The Truth About China's Gold

How much gold does China really have? And why does it matter?

If you thought the west was unprepared for the inflation that has struck this past year or indeed for Russia’s invasion of Ukraine, wait and see just how unprepared it is for this bombshell.

This is the biggest story in world finance, and yet nobody, bar your intrepid blogger, is reporting on it.

For those without the attention spans to read all the way to the end, let’s cut to the chase and get the main point out upfront.

China has more gold than the United States.

Why China might want to own a lot more gold than it’s admitting

We’ve seen many examples over the last few decades of how the United States weaponises the dollar, exploiting its status as global reserve currency.

The sanctions on Russia and its removal from the Swift messaging system this week are perhaps the most dramatic example of all, made possible by the swiftness, forgive the pun, of modern digital technology. Innocent Russian civilians have had their wealth decimated (in fact, probably significantly more than decimated for most) almost overnight.

China will be surely watching all of this, learning from Russia’s mistakes and thinking it needs to de-dollarize as rapidly and discreetly as possible. Whether to protect its citizens’ wealth or its national interests, China cannot be beholden to a banking system that is run by the west, the US especially, and which is one of their weapons of war.

But both Russia and China have known they must de-dollarize for some considerable time, which is why both have been so steadily increasing their gold holdings.

Let’s start with Russia’s gold. The chart is courtesy of Nick Laird of goldchartsrus.com and it shows the Russia Central Bank’s accumulation to today’s figure of, give or take, 2,300 tonnes - roughly 74m ounces.

That makes Russia, according to official figures at least, the 5th-largest gold owner in the world.

The table below, data courtesy of the World Gold Council, shows the top 20 owners of gold, also their foreign exchange reserves and their percentage allocation to gold. The US has the most – 8,134 tonnes – followed by Germany, Italy, France and Russia.

The UK sits proudly in 17th position. Behind Kazakhstan, Turkey and Uzbekistan. Thank you Gordon Brown.

The country we are focusing on today is the one in 6th place on that table, China.

First consider China’s US dollar holdings - over three trillion of them. That’s more than the UK’s annual GDP. Its US dollar holdings eclipse those of every other nation. China is not going to want those to go to zero, not yet anyway.

Then consider its gold holdings. It has 1,948 tonnes, barely 3% of its foreign exchange reserves. The US’s gold holdings equate to over 65% of its reserves.

What if China were to approach a similar 65% level?

Here’s why China’s gold reserves must be far bigger than official data suggests

My argument is that China has much more gold than it says it does and there are two parts to this argument. First, China’s gold mining.

In 2007, China overtook South Africa as the world’s largest gold producer. It has remained so ever since. This past decade it has produced about 15% of all the gold mined in the world.

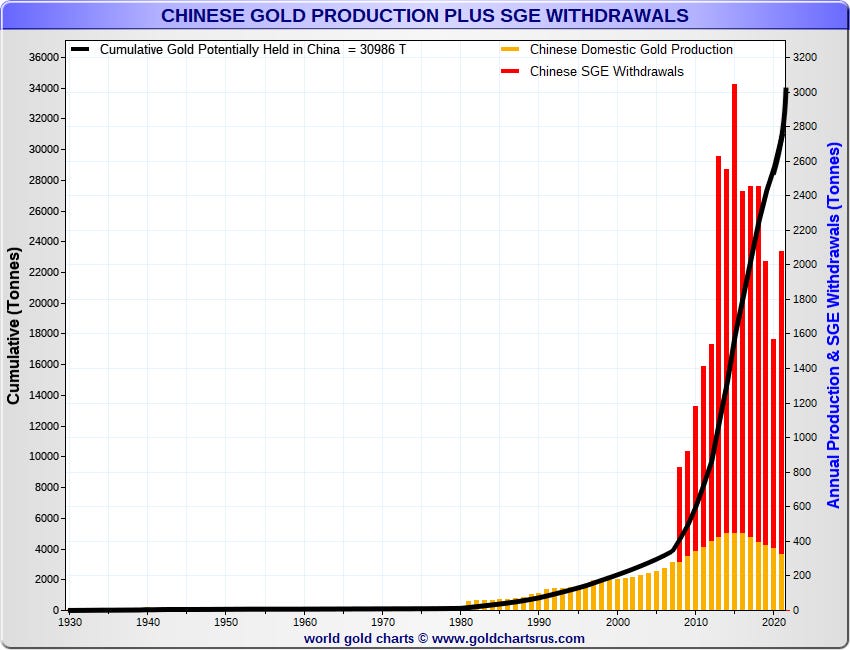

Since 2000, China has mined roughly 6,830 tonnes. Here’s the thing. Over half of Chinese gold production is state-owned. The China National Gold Group Corporation alone accounts for 20%. China keeps the gold it mines – the export of domestic mine production is not allowed.

I say that number again: 6,830 tonnes of production, over 50% of it state owned, close to none of it exported. Already that official 1,948 figure looks dubious.

With reserves in decline at home, Chinese mining companies have also been buying assets abroad, across Africa, South America and Asia. International production exceeds domestic production – by about 15 tonnes in 2020.

Second there is the fact that, as well as being the biggest producer, China is the world’s biggest importer. Gold imports via Switzerland and Dubai are not always declared, but we do know that via Hong Kong alone, over 6,700 tonnes have entered the country since 2000.

Whether imported, mined or recycled, most of the gold that enters China goes through the Shanghai Gold Exchange (SGE), including the gold imported from Hong Kong. So SGE withdrawals – for which we do have numbers – can act as something of an approximation for demand. And it is possible to get numbers for SGE withdrawals: since 2008, almost 22,000 tonnes have been withdrawn from the SGE.

Then we have to add in gold held in China, whether as bullion or jewellery, prior to 2000. The World Gold Council estimates a figure of 2,500 tonnes in privately-held jewellery. Added to domestic mining and official reserves, you get a figure of around 4,000 tonnes.

Cobble it all together – cumulative production, imports and existing stock – and you arrive at a figure not far off 31,000 tonnes.

I’ve spoken to some of the world’s top analysts – Ross Norman, Bron Suchecki and Koos Jansen – and they all arrive at similar estimates. Alasdair McLeod of Goldmoney thinks it is higher still.

So why would China keep its gold reserves quiet?

But there is more, as Ross Norman points out.

Not all gold entering China is accounted for by SGE withdrawals. The People's Bank of China (PBOC), the central bank, likes to buy 12.5kg bars, which do not trade on the SGE. The PBOC often uses dollars on exchanges in London, Dubai and Switzerland, while the SGE sells its gold in yuan.

The army, too, owns gold and does not have to declare its purchases. There are other state agencies, as well: the State Administration of Foreign Exchange and China Investment Corporation – the sovereign wealth fund, for example.

How much of this almost 31,000 tonnes of gold is state owned? Norman guesses 50%; Suchecki, formerly of the Perth Mint, says 55% .

At 50%, the implication is that China owns over 15,000 tonnes – closing in on double the US’s 8,133 tonnes.

“Chinese Central Bank gold holdings have apparently been entirely unchanged since mid-2019 at 1,948 tonnes,” Ross Norman tells me. “But few of us believe that. Put an additional zero on the end (19,480 tonnes) and I should not be surprised if that is not much closer to their official holdings”.

Alasdair McLeod goes one stage further. “The PRC probably has as much as 30,000 tonnes hidden in various accounts, but not declared as official reserves”.

China has been famously encouraging its citizens to buy gold since 2008. This encouragement to buy gold, as one reader resident in China reported to me, “kicked off a frenzy of laundry” as China’s citizens rushed to exchange the hoards of hooky cash they had built up. “In my local bank in Shanghai in 2009 I was standing behind a Chinese bloke unloading bundles of euros, US dollars, Singapore dollars and Swiss francs in exchange for five-kilo bars of gold across the counter.”

So it may be that state ownership is lower. 20 or 30% perhaps. But this almost doesn’t matter. The vast majority of Chinese people trust their government, especially when it comes to returning China to the top of the world. There is not the same mistrust of government held by western gold bugs – the Party is seen as a good housewife to the nation. It is commonly thought that, should Beijing invite private holders of gold to support a major government currency initiative by pledging their gold as a kind of war bond, the pick up would be over 90%. Gold ownership is registered, so the government knows how much its citizens have.

Nevertheless, whether 10, 15 or 30,000 tonnes, it is a lot more than China is saying and there is no way China can declare such large holdings. Not yet anyway. It would cause an unwanted surge in both the yuan and the gold price. The government's $3.2trn of US dollar foreign exchange reserves would be devalued.

“I don’t think China needs to brag about its largesse,” says Norman. “After all, a stronger currency as a result of that reserve backing would be counter-productive, as it would confer competitive disadvantage”.

What’s more, to declare so much gold would be a direct challenge to American supremacy, which China is probably not yet ready for. Parity first, then supremacy.

For now they follow Deng Xiaoping's doctrine of “we must not shine too brightly.” Its declared 1,948 tonnes is, perhaps, the bare minimum it could declare and look credible. But a mere 3% of China’s forex reserves in gold? Pull the other one.

If China decides to weaponise money, as the US has done, all it has to do is declare its gold holdings, perhaps even partially back the yuan with them. Talk was, at one stage, its central bank digital currency (CBDC) would be partially gold backed.

Unbacked western money risks losing a great deal of its purchasing power in such an event. To back western fiat even partially with gold would mean a dramatic upwards revaluation of gold – into the tens of thousands.

But that is the card China now has with its 20 years of relentless accumulation. He who owns the gold, makes the rules.

This article first appeared at Moneyweek.

UPDATE: Russia has just announced it abolish VAT on bullion. Bill will go to the State Duma on March 4 (today). What are the implications? After a long history of ruble volatility (to put it mildly) many Russians save or hold their cash reserves in the US dollar. Thanks to the weaponisation of money that option is now not open to them. The bill presumably is to enable its citizens to escape the currency wars by holding gold. Ergo, it is a step in the direction of gold standard, albeit a small one.

I will do a piece on how to buy gold shortly. If you are looking for ways to buy gold, I can recommend Goldcore in Dublin. Tell them I sent you.

There will be another special report for paid subscribers coming out in the next few days, so keep your eyes peeled for that.

The US has flexed its Dollar muscle and its enemies are receiving the message loud and clear. Why would China and Russia continue to use the currency of their enemy? The answer is they won't; not for much longer. The question is when will they opt out? My bet is it'll be during the current US administration which doesn't present itself as very capable.