The Do-Nothing Portfolio Beats Most Active Traders

Gold up 130%, bitcoin by more, oil remains the laggard. A full review of the do-nothing portfolio and why asset allocation beats stock-picking every time.

My outlook for a few weeks now has that, pretty much across the board, we are going in one of those sideways periods of frustrating consolidation.

Last week gold, silver, bitcoin and the S&P500 all looked like they were headed lower, only for them all to rally back this week sharply. The bears all got shaken.

Now, with this week’s rally, all of a sudden everything looks rosy again. Just as last week proved a false dawn for the bears, will this week prove a false dawn for the bulls.

We shall find out in due course, and I have to say I don’t feel enough conviction to call it one way or the other.

However, in the longer term, I do feel enough conviction to say that everyone should have gold, silver and bitcoin in their portfolio, and they should also have plenty of exposure to stock markets. Human beings, despite their governments, inevitably progress and, as we get increasingly productive, stock markets will inevitably rise to reflect that.

Today, therefore, I am going to check in on the do-nothing portfolio.

The idea behind do-nothing was to create a portfolio of low-risk investments to buy you can buy and, pretty much, forget about.

You don’t have to keep checking prices. You don’t have to worry about frustrating consolidations, such as (possibly) now. When bull markets come you will have you seat on the train.

I called “Dolce Far Niente” - from the Italian “the sweetness of doing nothing.”

We began it on October 1, 2023, and I’m going to go through it now.

Giving a precise figure for overall performance is hard, because of the various currency differentials, but you’ll see it has done very well.

(By the way, if anyone can recommend a portfolio tracker, which enables you to allocate on a percentage basis, please let me know. Then I can better monitor overall performance).

By the way, asset allocation is WAY more important than individual stock-picking. I could pick the best coal company in the world, but if coal is in a bear market, I almost needn’t bother. I’m better off out of the sector. Similarly, if a sector is in a full-on bull market, even pigs fly.

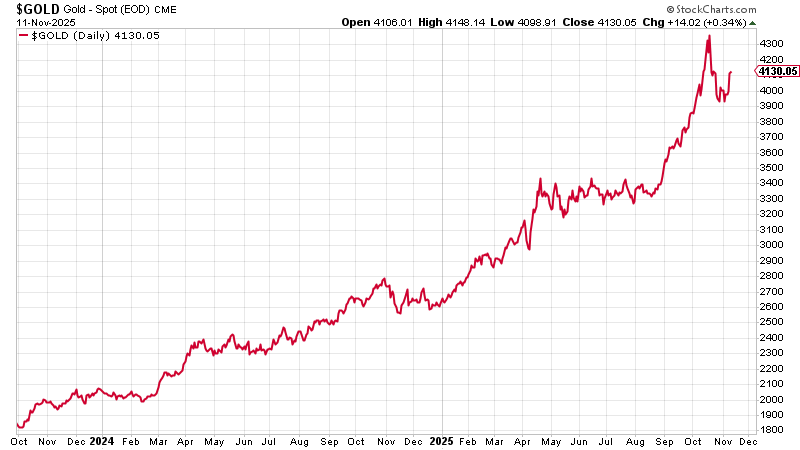

1. Gold

We began with a 15% allocation to gold, and I still recommend that as a staring point. That allocation has obviously grown within the portfolio due to gold’s stellar performance, but we are not sellers of gold, even to balance the portfolio. Gold has further to go, even if it could do with some consolidation for a few months.

A 130% gain. Nice.

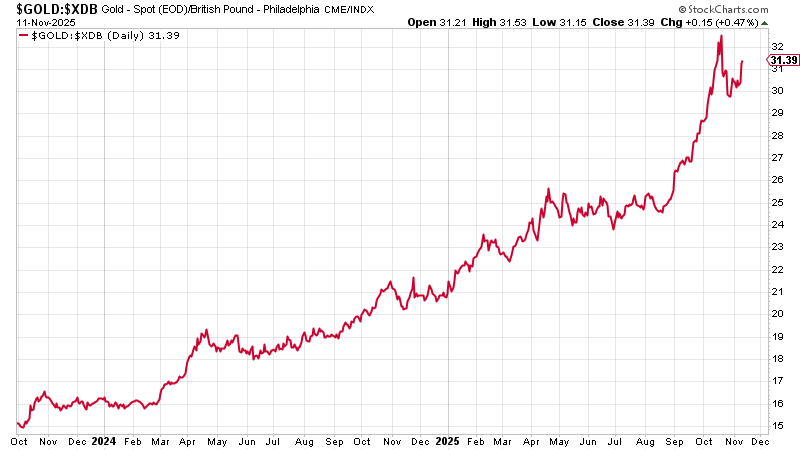

Here it is in sterling, just FYI.

If you live in a Third World country, such as the UK, I urge you to own gold or silver. The bullion dealer I recommend is The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.

While we are on the subject, let me plug the book: The Secret History of Gold - Money, Myth, Politics and Power, available at all good bookstores. If you want a signed copy to give someone for Christmas, please email me frizzers at gmail.com. I have a box full at home

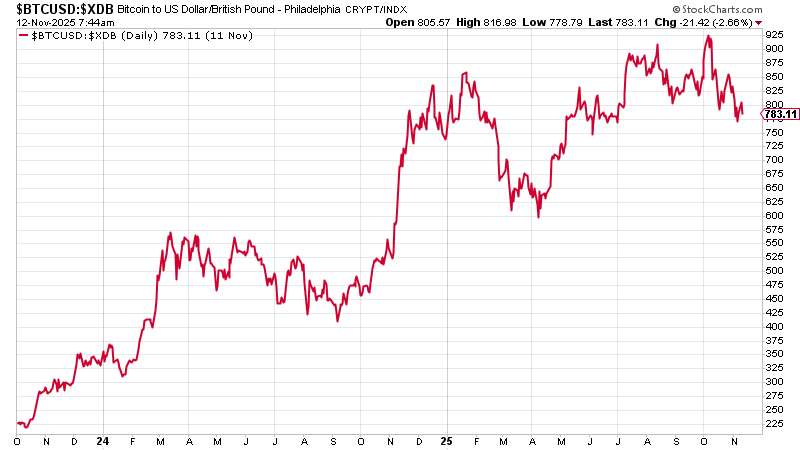

2. Bitcoin

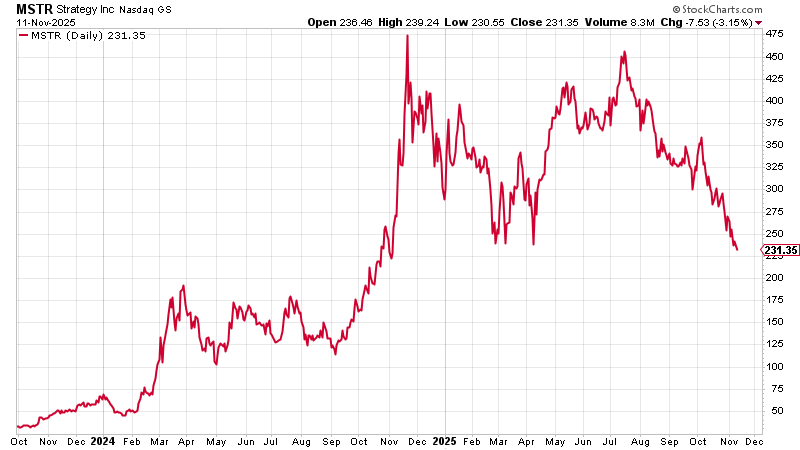

We began with a 5% allocation to bitcoin, and I think that is a good starting point. But, like gold, that too has grown within the portfolio.

Because of issues buying bitcoin in the UK, we recommended Strategy (MSTR) as a vehicle. It was $33 and proved a total winner, more than 10x-ing, though it is in freefall now, as the heat has gone out of treasury companies.

As I am forever saying, the risk is not so much owning bitcoin as not owning it. And if you are thinking about buying it through a UK broker, which you can (sort of) now do, you might find this article of use.

Here is bitcoin in pounds. Not as big a win as Strategy, but a 250% gain all the same.

3. Special situations (10%)

These are the small- and mid-caps that I often write about on here.

We have had some big winners, and some big fat dogs too, as is often the way.

I’ll write an update on these in the near future. But there has not been much change from the summer.

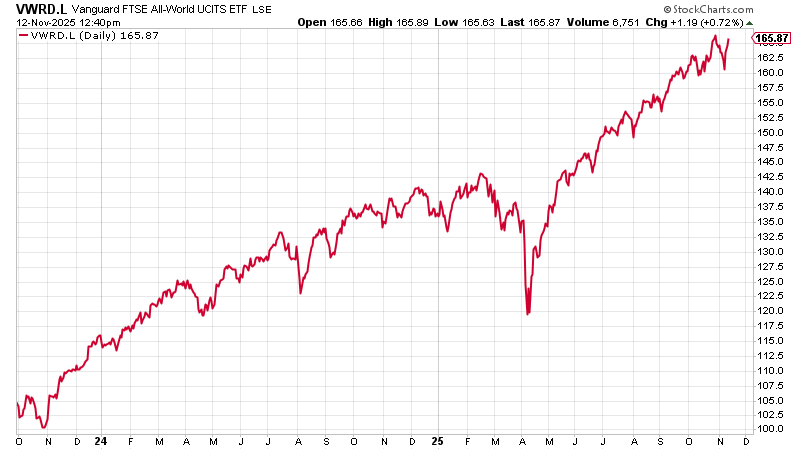

4. Equities (35%)

Originally we had an equities allocation that looked something like this.

UK & Europe 20%

US 25%

Smaller cos and private equity 30%

Asia 15%

Japan 5%

EMs 5%

But it was getting fiddly, so for the sake of simplicity, we sold it all and bought the Vanguard FTSE All-World UCITS ETF (VWRP.L), which tracks the FTSE All World Index (over 4,000 mid- and large-cap stocks).

This has a large 65% allocation to the US, which, despite what you hear, remains the place to be, as proven by the price performance of the S&P500. However, there is a danger with this, because within the US certain AI and related stocks, Nvidia being the most famous, have grown so enormous they are distorting everything. The top 40 companies now account for about 60% of the value of the S&P500. This concerns me. It’s been like this for a long time, but it is vulnerable.

Broad market exposure isn’t broad anymore. You’re essentially making a leveraged bet on a handful of tech giants. The diversification you think you’re getting from “the S&P 500” is increasingly illusory.

These periods of extreme concentration can mean-revert, often painfully. Think Nifty Fifty in the early 1970s, or the dot-com bubble in 2000.