An extra piece for you this week. I had planned to follow up on Dr John’s timely piece on oil and gas today, but it will have to wait.

We need to talk about bitcoin.

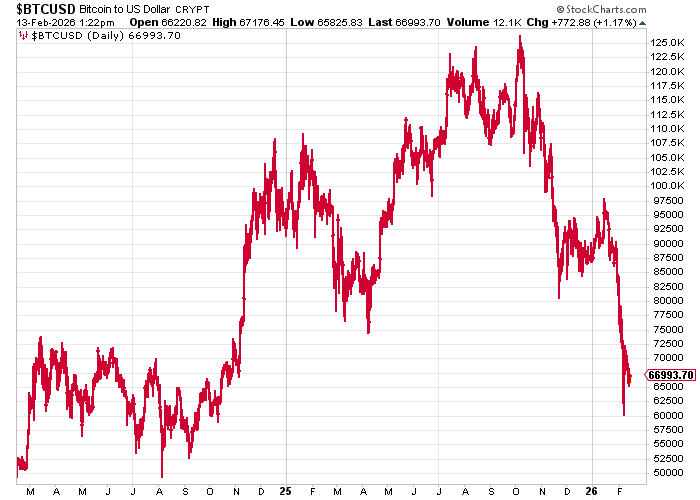

Since peaking at $126,000 in early October, the bitcoin price has been in freefall, and the declines have accelerated this year. Earlier in the week, it touched $60,000 - declines of over 50% from peak to trough. Today it sits at $67,000.

Call it what it is. It’s a bear market.

Here’s a 2-year chart so you can see the price action. All the gains of 2025 have been given back and we are back at 2024 levels.

Bitcoin has become a software proxy

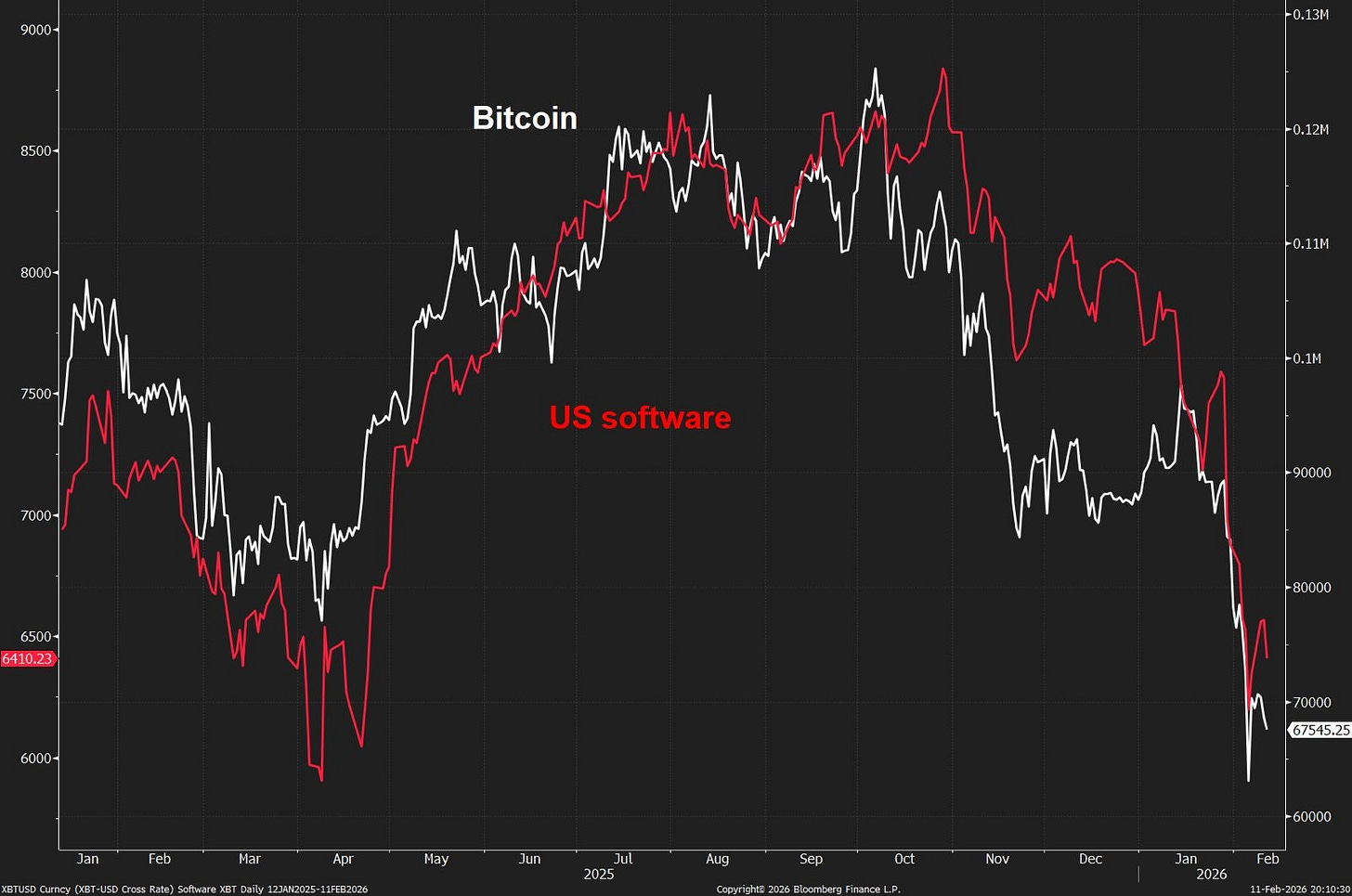

My first observation is that bitcoin’s decline since October has coincided exactly with a brutal selloff in software stocks, even as hard assets - gold, silver, and other metals - have caught one heck of a bid.

Just a few years ago, hard assets had no value, it seemed. Forget land, mining, the real economy. It was all about digital, software, IP, trademarks. How things have changed.

This chart appeared in a WhatsApp group and I don’t know who made it to give credit, but the story is clear: Bitcoin has become a software proxy and vice versa.

The correlation is striking. As concerns around AI have hammered software more generally, bitcoin has followed.

Hardware plays within tech have held up Maybe they're next to be hit. That remains to be seen.

When the mainstream media calls the bottom - the next wave of bitcoin obituaries

The Financial Times, wrong about bitcoin since 2009, came out with its latest stupidity this week claiming that bitcoin is $69,000 overvalued.

Yesterday the Daily Mail joined the Retard Gang in telling us bitcoin will go to zero.

Remember: just as media frenzy often indicates the peak of a market, so does a media scrum at the bottom.

All we need is a high-profile article from the Economist and the lows will be in.

I get that some people don’t like bitcoin, and bitcoiners can be obnoxiously vocal when the price is rising, but nocoiners can be just as bad. The amount of people trolling me about bitcoin - cc-ing me into tweets telling me how badly it’s doing, slagging off Michael Saylor, sharing “going to zero” articles - has risen sharply.

The more evolved and widespread these narratives, the more people repeating them, the closer we are to an end.

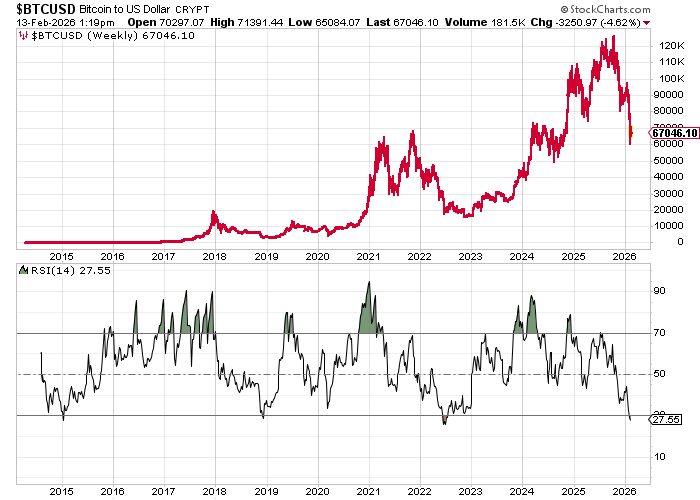

On which note, here is a longer-term weekly chart of bitcoin. That weekly RSI is close to all-time lows. Doesn’t mean this is the end. But you get these kinds of sentiment extremes at the end of cycles, not at the beginning.

Where we go from here

This is a bear market. Crypto winter is upon us once again. The trend is down.

But the trend will end. It always does.

Looking at the above charts, there’s a lot of price memory in the $50-70,000 range. Bitcoin spent much of 2021 and 2024 here. I expect $50,000 - or just below - to hold. I give that a more than 50% probability.

But it’s bitcoin. So anything is possible. A typical bitcoin monster correction would see us go all the way back to the 2022 lows at ~$15,000. I don’t see that as likely - especially as the preceding bull market wasn’t that mammoth - maybe 10% probability.

It’s also possible the lows are already in, but my gut tells me this bear market has a bit longer to play out. It’s not a short sharp correction like we saw in the spring of last year around the Tariff Tantrum ™, but more of a grinder. Corrections happen in price and time, and I feel this one has a few more twists to it, especially as markets generally are not quite as easy as they were a couple of months ago.

My outlook at the beginning of this year was that the S&P 500 would follow the typical trajectory of the second year of a US presidency - and that points to a rocky second and third quarter with a strong final quarter. That has implications for liquidity and sentiment more generally.

Bitcoin is the same technological genius creation it always was. It hasn’t changed. Only perception has changed, as it always does.

It has been repeatedly demonstrated that bitcoin is a volatile asset that goes to the extremities of both pessimism and optimism, that it is cyclical and that it crucifies hubris. Those cheering the bear market clearly haven’t learned.

Instead of celebrating, I urge the skeptical to take advantage of this bear market and use it to learn.

On which note, if you’re new to bitcoin, my 2014 book Bitcoin: the Future of Money? is a good place to start.

Bitcoin isn’t dead. It’s just going through a bear market. They happen.

What’s the story that takes bitcoin higher, then?

Remember: narrative follows price.

When the price starts rising, all sorts of reasons will get attached and the story will form. Just as now with the price falling, all sorts of bearish narratives have emerged. Quantum Computing is going to end it. Jeffrey Epstein hijacked it. The core devs have fallen out. Strategy (NASDAQ.MSTR) is going bust. Whatever.

It doesn’t matter what the story is. That will come. Price leads.

Quantum BS

When you go to a bitcoin conference, one thing that’s notable is just how intelligent, educated, informed and ambitious the participants are. There is not the proliferation of midwits that you might find on, for example, the FT payroll. The bitcoin community is super bright.

Do you think those involved haven’t thought about and prepared for Quantum computing and the threats it may or may not present? Of course they have.

Is bitcoin more likely to be ready to deal with the quantum computing threat than say SWIFT, the BBC, the NHS, or some bank?

And which is likely to cope with it better - a sector crammed full of genius computer scientists with their own capital at stake, or some institution run by a government?

If you actually had a computer capable of taking down bitcoin, there are much easier, more satisfying things to take out, such as the House of Commons email server.

Way more important than the actual threat of quantum computing is the perception of what that threat is, even if that perception is bogus. But, as I say, perceptions change, just as bull and bear market cycles do, and so will this narrative die except among the most ardent nocoiners.

Of course I would rather bitcoin was at $150,000. But I am not worried. I won’t like it if bitcoin goes to $50,000. I’ll like it even less if it goes to $15,000. But we have been here before, and we’ll likely be here again.

We know how this story ends.

A prediction for the record

Here it is: It may have to go lower first, but bitcoin will outperform precious metals over the next 18 months, and probably over the next 12.

Let’s mark the price: gold is $5,000. Silver is $78. Bitcoin is $67,000.

By the way, I advocate owning both: gold and bitcoin. So at this point I should really plug Charlie Morris’s BOLD, an ETF you can buy through your broker which owns both gold and bitcoin.

Until next time,

Dominic

Bitcoin: the Future of Money? by Dominic Frisby is available at all good bookstores.