How to Invest in Oil and Gas

A simple, definitive guide

Please do not share, copy, reproduce or distribute any part of this report without the express permission of the author.

Dominic here -

Everybody should have plenty of exposure to energy in their portfolio. Most of us don’t own enough. That is evident when you see stock market weightings. The S&P500, for example, (the largest 500 companies in the US) still only has a 4-5% weighting to energy - even with all the events of the last few years. I find that extraordinary.

Relative valuations of energy companies, against consumer discretionary stocks for example, are still low.

I’ve asked Dr John to put together this report on energy, as his finger is very much on this particular pulse.

So here follows a simple special report on how to invest in energy. In addition, check out Dr John’s report on the spicier end of the market: North American oil and gas plays. So look out for that.

Also, my report on helium is coming very soon. So keep your eyes for that too.

Over to you, Dr John …

Making hay where the sun don’t shine

The last few months have been something of a roller coaster ride in the energy space. Oil prices have now, largely, settled (thanks, Saudi Arabia), and people have mostly forgotten about the energy crisis, as this has morphed into a cost-of-living crisis.

Russia has increased and then decreased production. The Europeans have banned Russian oil, then have let it in via the back door (refined and blended with other oil via India, for example). Saudi has cut. The Permian shale in the US is either becoming less oily and gassier, plateauing, or falling in production. I want to stress: This is all noise.

The story is actually stronger than ever. The green transition just isn’t happening fast enough. In fact, some people say it’s not a transition. When you transition gender, you stop being a man and start being a woman (if you don’t believe me, I suggest you listen to Dominic’s song “I’m gonna marry Gary”). There may be a bit of a man left behind for a while but its days are, generally, numbered.

When a country transitions to democracy it stops allowing the king or queen (or church, or aristocracy) to have all the power and it becomes the people’s decision who rules them. There may be a titular head of state but that is all they are.

The green transition should be about replacing all the fossil fuels. There may be a few fuels left for special purposes (billionaires flying rockets to Mars is a good example –SpaceX’s rocket ‘Starship’ burns methane from natural gas). In the transition to combustion engines, the 300,000 horses in London in 1900 were replaced by cars within a couple of decades and similarly, fossil fuels should be mostly substituted with alternatives.

I’m not saying we shouldn’t replace fossil fuels. I believe that we should. Nuclear would have been the solution, but we listened too much to propaganda and I suspect that when all the figures are in, millions will have died because we didn’t transition from fossil fuels to nuclear when we could have. It is estimated that currently 34,000 people a year die from European coal-fired power plant pollution, and it is strongly claimed that, despite official figures, 20,000 die every year in China’s coal mines. These coal mines, incidentally, produce at least 70% of the electricity required in the manufacture of the “green” solar panels we use in The West.

Anyway, what I see when I look at the numbers is that, at best, so-called renewables are simply going to stop oil consumption increasing not replace it, at least for the next 25 years.

I believe fossil fuels will continue to provide us with the quality of life that we in the developed world value, such as the availability of cheap food, and our freedom to travel internationally.

More importantly, in the developing world it is fossil fuels that I believe will offer the quality of life people need and should reasonably expect, such as 24-hour electricity to power incubators in hospitals which prevent babies from dying - this is no facile comment but a very real situation to, for example, a South African, Malawian or a Liberian – as well as the electricity to refrigerate food in order to minimise food poisoning. Try eating ice-cream in Kashmir when there are power-cuts daily and you’ll be reminded how easy it is to get food poisoning, as I did last year.

What does the media say? Bloomberg states there will be just a 10% drop in oil demand over the next 25 years (current demand is about 100m barrels per day):

“Aggregate demand for oil products peaks in 2035 at around 107m b/d, declining by 10% out to 2050 to 96m b/d.”

The International Energy Authority are more pessimistic (or is that optimistic?):

“…oil demand, which was 94.5 million barrels per day in 2021, will grow to 102 million barrels per day in 2030, and still be 102 million barrels per day in 2050.”

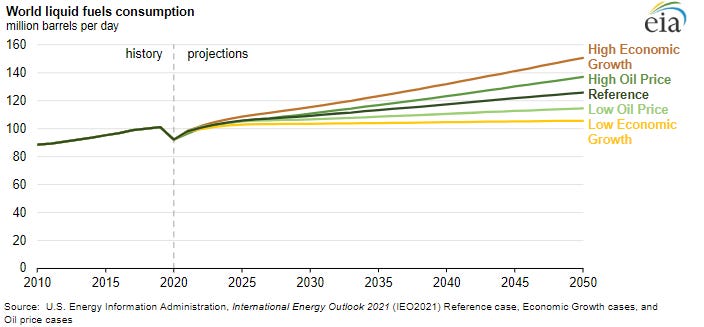

The US EIA also sees no drop in oil consumption at all:

If it is simply that new energy demand will be met with renewables while existing oil demand stays virtually flat, can we conclude there is no transition?

Anyway, back to investing….