Congratulations to all who bought. Gold is now trading above $3,300. Goldman Sachs has raised its target to $4,000/oz. It’s all going swimmingly. But nothing lasts forever.

(Actually gold does, but you know what I mean).

So, today, I want to ask: when do we sell our gold?

To answer that question, I am going to look at some long-term ratios.

How is gold looking relative to stocks, to other commodities and against house prices? (We’ll look at gold versus house prices in the US, the UK and Australia).

There is a strong argument, by the way, for never selling your gold, especially if you’re in a country such as the UK with an unreliable national currency. If you don’t need the money, keep the gold and pass it on to your heirs - and tell them to do the same. But macro conditions are not always as gold-friendly as they are now. See the 1980s and 90s for more details.

What’s more, given how these trade wars are unfolding, with unpayable levels of debt across the western world and China’s extraordinary accumulation of gold, there is a significant chance - say, 25% - that gold ends up being remonetized somehow.

(If China wants global reserve status for its yuan, it’ll almost certainly have to make it exchangeable for gold - meaning higher gold prices. But even if not, all China has to do is declare it’s real gold holdings, and the price will rocket).

In the event of remonetisation, which also means some kind of crisis, gold prices will be dramatically higher. However, it’s also likely that your gold would either be confiscated or heavily taxed, so that the gains from the revaluation (aka fiat devaluation) pass to the state rather than the citizen, as happened in the US under Roosevelt in 1933.

But let us leave such speculation for another day.

As always, if you are looking to buy gold, the bullion dealer I use and recommend is the Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. Find out more here.

Gold vs Stocks

I want to start with the Dow-to-Gold ratio: how many ounces of gold does it take to buy the Dow?

There is much history in this chart. It’s quite something.

You can see how, most of the time, the ratio stays within that green band. It is only at points of maximum extremity that it goes beyond, such as:

The peak of the stock market in 1929

The Great Depression in 1932

The suppression of gold in the 1960s, ending with the collapse of the gold standard in 1971

The peak of 1970s gold mania, inflation, and the Soviet invasion of Afghanistan

The end of the gold bear market in 2000 and the peak of Dotcom

Today, with gold at $3,300 and the Dow at 40,000, it takes 12 ounces of gold to buy the Dow - and we are in the low- to mid-range of that green prediction band.

At the peak of the last gold bull market in September 2011, the ratio reached 5.7.

To reach such a level again, either the gold price would have to double (possible) or the Dow would have to halve (unlikely, I would have thought).

Most probable is something along the lines of the Dow falling 25% and gold rising another 50%.

Would this ratio ever go to 1:1, as it did in 1980? If so, we would be looking at a gold price in the tens of thousands.

It’s possible, I suppose.

I think a ratio of 5-8 is a reasonable possible target.

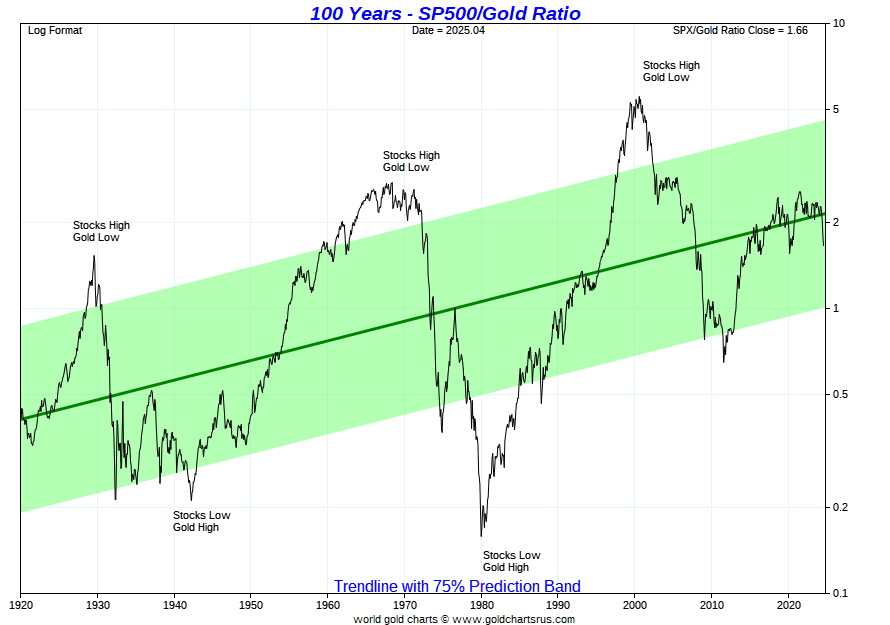

Here’s a similar history of gold against the S&P 500:

Today, we are at 1.7. It takes 1.7 oz to buy the S&P.

The ratio reached 0.2 in the 1930s and 1940s. It went to 0.13 in 1980.

I doubt we’ll see that again.

But that 2011 level of 0.6, or perhaps even a little below if things get really spicy, is not an unreasonable target, I suppose. That could mean the S&P500 at 4,200 and gold at $7,000/oz. Something like that.

So that’s some bull food for you.

In the interests of balance, let’s now put some bearish fodder on the menu.

We’ll start with gold versus oil - and the bad news. Then we’ll look at gold and house prices.