I’m watching amazing video after amazing video made by AI. They’re almost as gripping as the Lowe-Farage blood feud.

Hollywood is being “dis-intermediated”, to use the tech lingo. Just as television went from scheduled to on demand, now the content itself is moving that way. Want a different ending to Game of Thrones? Soon you will generate it.

And that’s just video. What about everything else?

Even if just a fraction of the AI hype actually scales, one thing is certain: we are going to need more electricity

More data centres. More compute. More cooling. More fabrication. More automation. Doesn’t matter where you are in the world - Asia, Africa, America, Europe - energy consumption is going to go up.

Because that is what humans do. As we evolve, we consume more energy. We also get better at consuming energy. It’s called progress.

Despite ESG orthodoxy, wind and solar subsidy and build, and everything else, global oil consumption keeps rising. That’s because it is currently the best form of energy.

Cheap energy is the foundation of industrial competitiveness. An economy cannot compete if its energy costs twice as much as its rivals.

Despite this inevitability, those in charge of energy policy - and Western Europe is the biggest offender - would have us consume less energy, and make it more expensive.

So, because of the idiots, this sector has been starved of investment capital.

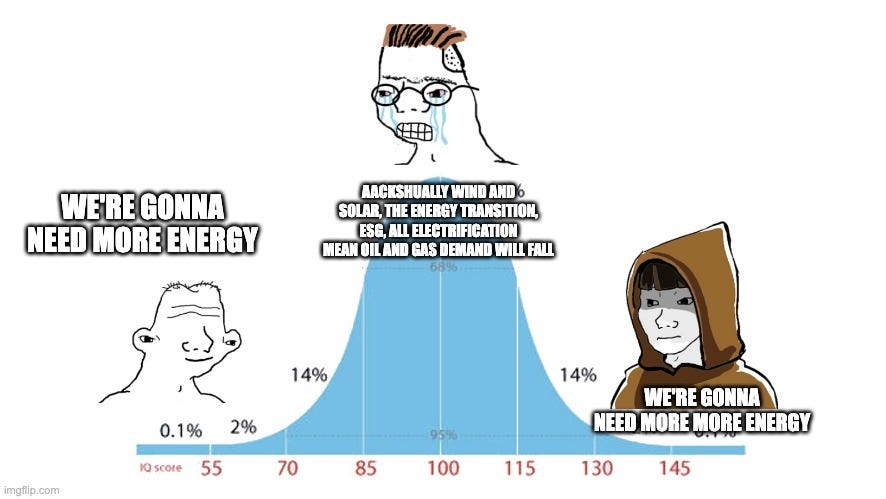

It’s all summarised here in the bell curve.

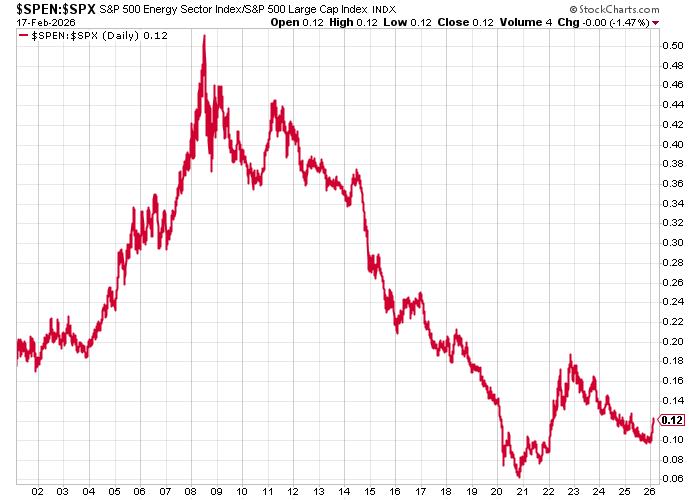

Even in the US, the sector has been starved of investment. Currently energy represents about 3.3% of the total S&P 500 market value. I know times have changed but in the early 1980s this was above 25%.

Here is S&P energy to S&P ratio over the last 25 years.

Time to put your capital to work, folks, if you haven’t already.

The house view is that oil and gas companies are where gold miners were 18 months ago. Unloved and under-owned, often tightly run, often cash generative and cheap.

We’ve been calling for higher energy prices in 2026 and we’ve been rolling investment capital into the sector. Dr John’s timely article early in the new year should be your starting point.

Today we go a step further.

We’ll explore how to invest in this theme, plus I’ll tell you the three largest oil and gas positions in my own portfolio.

I’ve got an exciting small-cap Colombian gas story to tell you about. Exotic.

The setup

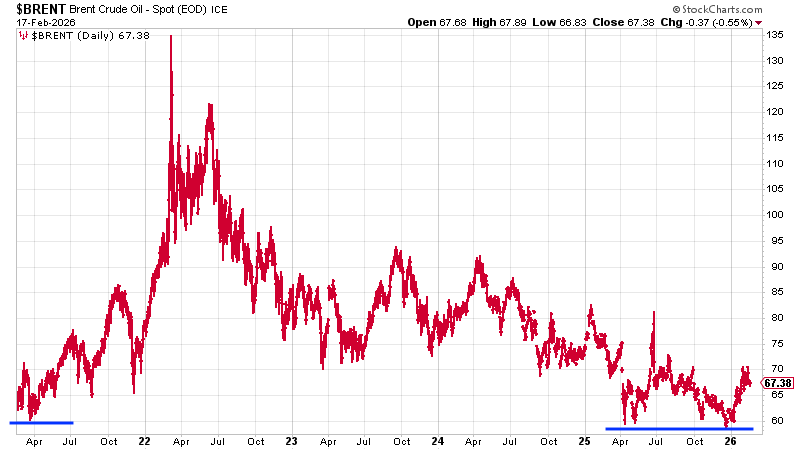

Here is the 5 year chart of Brent Crude. We have seen the spike, the collapse, the rebound and the drift. What matters is that the market has repeatedly found support around $59 (blue line), a level of support which goes back to April 2021

Today we are $67.

After a strong January, Brent has eased back, but if you can take a 12 to 18 month view, weakness toward $60 looks more like opportunity to me.

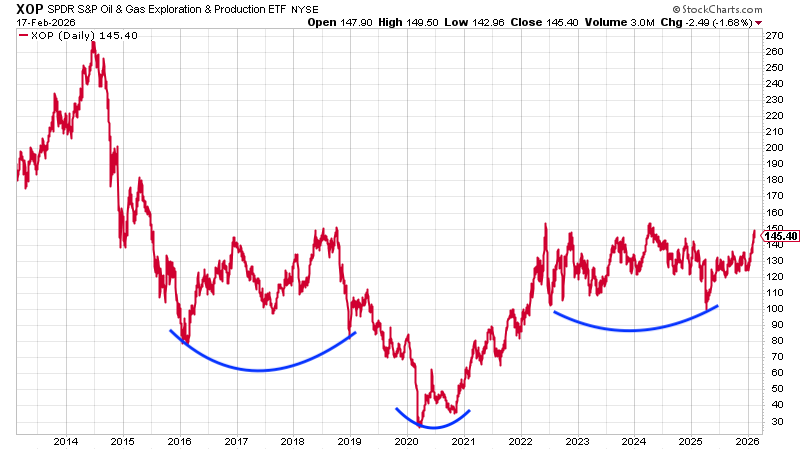

On the equity side, XOP, the US oil and gas explorers and producers ETF, has carved out what looks like a massive inverted head-and-shoulders base over the last ten years. It traded near $270 in 2014. Today it’s $145.

That is super bullish.