Silver: The Hot, Wild Metal That Will Break Your Heart

Silver's Wild Ride: $50 or $20? Plus updates on Sierra Madre and Semler Scientific

I'm going to put the cat among the silver kittens with this article, but needs must.

Silver is at $41. It's going great guns. I think it goes to $50. Possibly a lot higher. $200, even. But it could just as easily revisit $20.

Remember: it is silver. If it can let you down, it will.

Silver is like the hot, wild girl with whom you had that incredible night shortly after leaving university. You may well never forget her, but spend much more than a month with her today and you will find yourself drained, both emotionally and financially, needing therapy—be it physical, psychological, or spiritual—for many years to come. She is not wife material.

There are many reasons to own silver. But be clear why you own it—and don't own it for the wrong reasons.

Silver is not the same as gold. Yes, it was once a monetary metal, though its main purpose was as a medium of exchange, not as a store of wealth—just as gold's main purpose was more as a store of wealth than as a medium of exchange. Central banks, institutions, and individuals still use gold as a store of wealth today. Not so much silver. Yes, some of us have silver coins and bars, there are the ETFs, but silver has nothing like the significance that gold does in this respect.

Meanwhile, silver's role as a medium of exchange is long gone, nor will it come back. Not in our lifetimes, at least. We do not use cash anymore. Not to any significant extent anyway. Digital is the prime means of exchange.

The gold rushes of the 19th century did for silver. In 1850, most of the world was on bimetallic gold and silver standards. The UK and Portugal were the only major nations on a pure gold standard. Fast forward fifty years, and by 1900, the only country on a bimetallic standard was China. The increased supply of gold ended silver's role as money.

You can read a lot more about the gold rushes in The Secret History of Gold, which is available at Amazon, Waterstones and all good bookshops. I hear the audiobook, read by me, is excellent. Note: Amazon is currently offering 20% off.

Silver remains a beautiful, captivating, magical metal with a plethora of uses. Demand for silver will only increase as we make more mobile phones, computers, batteries, medical devices, and solar panels (the most rapidly growing demand source).

Current mine supply is not meeting demand. The market has been in deficit for five straight years, meaning above-ground stock (mainly from recycling) is running low.

Bubbling under the surface, with that extraordinary paper-to-physical ratio of 361 contracts for every physical ounce of silver, there is always the potential for a huge short squeeze as dealers scramble for physical metal to honour paper contracts. This happens occasionally, hence why silver has such a historically spiky chart. More on that in a moment. But it's worth noting that short-sellers have been covering aggressively since July, with the number of shorts reduced by 45%. Hence the rising price. But note: from 54,000 to 29,000 contracts—many of the shorts have already covered.

If you are buying gold or silver to protect yourself in these “interesting times” - and I urge you to - I recommend The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.

But its role as money is not coming back. Don't be under any illusions. This means the historical ratio between gold and silver—15:1—is unlikely, except on a spike.

Silver’s spiky price

The price action of silver is unlike any other metal. In the 1970s, it meandered around $5/oz, then suddenly exploded to $50 as the Hunt Brothers tried to corner the market.

It then collapsed and spent the next 25 years meandering around the $5 mark again.

Things picked up after 2004. That was quite the bull market. I remember it well. Huge spikes and dips as it launched to $50/oz once again in 2011.

Then—guess what?—it crashed again.

It range-traded for another decade between $15 and $30, but then—largely riding the coattails of gold's bull market—roughly since the US froze Russian dollar assets, silver has been creeping up and up and up.

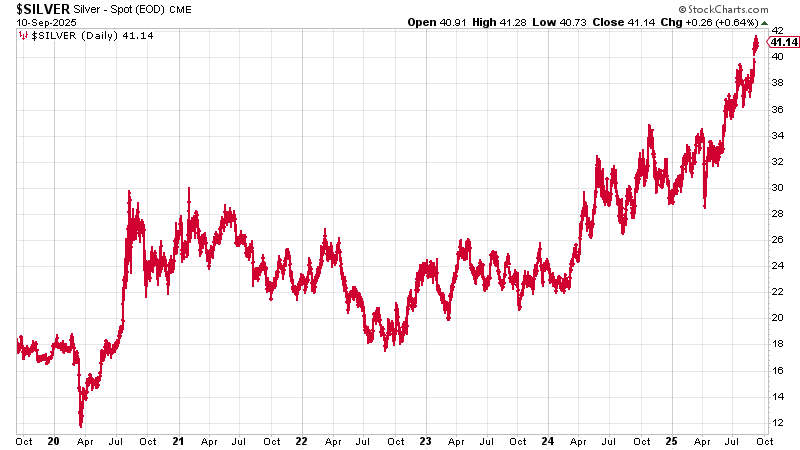

Here's the chart of the last six years. You can see that strong trend since late 2022.

But $50 is a huge line in the sand. We could even see it this year, though I expect to see it in the spring of next year. It will be the third time silver has got there in its long history: there is a lot of price memory at $50.

If it gets through, there is no resistance overhead. There is a huge cup-and-handle pattern formed over many decades, which projects prices as high as $100/oz.

But, as I say, it's silver. If it can let you down, it will. So $20 is just as likely.

There is some resistance at $44, but the path to $50 is fairly clear, and it's such an obvious magnet, I think we at least test it.

Then, “What happens next?” is the question. We'll worry about that in due course.

Company questions

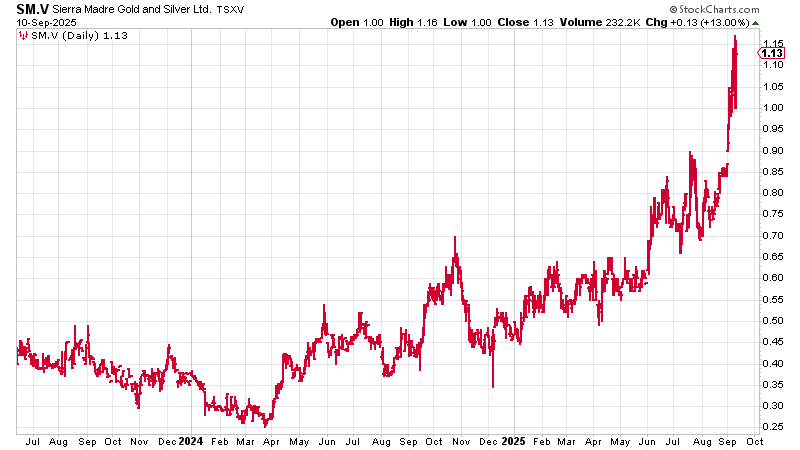

Next follows a note on my top silver pick, Sierra Madre Gold and Silver (SM.V), and also a word on Semler Scientific (NASDAQ:SMLR), about which I get asked more questions than any other company.

Sierra Madre has been a big win for readers. What we bought as a development play between 30 and 50c is now a producing mine trading north of a dollar. Great to see.

The company is expanding just as the silver price is rising, which is just as we like it.

We had C$1 as our first target on the stock, and, at C$1.13, now that target is met, a couple of you are asking what to do next.