The idea behind Dolce Far Niente was to create a portfolio of low-risk investments for today’s market conditions, that you can buy and, pretty much, forget about.

You don’t have to keep checking prices every day.

Hence “Dolce Far Niente” - “the sweetness of doing nothing.” No worries would be the Australian translation.

Asset allocation is WAY more important than individual stock-picking. I could pick the best biotech company in the world, but if biotech is in a bear market, I almost needn’t bother. I’m better off out of the sector. But similarly, if a sector is in a full-on bull market, even pigs fly.

The starting point for the portfolio, which we began on October 1, 2023, was as follows.

Gold: 15%

Bitcoin: 5%

Special situations: 10% (the ”fun” part of the portfolio, for example some of the smallcaps I write about on here)

Uranium: 5% (reduced to 2.5% as things got frothy)

Oil and Gas: 10%

Bonds and Wealth Preservation: 20%

Equities (35%)

UK & Europe (20%)

US (25%)

Smaller cos and private equity (30%)

Asia (15%)

Japan (5%)

EMs (5%)

No allocation to real estate.

Since that October 2023 starting point, certain assets - gold, bitcoin and US equities - now account for far greater percentages, with energy, bonds and wealth preservation not having done so well.

If you are starting this portfolio now, I would still recommend sticking to the original allocation and letting things grow.

Really, I should re-allocate, but I don’t want to sell any bitcoin and I don’t want to sell any gold.

In fact, to be honest, there is a very strong case for just owning bitcoin and being done with everything else. But that wouldn’t be balanced and that’s not what this portfolio is about.

The only change we have made since October 2023 was to reduce uranium from 5% to 2.5% in February 2024. Uranium felt a bit frothy was the reason. More a gut- than evidence-based decision, and it proved the right one.

I’m going to make one, quite major change to the portfolio today - in the equities department. More on this in a moment.

Lastly, do as I say, not as I do. In my own portfolio, my allocation to bonds and wealth preservation is tiny: maybe 2%. I am overweight gold, bitcoin and special situations (smallcaps mostly).

At some stage, I will get my comeuppance as a result, and it won’t be the first time. Then I’ll swear to change my habits, and then I will - for a bit - and then I won’t.

But a more sensible investor would keep their portfolio to the above allocation.

Let’s examine things in a bit more detail

1. Gold (15%)

It’s done very well. Up about 80% since we started the portfolio.

My firm belief is that everybody should own some gold in their portfolio. Especially now.

(If you do not yet own any, my guide to investing in gold is here. If you are looking to buy gold or silver, the bullion dealer I recommend is the Pure Gold Company.

There is also, of course, the soon-to-be definitive book on the subject. Here it is on Amazon, and Waterstones is currently running an offer.

💥 Pre-order now at Waterstones and get 25% off.

Use code SUMMER25 at checkout to get your 25% discount.

Hurry! Offer ends today, July 31.

2. Bitcoin (5%)

A huge win. Up about 450%

The potential of bitcoin remains so extraordinary, as I often say, I see the risk is not so much owning it, but not owning it.

Our bitcoin proxy for UK investors, who have been shut out of the sector by the FCA, is Strategy (NASDAQ:MSTR). That’s done even better. Up over 1,500%.

My sources tell me UK investors will be able to buy bitcoin ETFs from November. That’s what Charlie thinks anyway, and you should all subscribe to his letter.

3. Special situations (10%)

These are the small- and mid-caps that I sometimes write about on here.

We have had some big winners, and some big fat dogs too.

If you want to know what are currently my 7 biggest positions, here they are.

4. Uranium (2.5%)

Glad we reduced this to 2.5% when we did.

Yellowcake (YCA.L) is our vehicle. We reduced around 700p in February 2024. It’s now 500p

Now is probably not a bad time to buy back that 2.5%, but I’ll wait.

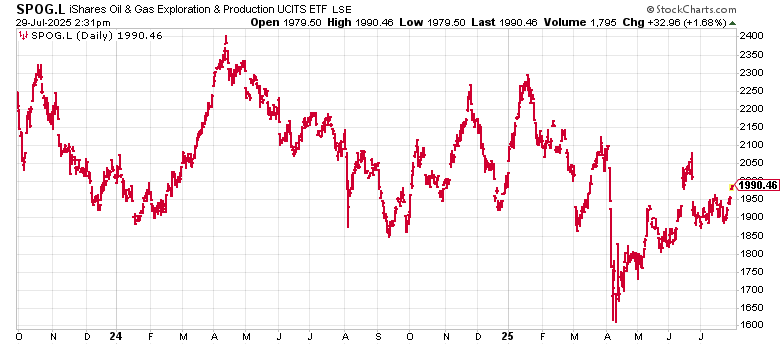

5. Oil and Gas (10%)

The iShares Oil and Gas ETF (SPOG.L) - North American oil and gas companies, basically - is my primary vehicle by which to play this. It’s off a little, but it’s outperformed oil itself.

I’m also of the view now that North Sea oil and gas’s time is coming and the government will u-turn on this as well.

Did you see Donald Trump’s comments today? One of the many ways he made Keir Starmer wriggle and squirm.