There will be no growth in the UK.

Chancellor Reeves’ budget was designed to placate left-wing back benchers, who want greater spending, and the bond markets. In that, it has succeeded. For now.

The ever-shrinking part of the country that actually builds wealth (and remember there are only 3 ways to build real wealth: you grow stuff, you mine stuff or you make stuff. Everything else is just pushing it about) is being further taxed to pay for it all. There are now extra taxes on property, dividends and savings, while fiscal drag means more people will pay higher rates of income tax (closing in on 25% of workers by 2030, apparently), further diminishing their chances of improving their lot. Never mind the currency debasement of the money they are being paid in.

Stealth taxes, such as fiscal drag, get my goat because they are so disingenuous. But perhaps of greater concern are doors which have been opened to new sources of taxation. The extra levy on high value properties, for example, has been set at £2,500 per year for properties in the £2-£5 million bracket, and £7,500 for properties above.

A £2 million house in London is not some decadent billionaire plaything: it is often a mere terraced house built 150 years ago for an ordinary working man and his family.

My friend, who is uber successful and very left wing, has an expensive house in Hampstead. She was actually happy about this tax, because she thought it was fair - and because she thought she was going to get hammered for higher taxes elsewhere. What she doesn’t realise is that this is just the beginning. The door is now open to further property taxes and the only way is up.

What’s more, as currency gets debased, fiscal drag means more and more properties will fall into this category.

Income Tax began as a tax only on higher earners. Within a few decades, ordinary workers were hit. Now they’re paying higher rates. These new property taxes will go the same way.

Never mind that you bought the property with taxed income, and then paid stamp duty. It’s endless.

Between that, landlord taxes, extra tenant protection, Section 24 and the plethora of petty regulation, the age of the small landlord in Britain is now over. Renting, like so many other parts of the economy, will become the domain of larger corporations. And we will all lose because of it.

It also means that real estate is over as an investment. All it really was was a shield against currency debasement, but those days are now behind us.

Similarly, the door is now open for local authorities to charge a visitor levy. This tourist tax will start small and then rise, like every other tax in history. We already have the tax on moving that is stamp duty, now we have this. If you tax movement, people will move less. If you have no movement, you have no growth. It really isn’t that difficult.

They do not seem to understand that capital flows to where it is welcome. If you tax it, it will not come; it will go.

What is the golden rule of the magnum opus? More taxes or higher rates do not equal greater revenue. But the reverse.

We are now, as you know, taxed at the highest rate since the Second World War. What is the money going on? You don’t need me to tell you how much is being spaffed. Waste, fraud, incompetence, misallocation. Government is the most inefficient means of spending money there is. As if to prove my point, they couldn’t even make the announcement about how they’re going to spend your money competently.

They’ve spent the last few months leaking stuff. Leaking is a tool of government, so when it backfires, at least we have some karma.

Meanwhile, the source of the leak, the OBR, rarely if ever gets a prediction right. How much is being drained from the productive to fund that thing? How many bad choices are made as a result of its utterances?

The state is already disproportionately large and it is only going to get bigger

Where do the salaries of those who work for the state come from? The ever-decreasing sector of the economy that actually builds wealth.

Even if you are providing some essential state service and are being well paid to do it, you are still a dependent, because it is the shrinking part of the economy that actually builds wealth that is the ultimate source of your wages.

Millionaires and billionaires, assuming they haven’t made their wealth through crony capitalism or government subsidy, are not the problem - they are the solution. We want to attract them here, not frighten them away. They create employment. Our lives are better for likes of Jeff Bezos and Elon Musk, not worse. The same goes for investment, profit, saving, trade, growth. We want to attract them not deter them.

The opposite applies to deficit spending, money printing, currency debasement, suppressed interest rates, high taxes, tax traps, welfare, dependency, regulation and bureaucracy. You want to deter them not attract them. Yet I am afraid all we are doing is the latter.

If you pay people to be unproductive, you will get more unproductive people. If you tax people who are productive, you will get fewer productive people. What is so hard to understand?

We can rant and rave. It won’t do any good. This is the path we are on. We are following the template of South Africa. (It was actually me that coined the term “the South Africanisation of everything”, something I am quite proud of). We keep thinking that things can’t get any worse. But they can and will. It is gradual and incremental. We are frogs being boiled while suffering water torture. The country is going to get even more socialist. All you can do is look after yourself and your family.

If you are young and reading this, the best thing you can do is leave, as so many are already doing. It is just so hard to build a future for yourself when you are so heavily taxed, and then the money you are paid in is being debased. Leave, travel the world, have adventures, learn, become a Sovereign Individual. The world is a big place. There are better futures to be had elsewhere.

It’s all happening just as I said it would in Daylight Robbery, by the way, even the mileage tax

Many of us, however, because of our circumstances, do not have the option to leave.

So what to do?

Real estate, as already mentioned, is now dead as an investment. It’s too easy a target for taxes.

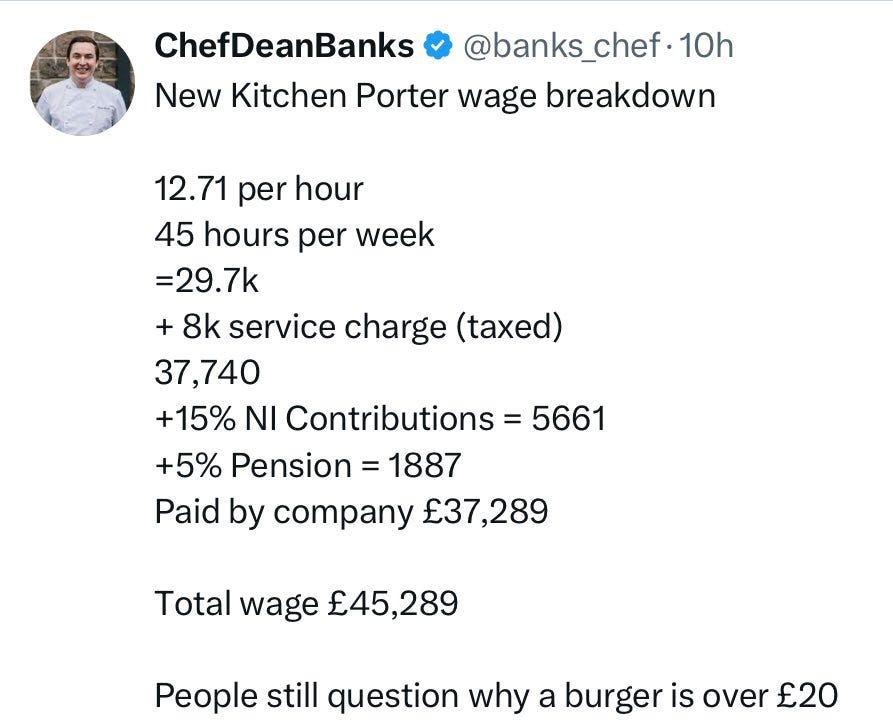

UK companies are going to find life that much harder - the rising minimum wage will reduce employment (and thus increase the burden of dependents). It’s also going to mean higher costs for you as this tweet demonstrates

If companies do well, they will face further taxes. Dividend taxes are a deterrent too. We are not quite at the point where UK companies are un-investible (in fact there is a wall of US capital that wants to buy the UK), but the foundations are not exactly enticing.

The one compensation for saving in fiat was interest, but taxes here are going to go up too. So cash is crap

As we have long argued on these pages, you need to park capital where governments can’t touch it, tax it or debase it. The best forms of non-government money are gold, if you want something physical, and bitcoin, if you prefer something digital.

We are not yet at the point where they try to tax or confiscate your gold and bitcoin, but we are on the trajectory I’m sorry to say.

All those horrible bitcoiners crowing about how much money they’ve made - do you honestly think taxing or confiscation of bitcoin won’t meet with public approval? You’re just another one of those loathsome rich people creating inequality.

It’s coming, but we are not there yet.

Bitcoin is in one of its down seasons. But it is still the best performing asset class of the last 15 years. And if you don’t like it, fine, own gold instead. There is plenty more gas in that particular tank.

Reeves may have staved off a tantrum in the gilt markets, and a resulting fall in the pound, but she has created an even bigger problem for her successors.

We need fewer taxes, lower taxes and simpler taxes. It all starts there. Reeves has chosen a path in the opposite direction, the road more travelled. And it takes us further along the road to serfdom.

If you live in the Third World Country such as the UK, I urge you to own gold or silver. The bullion dealer I recommend is The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.

Sunday’s thought piece has become the most viewed piece in this Substack’s history. Take a look, in case you missed it:

Until next time,

Dominic