Good Sunday to you,

Before we begin, let me flag this week’s commentary.

This a trade with a remarkably successful hit rate, a clear timescale and a relatively easy risk to manage - you know pretty quickly if it isn’t working. 8 of last year’s 9 ideas worked. By my reckoning you will find the biggest bargains of the year tomorrow, Monday December 22, and Tuesday December 23. So take a look:

The Annual Tax Loss Fire Sale: Ten Bargains for the New Year Bounce

So here, as promised, are those ten North American tax loss selling ideas.

Right, so today I am marking my own homework.

Every year, as old timer’s will know, I like to offer some predictions for the year ahead - usually 10, but with inflation being what it is, it ends up higher.

Today we look back and see how I did.

The usual disclaimers apply - the more outlandish the prediction, the more entertaining - so the more likely I am to make it. But the less likely it is to actually happen. I try to strike a balance …

As events change, so do opinions. Process is gradual. But when you jump a year, with no scope to revise as events turn in a different direction, quoted out of context and with the benefit of hindsight, predictions can look really, really stupid. Don’t judge me, bro.

I often find that the worse my predictions, the better my portfolio performs, which is odd, but there you go.

If you want to read last year’s piece in full, it’s here. But I’ll quote quite copiously below.

A reminder of the scoring system: 2 points for a direct hit, 1 for a quite good, 0 for a miss, and -1 for an epic fail, giving me a maximum of 30 and a minimum of -10.

How did I do? Let’s find out.

1. The long overdue correction in the UK housing market finally begins.

You can read my reasoning here, but it boiled down to: richer people being net sellers as they leave the UK, few foreign buyers, fewer buyers more generally because of high moving costs (Stamp Duty etc), little bullish sentiment in the economy meaning a reluctance to borrow and invest and the 18-year-property cycle turning down.

What actually happened is by no means clearcut, but I’ll try and summarise.

Price growth and transaction volume were relatively high in the first 3 months, until Stamp Duty changes came into effect in April, after which the market became “subdued”. Overall, the north saw some increase, while London fell 2.4% in the year to October. Average growth was 1.7%, which is some 2% below official inflation rates - real inflation is of course much higher - meaning there have been price falls in real terms. This is even with the Bank of England bringing rates down, thereby enabling more money to enter the market via increased borrowing.

Overall, transactions volumes increased by 9% on 2024, to get back in line with the 10-year average, though there is a very different story at the upper end of the market.

The housing market has big problems, especially in the south, but it hasn’t cratered - though nor has it soared. I’m giving myself 1 point.

2. Keir Starmer survives

Everyone thought he was toast this time last year - and he is - but my argument that “it’s too early for Labour MPs, worrying about their seats, to give him the shove” prevailed. 2 points.

3. Gold hits $3,000.

And the rest. It’s $4,300 as I write and going higher. I was too conservative. 1 point.

BTW. If you live in a Third World Country such as the UK, I urge you to own gold or silver. The pound is going to be further devalued. The bullion dealer I recommend is The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.

4. Microstrategy (NASDAQ:MSTR) becomes a top 100 company by market cap.

Oops. When Strategy hit $450 in July, its market cap would have been around $130 billion, making it perhaps a top 300 company but not a top 100. It would have needed to get above about $250 billion to make the cut.

And since then it has the skids so badly it’s now a tax loss opportunity.

-1.

5. Bitcoin goes to $200,000 then crashes

I got the crash bit right. Sort of. $126k was the high, having begun the year at $91k. Today it’s $88k. 0 points.

6. Sterling has big problems

Nope. It’s had a good year. -1.

7. X thrives, Blue Sky dies, Blogging Blue Skies

Well sort of. X saw strong numbers growth in the first part of the year, but these have tailed off. It is now a key place to go for breaking news and a leading news app, but by no means the Governor. The exodus to Blue Sky has slowed, but BS (LOL) is still growing albeit at a much slower rate. Blogging, as evidenced by Substack, is thriving. I’ll give myself 1 point.

8. The S&P500 Rises 10%

15% actually. We predicted a decent year, despite year 1 of the electoral cycle tending to be the weakest. 1 point. Do I get 2? Nah.

9. Oil ranges.

Oil would neither crater nor moonshot, we argued. We saw a range of $60-90. Its actually been $55-80. 1 point.

10. Small Caps Thrive

The Russell 2000 has had a good year - rising 12% - but the large caps are still winning. 1 point.

11. The US Dollar Index breaks out to 20-year highs.

Oops. I was looking for a high around 117 in the US$ index. It didn’t get above 110. It fell! -1

12. The BRICS don’t come out with a proper US dollar alternative … yet

Everyone says it’s coming, but it never actually does. 2 points.

13. Silver disappoints … as always

$33 is the high, $22 the low, I said. Ha! $28 was the low, and the high - $68. To be fair to myself, I said multiple times it was going to $50 and if it gets above there it goes to $90+, but the call was still an epic fail.

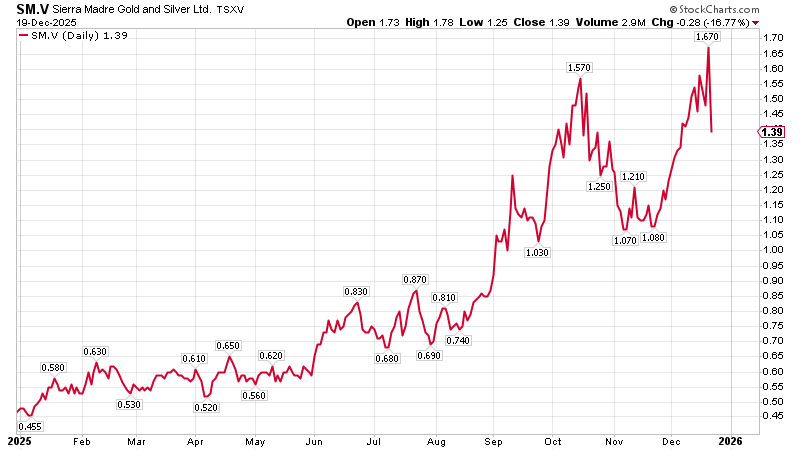

Irony: silver has been a huge winner for readers this year and our pick, Sierra Madre Gold and Silver (SM.V), has been a joy to own. From 45c north of $1.50 :(

I still get -1 though.

14. Despite all the crap, the world becomes a better place to live.

We live longer, we eat better, tech keeps improving things. We advance. AI makes us more productive and betters living standards.

It’s so obvious I can’t believe I even said it. I’ll give myself a point, but not 2.

15. Your Bruce-y bonus sports prediction.

Liverpool win the league. Ipswich, Southampton, and Leicester all go down.

Bullseye. I should take up sports betting. 2 points.

I don’t actually follow football any more, but one of my son’s told me that’s what would happen.

So, overall, a very poor showing for the DF Predictions, possibly my poorest year ever: totalling a measly 7 points.

And, as always seems to be case, a much better year for my portfolio of companies.

Here’s hoping I get all next year’s predictions similarly wrong.

I’ll be making those early next year - so look out for that.

Thank you so much for being a subscriber to the Flying Frisby. I wish you and your family a very happy Christmas. Don’t eat too much, go easy on the booze, pray, sing, get plenty of exercise, avoid toxic people and the lurgy, and be thankful for the many good things there are in your life.

Once again - I urge you to take a look at the tax loss opportunities. Tomorrow and Tuesday are the buy days.

Here’s to a healthy, wealthy 2025.

Until next time,

Dominic

PS This Wednesday being Christmas Eve I almost certainly won’t be putting out any commentary.