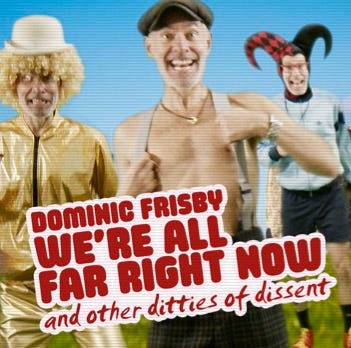

If you are looking for some entertaining Christmas presents, we have some celebratory “One of the 17 Million” Brexit mugs, my new album and other goodies for sale in the Dominic Frisby Shop. Take a look.

Something positive for you this Sunday morning - and why we should be grateful for government incompetence

The idea of Central Bank Digital Currencies (CBDCs), money that governments and their planners will be able to programme, rightly fills many of us with an Orwellian sense of dread.

“Did you not have the vaccine? Oh, well then you don’t qualify for the next payment.”

“Have you been saying wrong things on social media? Then you don’t get the good loan rates.”

“We suspect that you might not have paid the right rate of tax, therefore we are deducting what we think you owe and it’s up to you to prove otherwise. You want the money back? Please hold …. Your call is important to us.”

CBDCs allow for almost unimaginable interference in our lives, intrusions on our privacy and liberty, never mind meddling in the economy. Chinese social credit scores would be just the start of it.

When you combine the instincts of, say, the current Labour administration to intervene, together with its incompetence, the ramifications are truly horrifying.

Some say CBDCs are inevitable. Technology is destiny and all that. I’m a bit more optimistic.

Hete’s why.

CBDCs have been piloted in numerous countries and fully implemented in:

The Bahamas - the "Sand Dollar"

Nigeria - the "eNaira"

Jamaica - "JAM-DEX"

The Eastern Caribbean Currency Union

Nowhere has got them to work. The Bahamas is generally touted as the CBDC success story. My buddy, Dave Skarica, who lives there says, “LOL. I have never seen one person use it.”

Why have they failed? People don’t use them. When they do use them, they don’t work. People prefer the legacy systems they know.

CBDCs are yet another government IT project that is doomed to fail.

If you are thinking of buying gold to protect yourself in these uncertain times, I recommend The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.

You might say the internet was a government IT project. It was . The U.S. government - via ARPA and later DARPA - provided crucial funding that led to the development of key protocols like TCP/IP. But the Internet succeeded because of the immense infrastructure that millions of people, mostly working in their own self-interest, since built over many decades on top of it.

Our modern system of debt-based fiat money should long since have imploded under the weight of all the abuse and debasement successive governments have heaped upon it. But it has survived, indeed thrived as a medium of exchange, albeit a terrible store of wealth, because of the incredible fintech architecture that has been built on top of it, again by millions of people over many decades mostly acting in their own self-interest. That architecture is probably what has saved the system.

Fiat money is just promissory - worse than that it is a promise of something that isn’t even there - but the incredible advances in communication technology that we have seen in the last 150 years - telecommunications, digital technology and all the rest of it - have all enabled the sending and recording of those promises. The fortunes that have been invested have all helped the system evolve and indeed preserved it.

Fiat money worked as countries gradually abandoned gold standards over the course of the 20th century because they were the only currencies citizens knew. The payment and saving infrastructure was already built and normalised. The coins and notes and cheques and bank accounts all functioned perfectly well, and there were no alternatives. The removal of the gold backing did not really impact the overall architecture.

Government currencies worked in the first place because they were based on gold and silver, which everybody already used and instinctively knew had value. When they weren’t debasing their money, rulers, or those working for them, often actually improved the system: coinage, for example, certified the amount of precious metal in a coin and the ruler’s stamp legitimised it. Money was based on something people already knew and used and understood.

Not so CBDCs. They have no existing infrastructure around them, nor is their use normal.

Governments will not be able to design anything decent. They will need the private sector to do that, and this will take many years, perhaps decades before it gets as good as the infrastructure around existing payment systems. It would also take many years and lots of nudges for people to change habits

The private sector is not going to invest the required amount of money in payment systems if people are not going to use it, so you will end up with a situation, a bit like green energy, where governments will have to spend billions subsidising it in order to make it work, but the actual energy you get is not as good as that provided by fossil fuels: unreliable, more expensive and more damaging to the environment. There will not be the same green arguments - 10 years to save the planet and all that - to justify the spending. The scope for corruption and crony capitalism will be enormous. Again.

None of this will stop governments trying it, of course. Citizens might slowly start to use the system, particularly if they get free handouts, but it will be a long time before CBDCs reach a level where they compete with existing payment systems. At this point fiat money as we now know it probably won’t exist anyway. We tend to forget, but most nations as we currently know them are only about 200 years old. Many won’t exist in 50 or 100 years time. They’ll go bankrupt and break apart. What will happen to their money?

There is the possibility of demanding that taxes are paid in CBDCs, I suppose, but again this opens up so much scope for outcry, waste and inefficiency, I just can’t see it working.

People within the blob look at bitcoin and admire it and think they can copy it, but even bitcoin is what it is, not so much because of Satoshi Nakamoto’s genius invention, but because of the way hundreds of thousands of people in the free market embraced it and built on top of it. The reason they did was, again, self-interest: the value of bitcoin kept going up. Every bit of bitcoin fintech, every podcast, every tweet - every transaction. They all help the bitcoin price. It’s a colossal open-source contribution and movement. There is not the same incentive with CBDCs. Their value is never going to go up. Quite the opposite. Their value will fall as governments issue more and more of them. There is not the same incentive.

To have any chance of working, CBDCs will require billions and billions of subsidy. Most governments do not have the resources. They are already bankrupt. They will struggle to justify the expense. Health or welfare or pensions or something will be deemed more important.

Plus they will meet with huge resistance from the freedom-fighters and possibly even the media .

None of this will stop them trying of course. But on this issue at least you can sleep soundly. CBDCs are one Orwellian nightmare that is not going to work.

They will end up yet another failed government IT project.

All ye from the future look back on this ‘ere prescient article and marvel at my foresight.

If you are interested in this subject, take a look at my song, Programmable Money.

A reminder about those mugs, my album and other fun Christmas presents - all for sale in the Dominic Frisby Shop. Take a look.