Before we begin today’s piece, let me flag this video I made based on my recent article about Triffin’s Dilemma. 13 mins long and hopefully worth the effort. Might be the most important thing you watch this week.

With all the narratives that come with a gold bull market - and also a bitcoin bull market - that we're heading to some kind of money reset, the dollar or the pound is going to collapse, we are going to end up on a gold or bitcoin standard and so on - you have an end goal. The bull market will continue until we reach that eventuality.

However, I doubt very much we go back to a gold standard. Yes, gold's role as reserve asset increases, ditto bitcoin, but I don't see a return to the gold standards of the 19th or 20th century. Much more likely is a Hayekian world of competing currencies.

The 20th century gold standards were bogus anyway - which is why they failed. There was no gold in circulation. Americans weren't allowed to own it. When Britain returned to a gold standard in 1925, the British government ensured there was little gold actually circulating. It minted zero gold coins, while the Bank of England hoarded what it already had. ( It's all in the book, if you're interested).

The Secret History of Gold is available to at Amazon, Waterstones and all good bookshops. I hear the audiobook, read by me, is excellent. Amazon is currently offering 20% off.

There was plenty of gold in circulation under the gold standards of the 19th century, but we are not going back to them because we barely use physical cash any more. We are not going to pay for physical things with gold or silver coins in the way we once did.

It might be that China gives the yuan some gold backing, and makes its (digital) notes interchangeable with gold, but I find that unlikely. It might also be that gold backing is used to make US Treasuries more attractive, as economist Judy Shelton, former advisor to Donald Trump, has proposed.

Again, though possible, I would give it a low probability.

The gold bull markets of the 1970s and 2000s did not end with gold standards. I doubt this one will. A gold standard is a political ideal. Real life is a lot more mucky.

Unlike gold, gold bull markets do not last forever, any more than tech or any other kind of bull markets do.

And this bull market is getting hot. That's for sure. Gold is at $3,700/oz. While the mainstream press are not really covering it, there has been a definite change in tone online. Silver is starting to lead. Gold miners are starting to deliver.

Towards the end of previous gold bull markets, I usually get invited on to the BBC to talk about gold. Massive name drop, I was actually fraternising with BBC Director General, Tim Davie, this week - enough to get a selfie at least - but I am currently so far from being invited on to the BBC, whether for my satirical songs or for my market commentary - even with a new book on gold just out - that I believe we are a way from that.

(In another age, I would have been a fixture on BBC radio. I have got the voice. I have got the intellect. But obviously, wrong age, wrong sex, wrong colour and all of that. Wrong views too).

Anyway, back to more important matters.

Things got hot and spicy with gold in the spring, as we warned, not unlike now. But we didn't feel it was the top. We just needed to go sideways for a few months, which we have.

With physical gold, especially if you live in a Third World country like the UK, there is a strong argument never to sell. Even during gold's bear market (2011-2020), gold was a brilliant hedge against woeful sterling.

If you buying gold or silver to protect yourself in these “interesting times” - and I urge you to - as always I recommend The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.

You could just hold your gold and then pass it on to your heirs. Bitcoin's the same. But then again you might want the money for something else.

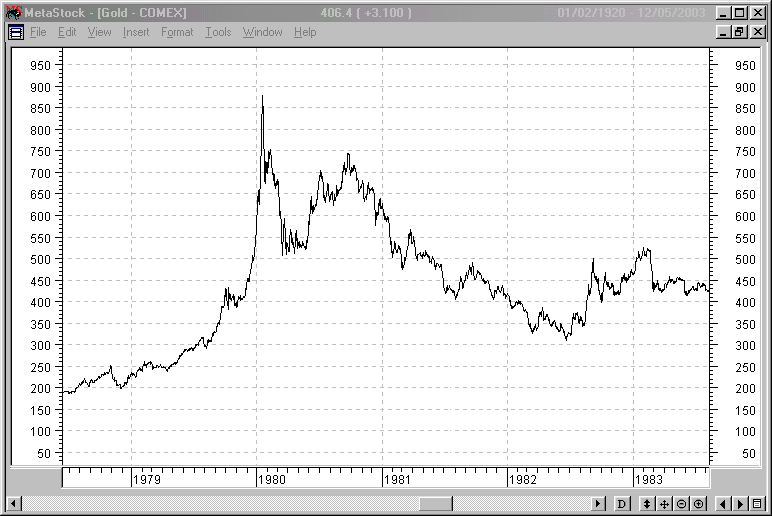

In the 1970s gold went from $35/oz (an artificially low price due to US suppression) all the way to $850/oz.

But that $850 mark was just as much an illusory price. Though it has been logged in people's minds for decades ever since, the reality is it reached that price during one spike on one afternoon. The Cold War was looking grim: the Soviet Union had just invaded Afghanistan a month before. The Iranian hostage crisis was making everyone panic (the hostages were released the day before the spike). It was the day after US President Ronald Reagan had been inaugurated. Nobody yet knew what a success he was going to be. There was an ongoing and severe crisis in the US bond markets, which had sent interest rates above 10%.

In other words, there was a lot going on. And yet gold only hit $850 for an afternoon. Hardly anyone sold the top of that spike.

The launch to $850 gold began in December 1979 with that Soviet invasion. Gold broke above $450. The day after the spike, gold collapsed like a stone. By March it was below $500.

Gold then did something you commonly see at the end of bull markets. The Nasdaq did something similar in 2000. Silver did it in 2011. It rallied. That rally persuaded people the bull market was still on. It was a suckers’ rally.

But the retest did not even make it back to the old high. It was a lower high, in other words.

Then the relentless declines kicked in. By 1982 - 18 months later - gold was at $300/oz. It then spent the next 20 years - 20 years! - trading between $300 and $400, before eventually hitting a low in 1999 at $250/oz, when Gordon Brown sold. Idiot.

My point is that in 1980 it looked to some like a return to gold standards was coming. The US had only abandoned gold 9 years earlier - and, in President Nixon's words, temporarily. Gold was still normal in people's minds. But the gold standard never came and gold was a rotten investment for 20 years.

2011, by the way, was not of 1980 standards but the price still shot from $1,500 to $1,920 in a couple of months with the Greek debt crisis. There followed another gruesome bear market which saw gold go all the way back to $1,050.

There is so much anti-dollar sentiment out there now, it might be that everything turns on its head - as things are wont to do - and we get a dollar rally.

I recognise that things are looking frothy. Anytime silver starts doing well, that is usually a warning sign.

A lot of American commentators like to use the baseball analogy. I would suggest maybe we are in inning six of nine. Something like that, possibly.

So when to sell?