get taken out.

Here it is updated. The distance from the rim ($50) to the bottom of the cup ($3.50) is $46.50. So, according to the methodology, $46.50 plus the rim becomes the upside target: $96.50. We hit $93.50 this week, so we are pretty much there.

Note this is a log chart which is why the downside looks so much bigger than the upside. Which brings me to my next point.

Many argue that, as this cup-and-handle pattern formed over so many years, we should be calculating the upside target on a percentage basis rather than a price basis. Such mentalities tend to creep in during bull markets, though they have a point. If you start using percentages we are talking about a target above $700!

If you live in a third world country such as the UK, I urge you to own gold or silver. The pound will be further devalued. The bullion dealer I recommend is The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.

It’s a mania, folks, driven by genuine shortages and sudden buying. It’s difficult to know just where or when the top will be, but I do know it won’t last forever, even if it currently feels like it will.

My instinct tells me silver wants to go higher still. But remember, folks, this is silver, so at some point it will all unravel. If it can disappoint, it will.

We can expect the unravelling to come at the moment when it can inflict the most possible pain on the most possible people. For now, the price is mocking the silver cynics. At some point it will start mocking the permabulls.

Yes, you want to be greedy in a bull market, and you never feel like you own enough, but don’t be too greedy, is all I can say. Keep taking that little bit off the table. And listen to that voice at the back of your head.

Word is physical silver is trading at double the spot price of $90. Let’s put that to the test. I have a 50oz silver bar. Its value, therefore, should be $4,500. Anyone want to pay me $9,000 for it, message me. It’s yours.

Tax Loss Time

Given it’s now mid January, today I thought we should check on the tax-loss trade and see how that’s progressing.

The short answer is nicely, though it is a white knuckle ride.

The biggest win has been Sol Strategies (NASDAQ:STKE), which went from lows of $1.50 to $2.80 in a week and has since retreated a little.

No out-and-out losers, I’m pleased to say.

The weakest area has been the oil and gas trades, which are flat. They were derailed when a certain president had another president kidnapped. You might have heard.

So let’s break it down company by company.