It’s that time of year once again when I get out my crystal ball and tell you exactly what is going to happen in this the Year of our Lord 2023 (here’s how I performed last year).

You can normally rely on your intrepid author to have strong, even if wrong opinions on markets, but I must confess to not feeling as strongly about things as I usually do.

My biggest concern is how Chat GPT - the new chatbot that can generate intelligent text about, it seems, almost anything - is going to change the world. In fact, my greater concern relates to the extraordinary influence its designers are going to wield on the global narrative.

So it is a humble Dominic Frisby you find today, one lacking in clear vision, nervously looking up at the egg that is no doubt going to be on my face in a year’s time.

Nevertheless here are 14 things I think we will see in the year ahead.

Commodities have a good year. Oil is currently in a downtrend, so it may have a bit more to fall. Metals took their hit in mid-2022 and appear to have made their lows. For the last couple of months, they have been rising, but both fossil fuels and metals have suffered from many years of underinvestment, which has hurt supply. China opening up should see increased demand. I see a good market for metals and energy in the first half of 2023 at least. Possibly the second half as well. Let’s set some targets. Brent, currently at $80/barrel, revisits three figures.

And Copper revisits with $4.80/lb.

Yield becomes a thing again. With choppy, uncertain markets, but sticky inflation, investing for yield rather than capital growth becomes a much bigger theme in 2023 than it has been for a decade or more.

This is a classic recessionary bear market. This bear market proves to be more of the recessionary variety, rather than an all-out collapse. It’s a tricky, grinding market, but the S&P 500 gets back towards its old highs at 4,800. Briefly.

Emerging Markets outperform. That’s something we haven’t seen in a while, but their time has come again.

Biotech becomes a thing again too. Remember how back in the day biotech was all the rage? Somehow it was overlooked in the last tech bull market. Not anymore.

European banks have a good time of it too. Thanks to Swen Lorentz for pointing out to me just how uninterested people are in them. Normally a good sign.

Bitcoin also has a good year. It’s hard to think of a time when sentiment in bitcoin has been as low as it’s been these past few months and yet it’s still $17,000. It has a market cap north of $300bn. The mining hashrate hit all-time highs this autumn, meaning the network is more robust than it has ever been. The tech is stronger than ever.

Usage is growing in East Asia, Africa, especially in Nigeria, and anywhere there is a currency crisis (which is a lot of places - Turkey, Lebanon, Argentina, and Venezuela).It solves the many issues facing the member nations of the Shanghai Cooperation Organisation - China, India, Russia et al - which are desperately seeking a non-dollar alternative money to trade with that doesn’t rely on trusted third parties. (I doubt they’ll go for bitcoin by the way, even though it does everything they want it to).

Bitcoin’s Lighting Network solves the problems facing Elon Musk who is looking to incorporate a payments system into Twitter.

There are so many reasons to be bullish about bitcoin, yet sentiment could not be worse. It will not always be this way. My prediction for 2023: bitcoin will have a good year.Silver fails to deliver yet again. I’m getting so complacent with my predictions about silver that I’m bound to be proved wrong. If you can count on anything in this cruel world, it’s that silver will let you down. Silver can’t get above $30.

The US dollar - up and down. It’s perhaps the world’s most important price and it has periods of strength and of weakness, but it ends the year higher than where it started. As I write, it’s at 102.

CBDCs - they’re coming. Currently, there are two countries in the world with functioning CBDCs - the Bahamas and Jamaica. Several other Caribbean nations are at the pilot stage, including St Lucia, St Kitts, Dominica and Grenada. As demonstrated by the reaction to Covid-19, risk-averse governments tend not to trail blaze, but to follow the lead of their neighbours. In this regard, it is likely that a couple or more Caribbean nations could have functioning CBDCs before the end of 2023. Such a roll-out is easier in nations with small populations.

But my forecast is that in 2023, probably in the latter part of the year, a nation with a population greater than 15 million rolls out its first CBDC, likely one of Canada, China, India, France, Saudi Arabia, Ghana or Nigeria.Ukraine. I know Dominic Frisby is the first person you turn to when you want insights into the Ukraine conflict, so here they are: The Ukraine War will not end before October. There will not be a nuclear war and Vladimir Putin will still be Russia’s president by year's end.

Gold. Everyone always wants to know what I think about gold, however. "Well, this is a bull market, you know!" While it’s currently overbought, so don’t rule out a pull back, I think it goes up. Miners have a good time of it too. Gold retests its old highs around $2,080. But then it finds a way of being frustrating. It always does. It’s gold.

Your Bruce-y Bonus sports prediction. Manchester City wins the League. Southampton, Wolves and Bournemouth go down.

So there we are folks. Everything you need to know about 2023 in one handy list.

Have a great year folks - and stick to those resolutions.

Make your Number One resolution for 2023 to listen to Kisses on a Postcard.

Interested in protecting your wealth in these extraordinary times? Then be sure to own some gold bullion. My current recommended bullion dealer is The Pure Gold Company, whether you are taking delivery or storing online. Premiums are low, quality of service is high. You can deal with a human being. I have an affiliation deals with them.

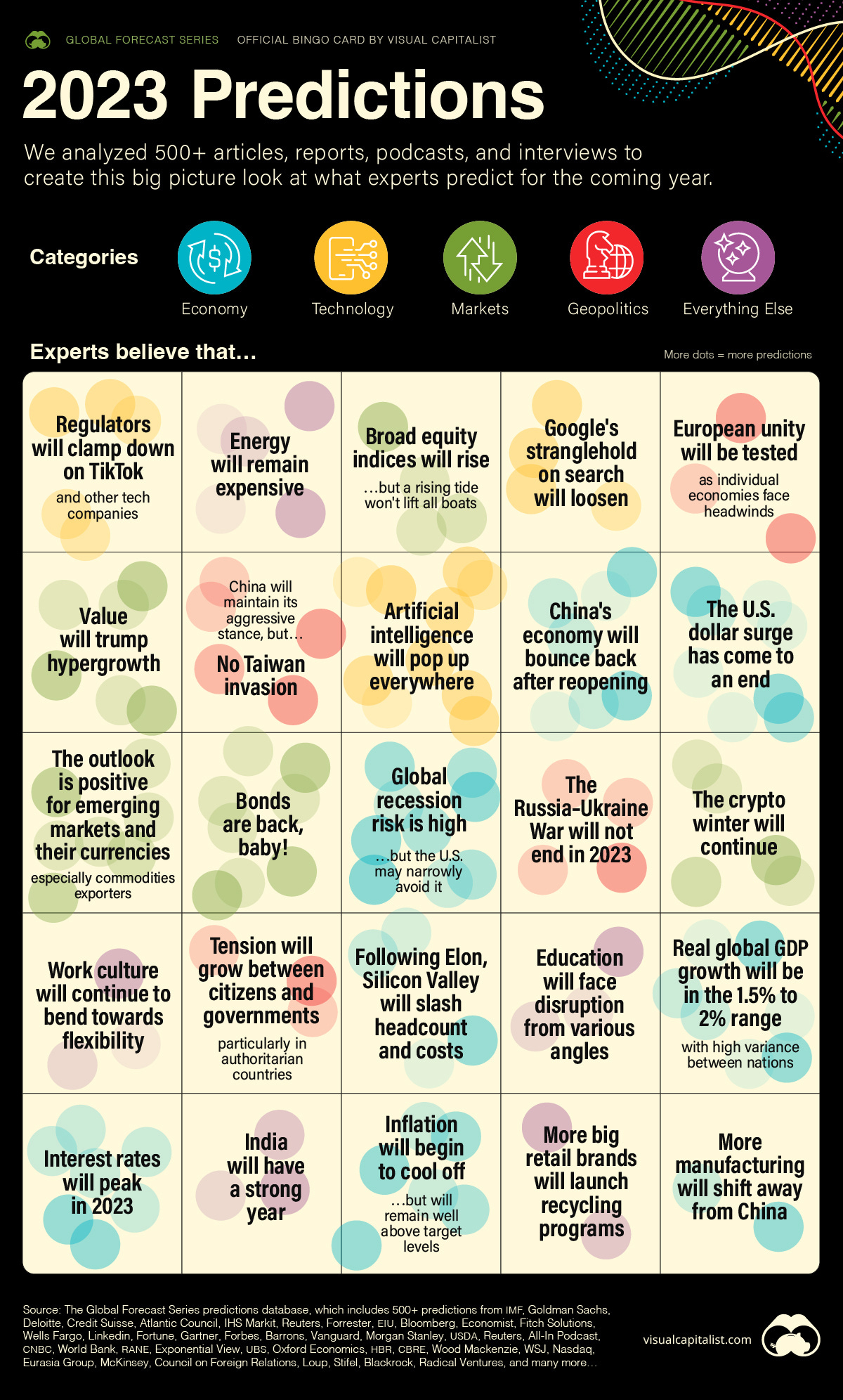

Finally, folks, the good folk over at Visual Capitalist put together the graphic below. I thought you might find it useful.

This article first appeared at Moneyweek.

It's New Year Predictions Time