Small is beautiful: Is now the time to buy smaller companies?

Sensible Investments with Dr John

Good morning to you from sunny Albania,

I’m here on summer hols with my two boys, before heading off to Edinburgh next month for the Fringe. It is very hot.

We have Dr John today with more of his Sensible Investments, a piece on small companies. Small companies have been, to my considerable surprise, laggards in the market for several years now. My kids are giving me lots of stick about it, as their ISAs have lots of “smallco” exposure. Small companies usually outperform over time - I guess, because there is so much more growth potential - but not, it seems, of late. Dr John has plenty to say on the matter. As ever, he takes a contrarian view.

And he has really interesting some small cap investment trust ideas with plenty of potential to share with you

Part 2 of the summer Best in Class will be out soon - but I may put it back to next week, largely because the internet is so rubbish here.

Finally, if you missed Friday’s piece on gold, it attracted a lot of positive feedback, so do take a look.

Right, over to Dr John, who asks if now is the time to buy smaller companies?

All the best,

Dominic

Spoiler: Yes, I think so

Smaller companies have had a torrid time recently. Not just in the UK, but also in Europe and Japan, and, to a certain extent, in Asia and the USA.

Look at these four charts of some small company investment trusts over the past five years. The companies are British, American, Asian, and Japanese:

The best have been, perhaps unsurprisingly, the USA - top left, JP Morgan US Smaller Companies (LSE: JUSC) - but this trust is only up around 10% over five years. And Asia - bottom left, Aberdeen Asia Focus (LSE:AAS) - up a little more, by nearly 20%.

Despite the bull run in Japan this year, over five years, the Japanese trust (Baillie Gifford Shin Nippon (LSE:SHN)) is actually down over 20%. The UK trust (Aberforth Smaller Companies (LSE: ASL)) is down too, by about 10%.

But when you include dividends, this can make quite a difference. Even a 2% or 3% yield can add another 10% - 15% over five years.

Of course, the various trusts will have performed differently, according to whether they were growth- or value-oriented, hedged against currency, into basic materials, technology, finance or real-estate. Some trusts have private-equity holdings, and small-cap can mean anything from £20 million to over a billion. These four trusts are a mix of value (ASL) and growth (SHIN) and both (JUSC, AAS).

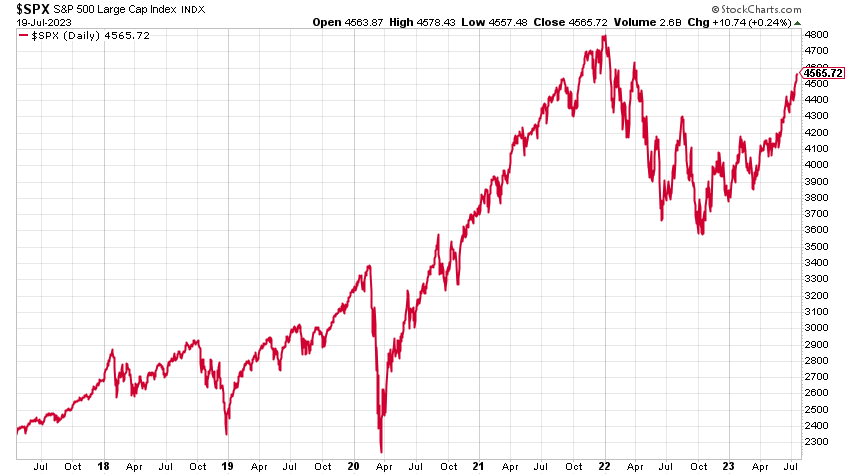

My point is though, the S&P 500 blows them all out of the water over five years - this is up well over 50%. This year it has been extraordinary, as Dominic thought it might.

Smaller companies historically underperform in bear-markets. Investors worry that they have to pay more for debt, have less pricing power for the products they sell, especially if there is inflation, and that smaller companies have weaker balance sheets.

And it can take just a few sellers to depress the share price in a small, illiquid company.

But have we hit maximum pessimism? I think we may be close.

Aberforth Smaller Companies Trust pointed out recently that the smaller companies in which it invests have, in the past thirty-two years, rarely been cheaper.

In the UK, investment bank Numis says that price to earnings multiples in the UK are around eight for smaller companies in their Small Cap index. They have only been cheaper on an absolute basis in 2009 and the period from 1979-1981.

Price-Earnings ratios have bottomed out at six twice since 1980. At eight now, even with earnings growth, there could be a little more to fall. But the risk-reward surely favours small caps.

The S&P 500 was similarly cheap in 1980. But, right now, it is much more richly valued, on a p/e of around twenty. The disparity between small and large cap has rarely been larger.

The Winner Takes It All

Some of this is perhaps a consequence of “winner takes it all.” As the most famous actors, models, authors and sportsmen and women become global sensations, the rest, despite their merits, flounder, unknown and unloved. The same has happened with companies - Microsoft, Apple et al. Apple now has a larger market cap than the FTSE. Extraordinary.

But smaller companies often grow much faster than their behemoth siblings. Among them are the next global sensations. Value will out.

Not only do we have underperformance, there has been (according to the Bank of England) 20% inflation in the UK since 2020. And 17.5 % in the USA according to inflationcalculator.com

On an inflation-adjusted basis, smaller companies in the UK and USA are not much different than October 2020 when COVID vaccine efficacy was announced. You can buy Japanese smaller companies for less inflation-adjusted money than at the very lows in March 2020.

Everywhere, inflation adjusted, they are historically cheap. It’s time to buy, on absolute, relative, and historical grounds, I think.

But is it time to buy on economic grounds? That’s a hard question to answer, so I suggest pound-cost averaging is the way to go (buy a fixed amount each month, over the next six months or so).

I’m going to recommend eight trusts, two each from North America, Asia, Japan and the UK. I think it is too risky just investing in one trust from each region.