Bitcoin Ownership Made Easy

A Hassle-Free Broker Solution

If you’re looking for a way to own bitcoin via your broker, without having to go down the rabbit hole of exchanges, wallets, cold storage and all the rest of it, then today’s piece is for you.

Everybody should own at least a little bit of bitcoin. That is my long-held view. Its potential remains so enormous, why would you not want exposure?

Let me evangelise for a moment. By owning bitcoin you are effectively owning 'shares in this most brilliant, breakthrough technology, perhaps the most technologically brilliant system of money in history. The tech is already becoming the template for national currencies, CBDCs. But as an supranational money for the borderless medium that is the internet, and with its potential for micropayments, bitcoin’s potential scalability dwarfs national currencies.

With its finite supply, it has the potential to become a widespread online savings vehicle for both individuals and corporations. With its network advantage - the first and foremost cryptocurrency - with recent advances in Lightning and with bitcoin’s incredibly robust blockchain, in a world of AI and automated payments, it has the potential to become the default cash system for the internet, the standard on which internet monies, from the mPesa to airmiles, are based.

If I look at the combined average IQ of the bitcoin space and compare it to, say, gold mining, there is no comparison. Bitcoin abounds with brain boxes. By owning bitcoin, you are effectively leveraging this extraordinarily high combined IQ.

You can see why I think everyone should own some. (My guide to buying bitcoin is here).

That doesn’t necessarily mean you need to rush out and buy tomorrow. As I’ve outlined before, bitcoin tends to go through a repeating cycle:

Quiet accumulation.

Frenzy and Blow-Off Top.

Monster Correction.

Frustrating Consolidation.

And, at present, we are somewhere either in phase 4 or phase 1 - there is a lot of crossover between the two - but such phases can go on for a long time.

Bitcoin had a good recent move to $30,000 and then in the last week it suddenly tanked to $25,000, throwing off many bulls with the violence of the move. It may have a bit further to fall, who knows. We may be being given another buying opportunity as well.

But the practicalities of owning bitcoin can be a little problematic, so it is not for everyone. Bitcoin purists will bite my head off for saying this, but wallets and cold storage and keys and seed phrases and all the rest of it are tricky for some people. There is so much to learn and that puts people off. Nobody wants to lose their coins. Nobody wants to get hacked. (It happened to me in 2015 and it still hurts now). There is not the same insurance and protection as in traditional finance, or legacy finance as bitcoiners like to call it, and that makes many people uncomfortable. Sending money to and receiving money from bitcoin exchanges can be also problematic, in a world in which banks treat any transfer as an attempt to launder money.

In the UK, while Rishi Sunak, when Chancellor, like George Osborne before him, gave it the big one about turning the UK into a “hub” for cryptocurrencies, the UK regulator, the Financial Conduct Authority (FCA), went the other way and made life very difficult for the UK cryptocurrency investor. It banned the sale of crypto derivatives and exchange traded notes to retail investors. It made sending money from a bank to a crypto exchange so problematic most banks refuse to do it. The plethora of scams don’t exactly help either.

All in all it takes effort and it’s the fag (English use of the term) of buying and storing bitcoin that has lead many not to not get round to it. But how many times have you kicked yourself for not buying bitcoin sooner?

I remain of the view that bitcoin’s potential, even from these levels, is too great not to have some exposure.

Today I am going to show you a simple and effective way by which you can get exposure to bitcoin via your broker. You can buy it in your ISA, your SIPP or your regular brokerage account, FCA or not. It’s not the same as owning bitcoin itself, but it saves you having to go down the rabbit hole of sending money bitcoin exchanges, safely storing your coins, seed phrases and all the rest of it. You can let somebody more competent and experienced than you do all the heavy lifting for you.

Nasdaq-listed Microstrategy (NDX:MSTR), market cap $4.6bn, is, to use the company’s own words, “the world’s leading enterprise analytics platform.” What, you may wonder, is an enterprise analytics platform?

Enterprise analytics is to collect and analyse data, and thereby gain insights which lead to better decisions. Data discovery, data mining, predictive modelling, correlations, graph analysis, trend analysis and data visualisation - all that kind of stuff. But whatever enterprise analytics are, good though the company may be at them, they are not the reason to buy Microstrategy.

The reason to buy Microstrategy is that it is the world’s largest corporate holder of bitcoin. That is to say it has more bitcoin than any other publicly traded company in the world. It keeps its treasury in bitcoin. And, in the company’s Chairman, co-founder and former CEO, Michael Saylor, it has one of the most articulate and popular proponents of bitcoin. (You can watch my interview with Michael Saylor here or listen here).

For years and years, when Microstrategy was “just” a business intelligence software firm, the stock range-traded between $100 and $200. Then in 2020 Saylor got into bitcoin, and started issuing shares in order to buy it. The stock has since become a proxy for bitcoin. If bitcoin goes up, so does Microstrategy. If it crashes, so does Microstrategy.

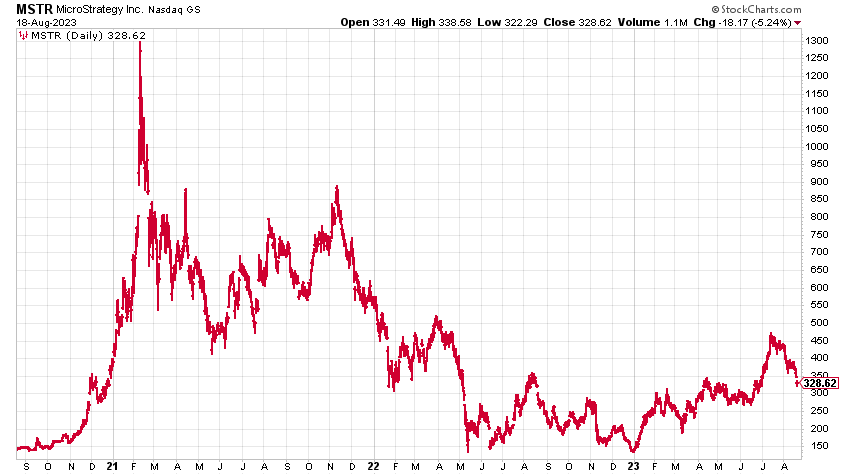

Here is 3 years of Microstrategy, since around the time its move into bitcoin began to be publicised. You can see it rose from $150 all the way to $1,300, then came all the way back down again.

But it seems to have made a nice low around $150, and this year, in tandem with tech generally, has been in something of an uptrend. Since July, however, it’s been dropping. Where does it make its low? There’s the question.

On July 31, 2023, MicroStrategy held 152,800 BTC, purchased for $4.53 billion at an average purchase price of $29,672 per coin. Given that bitcoin now sits around $26,000, the company is a little underwater on its purchases. As they were originally bought as a hedge against inflation and currency debasement, Saylor’s critics think this is very funny. Whatever.

If Saylor’s predictions - that bitcoin will eventually go to $100,000 and then $1 million - come good, then the current situation is meaningless. Microstrategy stock will launch to similarly stratospheric levels. Of course, if bitcoin tanks - Microstrategy will go the same way.

With bitcoin at $26,000, Microstrategy’s coins are worth just shy of $4 billion. So you are getting the enterprise analytics business for around half a billion US.

With Saylor’s evangelism, the amazing things he and his company are doing to try and persuade other corporations to keep their treasury in bitcoin, his corporate first-mover advantage and the businesses being developed by Microstrategy in and around bitcoin, there is a good chance that Microstrategy will actually outperform bitcoin. It’s a slightly geared play.

On the 2-year chart below, I have overlaid the bitcoin price in black. You can see that the two trade in tandem, though this year Microstrategy has outperformed slightly.

It’s not the same as owning bitcoin, but it’s probably the next best thing and it solves the broker issue.

As a Nasdaq-listed corporation, you can buy Microstrategy in your SIPP or ISA, though you will need a broker than trades international stocks. (I can’t believe there are any these days that don’t).

If you want to own bitcoin itself, then here is my guide. The exchange I use is Coin Corner.

Disclaimer: I am not regulated by the FCA or any other body as a financial advisor, so anything you read above does not constitute regulated financial advice. It is an expression of opinion only. Tech stocks are famously risky, , so please do your own due diligence and if in any doubt consult with a financial advisor. Markets go down as well as up. I do not know your personal financial circumstances, only you do, but never speculate with money you can’t afford to lose.

Great piece Dominic, thank you & hope your Edinburgh show is going well. Out of interest how do you rate (or otherwise) Trading212’s platform for this, and for ‘across the board’ trading?

Anyone have views on how MSTR woud perform when the pending bitcoin ETFs come on stream?