I don’t mean to get all bearish on you.

Bearish copy - it’s all going down, it’s going to crash - gets more eyeballs than “everything’s fine”. Bearish commentators usually have bigger followings. Bad news sells.

But bears are usually wrong. They’ve predicted 13 of the last two corrections.

The fact is, as human beings progress and economies grow, markets tend to rise. This is doubly so when the underlying unit of account - the pound, the euro, the dollar - is being systematically debased. (Which makes the underperformance of the FTSE these last 25 years even more incredible by the way). Stock markets, especially in the US, have become places to park capital, where you can reduce erosion by inflation.

So that’s my disclaimer out of the way.

I’m feeling bearish

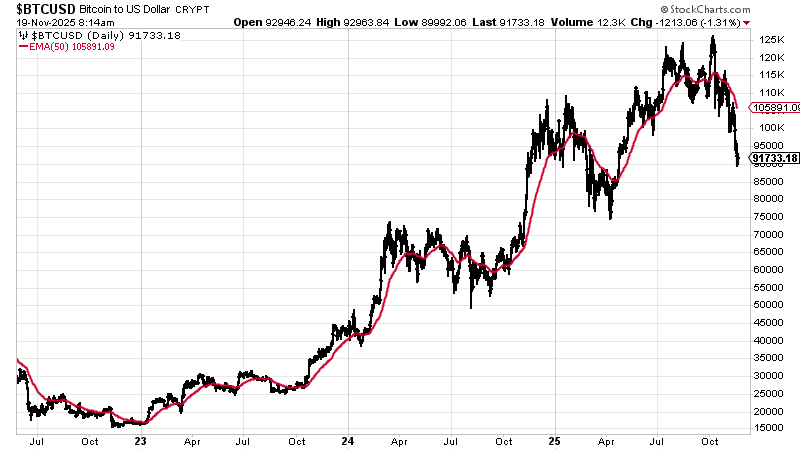

We’ll start with bitcoin. It’s a leading indicator for the Nasdaq and tech. It’s sold off - from $125,000 in early October to $90,000 a coin on Monday. Remember: I targeted $90,000 a coin a few weeks back.

The crypto summer was muted, so we can expect this crypto winter to be similarly muted - no 90% corrections in other words. But we are almost 30% down already.

Strip out the noise and HODL is my advice. That’s what I’m doing. There has been no better investment strategy over the last 15 years and I’m sticking with it. But a crypto winter is upon us, it seems. Let’s hope it’s a mild one.

Here’s the chart. Look at the 50 day moving average in red. This is the third time in since 2024 that we have been in this situation.

One correction lasted most of 2024 - well, March to October - the other took up the first five months of this year. They passed.

Also worth noting is how each correction seems to have three spikes down - three drives to the bottom. This time around we have only had one, so maybe a couple more to go. That is not a prediction by the way: just an observation.

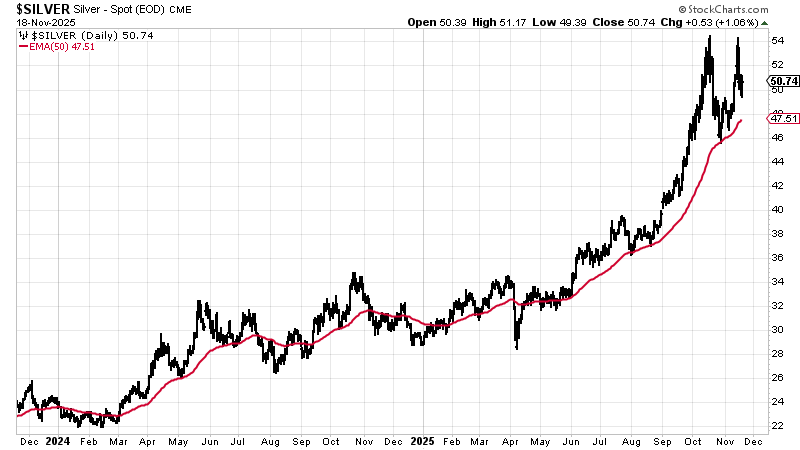

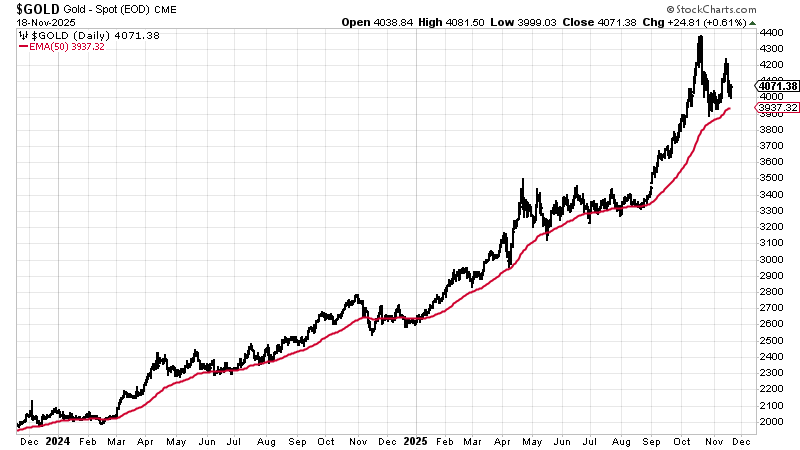

The corrections in gold and silver have been more muted. But I have to say the silver chart concerns me. Double top or what?

I thought the October correction would go deeper than it did, but it held up at the 50 day moving average (red line). That’s a sign of strength. This rebound rally, dead cat bounce - whatever you want to call it - has taken us right back to the old highs, while gold and the S&P500 both made lower highs. That is also a sign of relative strength.

But the second high was not confirmed by the silver miners, that is not good. And now we have a double top on our hands, until we don’t.

I would think we have one more leg down to get through plus some sideways consolidation to digest the gains of earlier this year.

Here is gold, FYI, which has conspicuously made a lower high. This one might want to go into the $3 thousands for a bit.

The stock market has this ridiculous Nvidia situation to get through. $4.4 trillion market cap - and that’s after the recent pullback. 40 stocks account for something like 60% of the market cap of the five hundred stocks in the S&P. It needs to rebalance, otherwise it’s an index of 40 stocks with 460 hangers-on. Corrections are how these things happen.

So I am feeling über cautious. There is nothing wrong with having cash in times like this - it means you can buy stuff.

On the other hand, the year end rally is approaching - so maybe we should just stay long. As with bitcoin, the way to play the stock market since 2009 when the S&P500 reached 666 - it is ten times that today! - has been simply to hold on through. With so many conflicting messages, it’s hard to know what to do. Dolce Far Niente … Italian for HODL.

With all that in mind, I want to just skim through some of my speculative positions and give you my latest opinion on them. we are going to look at Metals Exploration (MTL.L), Comstock (LODE.NYSE), Lightbridge (LTBR), Minera Alamos (MAI.V) and more. Time to sell? Time to buy more?

Let’s see.

A review of the speculative portfolio

We’ll start with Metals Exploration (MTL.L), my largest position.