Inflation in the UK has just hit 10.1%, says the Office for National Statistics.

That is five times the Bank of England’s stated target of 2%.

FIVE TIMES!

Sorry to shout.

The joy of the public sector is that you can be this bad at your job and still keep it.

Inflation hasn’t been this high in over 40 years.

Are you prepared?

None of this should be a surprise

When you delve below the surface, it gets a lot worse. Retail Price Inflation (the old measure) is 12.3%.

Energy prices are rising. We all know that. Food prices too.

But the Bank of England base rate is still 1.75%. Carnage or not, it is going to have to go up. That means borrowing costs are going to go up. And house prices are likely to come down.

The pain of all this is going to eat into your wealth. On the one hand the value of your most prized asset – your house – is flat or falling. On the other, your costs – from food to energy to monthly mortgage repayments – are all rising. And it’s doubtful your income is keeping up with the increase in costs.

A lot of people are going to lose their jobs and their livelihoods in the squeeze (though no one at the Bank of England).

And so much of this is self-inflicted.

I get so cross when I hear officials say, “no one could have predicted this” and it is “beyond anyone’s control”. We have been warning about it for years on these pages.

If the market set the price of money, you can bet your bottom dollar that rates would have risen a lot higher a lot quicker.

What are the causes? There’s deglobalisation – China especially has been exporting its cheap labour and deflation for so long, low prices had become normalised. Now nobody trusts anyone any more and globalisation has slowed. You can’t blame those in charge for that.

There are the Covid-supply chain issues and the punitive, punishing-the-British-for-Brexit legislation on the continent that is hampering trade and thus raising end costs.

Dimwitted, short-sighted, beholden-to-the-Green-lobby energy policy leading to a failure to invest in fossil fuels and nuclear has put up energy costs.

Failure to measure inflation properly for decades (especially not including house prices in CPI) has meant interest rates have been too low for too long and asset prices have got totally out of kilter.

And finally – yet perhaps, along with artificial rates for years, most significantly – hundreds of billions of money created at no cost through Quantitative Easing, first post 2008 and then through Covid.

In short: printing money, debasing money, misguided energy policy and bureaucracy. Too much government has caused this.

Now the chickens are coming home to roost.

The irony is there is a scramble for cash, even though cash is now officially losing 10% per annum.

This must be one of the most difficult investment landscapes I have ever known.

How to protect your wealth

The most obvious asset to own in all of this is gold.

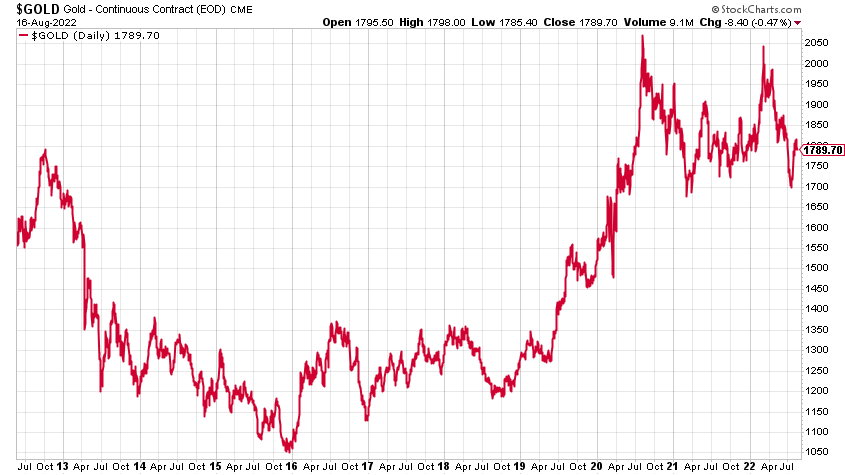

Yes, in US dollars at least, gold has been a dog since the spring. Not as big a dog as other metals, or indeed tech (until a month ago), but it hasn’t exactly been doing what it did last time all this was happening in the 1970s, although dont forget it has a 50% correction mid decade. The US dollar being so strong has masked things.

But let’s look at gold in sterling, and the story is different. Here we see gold in pounds over the last ten years.

It was £700/oz in 2015. Today it’s £1,480. A double. It’s in a clear uptrend, and has been a good, low risk hedge against incompetent leadership and the incompetent management of the pound.

You can see how gold has been making a series of higher lows – since 2015 in fact. Each sell-off comes to an end at a higher price than the last.

Even since 2021 this has been the case. The current sell-off since the spring Russia’s-invasion-of-Ukraine-high has been painful. But the low in July was higher than the lows in January. That is long-term bull market action.

My concern looking at that chart is a potential double top just above $1,550. Maybe it all ends there. Maybe it has already ended there.

But while this sequence of higher lows continues – and looking at the mess around me – I am going to give the bull market the benefit of the doubt.

Self-inflicted or not, the Bank of England is caught between a rock and a hard place. It’s damned if it puts up rates and it’s damned if it doesn’t. It’s going to have to. Looking forward to the winter, it’s easy to see a host of problems – energy shortages, more Covid, further escalation in Ukraine, squeezed citizens, no end of political discontent.

I don’t know where all this ends. Often I can see where stuff is going, but this I can’t without getting shudders. We’ll find a solution. We always do. We are human beings, we work, we create, we innovate, we solve problems and life gets incrementally better. But it feels like we are early- to mid-series rather than going into the final episode.

So my advice is to own some gold. I’m glad I do. It helps me sleep at night. It’s about the one part of my portfolio that I’m not worried about.

The maxim “put 10% of your net worth in gold and hope it doesn’t go up” applies.

Finally, here is gold in dollars, again for your reference.

The bulls will want those lows around or just below $1,700 to hold – and for that to prove a double bottom. The bears on the other hand will want those highs around $2,050 to prove a double top.

For now it looks like we are range-trading between the two.

If you’re interested in buying gold my recommended bullion dealer is the Pure Gold Co, with whom I have an affiliation deal. You can buy gold and either store it with them or take delivery. My report on how to buy bullion is here.

This article originally appeared at Moneyweek.

How to protect your wealth as inflation hits new record highs