We need to talk about Comstock

Capital discipline, dilution and trust matter more than upside

Somebody is impersonating me again on social media. If anyone DMs you, trying to solicit your money for something, it is not me. Please don’t engage.

Also I am just getting on a flight and I need to get this out before take off. If there are errors, I apologise, but at least you know why. It also means there’s no VO.

I don’t normally put out pieces on a Friday but needs must.

I own a large position in this company, many readers do as well, and, while having clearly stated doubts about management, I have been something of a champion of Comstock Inc (NYSE.LODE).

(For reference, here is my original write up).

You might remember last August Comstock Inc, then with a market cap of $115 million, trading at $3, raised $30 million at $2.50 - a 17% discount to market, diluting the company by 30%.

We gave them the benefit of the doubt. At least they have cleaned up the balance sheet. They have the capital they need to get their recycling plants operational. “This is the last raise,” CEO Corrado de Gasperis assured us.

This week, not 5 months on, Comstock announces another financing. $50 million. Amounting to, if the over-allotment gets filled, a 41% dilution.

Like the most brutal of punches, the financing came out of nowhere. Just two days previously de Gasperis was boasting on X about being funded.

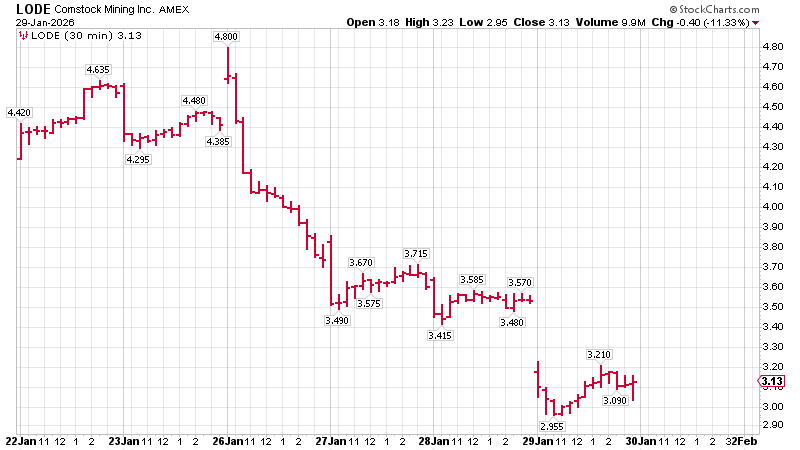

Here is what is really concerning. On Monday morning the stock hit $4.70. By the end of the day it was at $3.50. No news. What’s going on? Why all the selling? A million shares dumped. What did somebody know?

Then following evening de Gasperis announces the financing.

“The offering was first confidentially marketed,” de Gasperis tells me.

Not that confidentially, it would seem from all the prior selling.

The £50 million is being raised at $2.75. The stock was at $4.70!

Here is the sordid story in chart form.

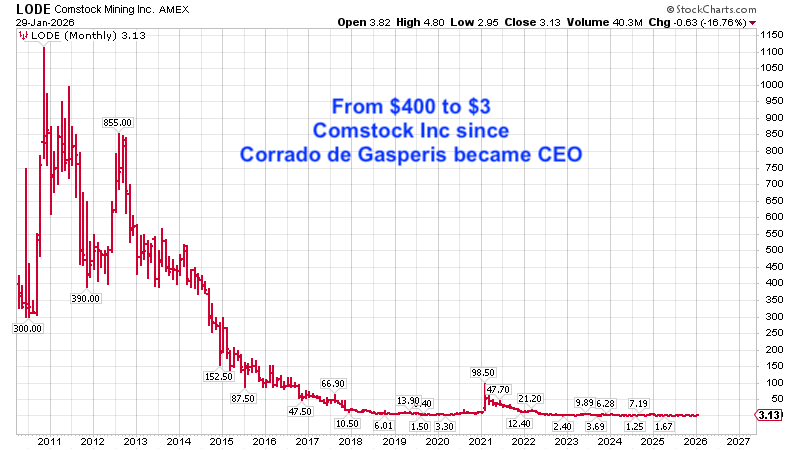

De Gasperis has been CEO since 2010. He owns just 135,818 shares in the company.

That is optionality without consequence.

No wonder his track record of dilutive stock raises is so abominable. His interests are not aligned with shareholders. “Show me the incentive,” and all that.

In his time as CEO he has taken the company from ~$400 to $3

Comstock Inc should, via its recycling plant, be producing bucket loads of silver by Q1 of this year. It has the potential to become the largest silver producer in the US. We are living through the greatest silver bull market in all recorded memory. Silver companies are doubling, tripling and quintupling left right and silver. Comstock is flat. Flat!

It’s the greatest silver bull market in history (or it was until this morning). How is flat even possible?

That does not reflect at all well on management if flat is all they can achieve whilst silver is like this What happens when silver goes into the inevitable bear market?

Previously we gave management the benefit of the doubt because this is such an extraordinary asymmetric opportunity. Between the recycling and the bioleum this $160 million market cap company could have a valuation in the billions.