The Nuclear Stock That's Ready to Explode (In a Good Way)

From $800 to $3 - and back again? AI, Nuclear Power, and the Craziest Stock Chart You’ve Ever Seen

You might remember a few months back I wrote about a company called Novavax. It caught my eye because it had one of the most volatile yet regular charts I’d ever seen. It would swing from $4 to $300 and back again. On the basis of the chart action alone, I felt it was a buy with multi-bagger potential. Within a few weeks of writing when it was in the $4-$5 range, it quintupled to $24, and even today, it sits around $14, 250% higher than it was.

I think I’ve stumbled across a similar opportunity.

The chart action is not as regular as Novavax, but it’s very appealing.

The stock is currently trading at $3, near its lows. It looks like it has properly bottomed out – a process which has taken several years. But in a previous incarnation, it was as high as $4,000.

It’s one of those opportunities you treat like an option. Stick a tiny bit of capital in, accept that you could lose it all, but know that there’s also the possibility of making many times your original stake.

I stumbled across the stock while researching a piece I’m writing for this week’s Moneyweek about nuclear power and small modular reactors. (I’ll put the piece on here in due course so you can read it).

This company is developing some proprietary fuel technology that could dramatically transform both the economics and safety of nuclear power plants.

It’s the chart that really got me going, then the fact that what were headwinds for nuclear are now tailwinds.

AI needs shedloads of power, and there is currently a rush to secure it. In fact, the rush to secure power has suddenly made nuclear legitimate. The narrative has changed. After Microsoft agreed to pay a roughly 85% premium for reliable power from Three Mile Island a fortnight ago, anything nuclear or uranium-related has shot up. The bigger picture has changed.

I have invested and I’m going to tell you about the company today.

Its name is Lightbridge Fuel (NASDAQ:LTBR).

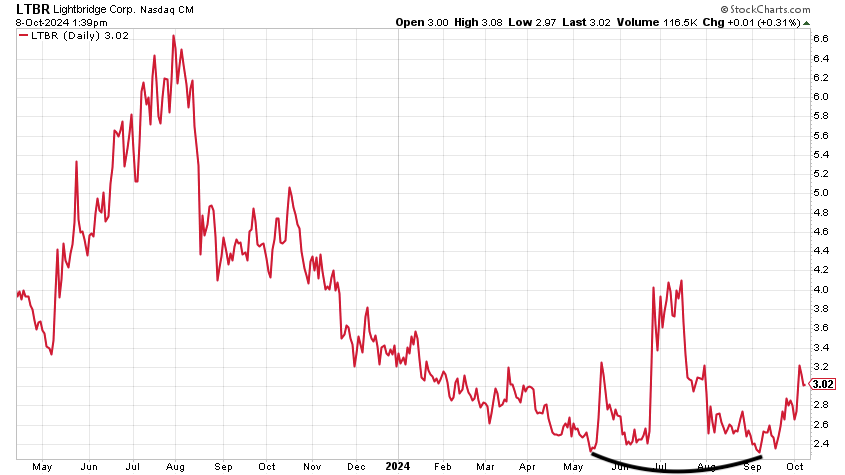

It is developing a nuclear fuel technology to improve the efficiency, economics, and safety of nuclear power plants. All good. But that’s not what got me interested. What got me interested is the chart.

This is such a nuts chart that you can’t even see the numbers on the Y axis. I’ll have to tell you what they are.

The company IPO’d on October 6, 2006, via an RTO. The price was somewhere near the $800 mark. (The previous incarnation - Novastar Resources Ltd - touched $4,000 in 2001). Lightbridge has been in near terminal decline ever since.

It hit $1.71 during the Covid panic, and then retested that low in the summer at $2.20, just before it put out its Q2 financials. From $800 to $3. How about that for wealth destruction?

But here’s the thing. I think there’s a chance, after all those years, it has bottomed. No guarantees, of course, but that looks like a solid double bottom to me. In a moment, I’ll show you further evidence in the short-term chart.

This does appear to be a legitimate company, not some fly-by-night tech or natural resource stock. It has partnerships with the US Department of Energy, MIT, Idaho National Lab, Texas A&M Uni, and, perhaps most significantly, Centrus Energy.

Centrus is a serious (and quite hot) $1bn market cap player, developing HALEU (high-assay low-enriched uranium) fuel. Centrus Energy has the fuel. Lightbridge has the fuel rods. Let’s synergize! (If this technology of enrichment comes good, by the way – low-enriched uranium (LEU) and HALEU – then the efficiencies of uranium and nuclear industry will transform, but we are some years from that.

Lightbridge also has some institutional support which is a good sign. BNF Capital took an 11% stake with a $13 million investment in 2021. Other shareholders include Vanguard Group, BlackRock, Geode Capital Management, and Citadel Advisors LLC.

Lightbridge’s financials are decent. It has a $44 million market cap, $26 million in the bank as of June 30, no debt, and is losing about $10 million a year, so it has about two to three years' runway before it needs to raise more capital. Its share structure is not bad either. There are 14 million shares outstanding, and it trades around 150,000 shares per day.

You never know – the proper reason to buy the stock – Lightbridge’s proprietary technology – might actually work out. Lightbridge is developing a metallic nuclear fuel that promises several advantages over conventional fuel. It is, we are told, more efficient and could increase the power output of nuclear reactors by up to 30%, which means more electricity from existing reactors without needing new infrastructure. Gotta be attractive, no? It also extends reactor life. Plus, it operates at lower temperatures than conventional fuels – about 1,000° C cooler (!) – which should also improve safety and reduce the likelihood of accidents.

It says its tech can work “with every reactor in the world, planned or operational.” So there’s lots of scalability potential. It wants to become the global standard (I bet it does). In any case, it has lots of patents. This has been years in the making.

NASA’s TRL system illustrates how far a technology is advanced. T1 is concept, T9 is proven in operation. On this scale, Lightbridge is at T4-5, so it has moved beyond the theoretical and is presently in the lab test phase. Its roughly halfway.

Here’s a chart of the company over the last 18 months. You can see it has also put in a bottom on a short-term basis too at that $2.20 mark, and is now in something of an uptrend.

You could limit your risk to $2, if you wanted.

The long-term investment case for Lightbridge Fuels hinges on the successful commercialization of its advanced nuclear fuel. I can’t pretend to know whether that will work out or not. As I say, I like the chart. The downside looks limited. The upside is huge.

What’s more, the bigger picture has changed too. Nuclear winds are now blowing in the company’s favour. The headwinds that blew through most of the company’s decline have gone. The narrative has changed, particularly thanks to AI. We have tailwinds now. Politicians need nuclear power to work. Regulators will, largely, support rather than oppose.

I have mentioned the company in this week’s Moneyweek, which comes out on Friday. Sometimes when I mention small-caps in Moneyweek, a lot of buying comes in. If you’re interested in the stock, I’d try and buy it in the next day or two, as sometimes volumes can go a bit bananas when I mention small caps in that mag. Either that or wait a week.

You heard it here first. One of the privileges of being a subscriber :)

Until next time,

Dominic

PS here is some research on Lightbridge which a reader sent me, in case of interest

PPS In other news, we should see Stllr Gold’s next mineral resource estimate (MRE) in the next fortnight or so. Gold stocks are moving nicely at the moment – finally. Let’s hope this MRE changes the way this company is perceived.

Disclaimer:

I am not regulated by the Financial Conduct Authority (FCA) or any other regulatory body as a financial advisor. Therefore, any information provided in this newsletter does not constitute regulated financial advice. It is solely an expression of opinion. Smallcap stocks are inherently risky. Please conduct your own due diligence and consult with a financial advisor if you have any doubts. Remember, markets can both rise and fall, especially in the case of small and midcap resource stocks. I am not aware of your individual financial circumstances, so only invest money that you can afford to lose.

Thanks Dominic - just brought a very small amount of Centrum on eToro - let’s see how they do but the future is Nuclear from all my work experience in related businesses during the last 40 years. Keep these great tips coming 😊😊😊

Earnings are released on 31st Oct.

I wonder if recent moves have been driven by rumours of good results?

I’m torn whether to hold or sell. It’s broken the $5-6 resistance, meaning 10 would be a decent next bet. But it doesn’t hang around there for long!