Most of us have busy lives. We can’t be spending them looking at screens and worrying about our money. That’s why last September we started the Dolce Far’ Niente portfolio: a portfolio of slightly contrarian investments, designed for today’s market conditions, which you don’t need to constantly fret about. We might tinker with it every now and then - add a bit here, take away there - but for the most part we do nothing and let it grow.

It’s been repeatedly proven that sector allocation is more important than individual stock picking. That is to say owning - or not owning - tech or pharma or miners is more important than the company you pick within that sector. This portfolio is all about asset allocation.

Five months since inception, how are we doing? (I’m using October 1, 2023 as start date).

Let’s take a look at the portfolio and find out.

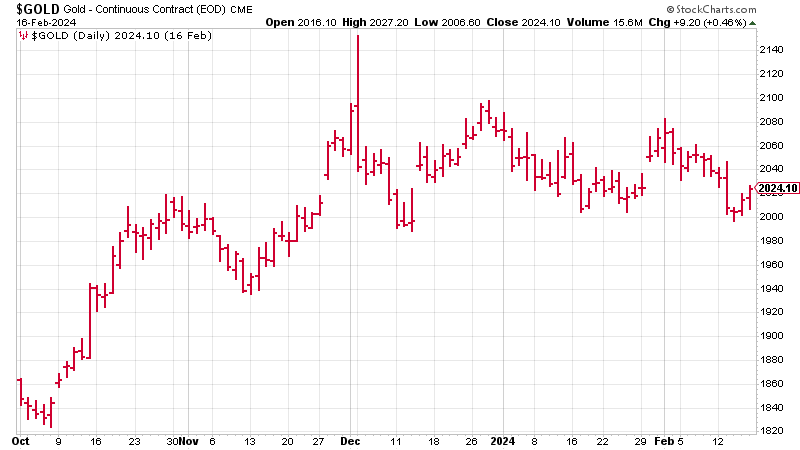

1. Gold (15% allocation)

We have a sizeable allocation to gold for reasons which don’t need spelling out here. It is up 9%. Solid.

If you are based in the UK, and so use pounds to buy your gold, in sterling gold is up about 7%.

(My guide to investing in gold is here. If you are looking to buy gold, use the Pure Gold Company).

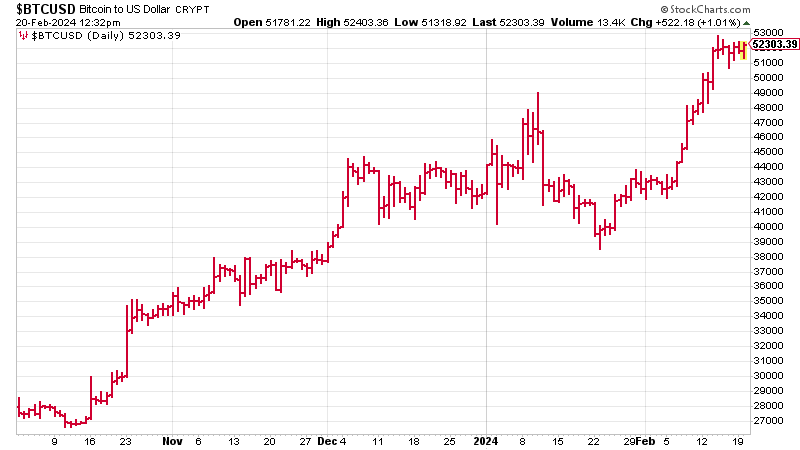

2. Bitcoin (5% allocation)

The potential of bitcoin is so extraordinary I see the risk is not so much owning it, but not owning it.

This is one of those times when I wish the allocation was more than 5%. It will not always be that way. It’s up 87%. (80% in sterling).

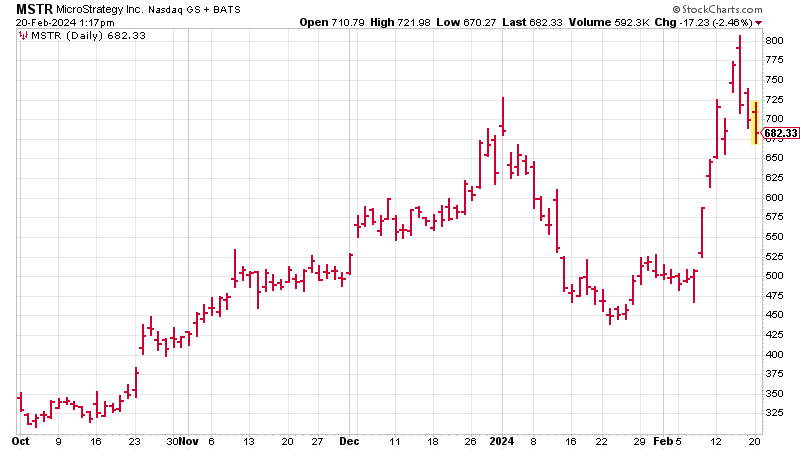

Our vehicle to play bitcoin via a UK-broker, and circumvent/satisfy ill-conceived-FCA regulation, is to own Nasdaq-listed Microstrategy Inc (NasdaqGS:MSTR). Microstrategy is up 100% and going great, albeit volatile guns.

It suffered, as anticipated, with the launch of the bitcoin ETFs. Many in the US sold as it was trading at a premium to NAV and invested in the ETFs instead, hence the dip. UK investors, thanks FCA, do not have that option to buy the ETFs. Fortunately, Microstrategy has made back lost ground, and, indeed, quicker than I thought it would.

3. Uranium (5% allocation, reduced to 2.5%)

I have reduced the uranium allocation for the time being, as outlined here, because I felt things were getting just that little bit too hot and frothy, even if the supply squeeze that we were warning about in August is not yet over.

Keep reading with a 7-day free trial

Subscribe to The Flying Frisby to keep reading this post and get 7 days of free access to the full post archives.