If you enjoy this article. Please like it, share it and so on. It all helps. I thank you.

It’s time for my annual slagging off of silver.

Why now?

Because, according to one of my WhatsApp chats, it’s breaking out.

Silver is always breaking out. It never actually does.

Was ever there a metal with as much potential as silver? Probably not.

Was ever there a metal you could so wholly depend on to let you down?

If there is, I’m not aware of it (though these past 15 years, platinum has been running it close).

But maybe, just maybe this time is different.

Really?

Let’s start with a bit of gossip from the front line.

I have three mates who are CEOs of silver mining companies, as you do. All three of them, based in Latin America, have reported back with the same story.

Typically, a miner would pay a company — usually a refiner — to take ore off their hands, treat and smelt it, so it can be sold. So-called off-take agreements would usually amount to $120–180 per tonne of ore. But, at the moment, refiners aren’t charging anything. Somebody is subsidising it all.

Could it be that humongous, commodity-guzzling nation that begins with a C, I wonder?

It wants silver for all those solar panels Ed Miliband is buying.

The way things are behaving and moving at the moment, it’s starting to feel like we are moving into a proper commodities bull market. Maybe 2021–22 was just the appetizer.

Stop! Don’t get excited. It’s silver we’re talking about here.

The case for silver runs roughly as follows:

We are in an age of currency debasement, therefore you want to own hard assets. In such an inflationary environment, the monetary metals — gold and silver — perform best. Silver has been money since forever. It is natural money etc etc.

Let’s just address that before we move on.

Gold is still used as money in the store-of-value sense of the word. National banks keep it. Institutions keep it. Individuals keep it. Gold’s role was always more store of value than medium of exchange. Historically, we used silver, copper and nickel for all but high-value transactions.

Silver was not used as a store of value to the extent gold was. Its function was more, as I say, as a medium of exchange. That role has long gone. The gold rushes of the 19th century did for silver.

Long story — it’s in my book, which comes out in August — but to cut it short, the vast increase in gold supply enabled nations to abandon silver. In the case of the US, it was the Coinage Act of 1873 — or as silver bugs like to call it, the Crime of ’73 — that began the end of silver as official money. In the UK — largely thanks to the Portuguese discoveries of gold in Minas Gerais (again, long story, it’s in the book) — the process began a good 150 years earlier.

In these cashless times, there is little chance of silver regaining its role as medium of exchange.

As a result, looking at gold-to-silver ratios — it now takes about 100 ounces of silver to buy an ounce of gold — and saying we are going back to the historical average of 12 or 15:1 is mistaken. There may well only be 15 times as much silver in the Earth’s crust as gold (making 15:1 the natural ratio) but without its role as money, this is just not going to happen. Not for any prolonged period.

In the last 100 years, we have only touched this level once — Thursday, March 27, 1980. Uncommon circumstances. Two brothers were trying to corner the silver market.

Silver’s role as money is as good as over. Silver bugs hate me when I say that. But I can only say it like I see it.

Physical silver in your possession is nobody else’s liability — I get that — and it is outside of the financial system — I get that too. There are many reasons to invest in silver. I own physical silver. But expecting it to be monetised again should not be one of them.

If you are thinking of buying silver or gold bullion, the bullion dealer I use and recommend is the Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. Find out more here.

If Armageddon comes, you’ll be glad you own silver — maybe — but there will be bigger problems on your plate. Like Armageddon.

Everywhere silver

Silver has widespread industrial use, especially in these times of mass electrification. You could write a book about the industrial uses of silver, there are so many. It might not be a very good book, but it would be long.

From medical equipment to electrical appliances, it’s almost harder to find things that don’t contain silver than things that do. Every smartphone has silver in it; every computer; every jet engine; every solar panel. The best batteries contain silver. It’s used in detergent, deodorant, wart treatment, antimicrobial lab coats, 3D printing, plastics, jewellery, wood preservation, water purification — it’s like a picks-and-shovels play on new tech and the growing middle class of the developing world.

Annual silver demand stands at around 1.2 billion ounces. Roughly 60% of that demand — 700 million ounces — comes from industry (500 million from electrical and electronics, half of which is solar panels); 22% from jewellery and silverware; and 18% from investment.

Annual supply is about one billion ounces (80% mining, 20% recycling) — so the market is in deficit. Hence the current rising price.

Most silver is produced as a bi-product of other mines, especially lead and zinc (eg at one point BHP Billiton was the world’s largest silver producer).

There is, however, a romance to silver. It catches the public imagination — occasionally with explosive results. It did in 1980 when it went to $50 (it had been $2 just a few years earlier). It did again in 2011 when it revisited $50 before collapsing. It nearly took off during Lockdown Meme Mania, but didn’t quite get going.

As a result of this romance, it has a tendency to go bananas every few years — but it never lasts. Does romance? Sometimes, if you’re lucky.

There is also the issue of silver price suppression, which some use to explain every sell-off in the silver markets. There’s nothing any of us can do about that — even if true — so let’s not go there.

Silver will at some point revisit $50. At some other point it will get above that figure. The mother of all narratives will take hold, and silver will probably end up going to $100 or even $200.

At which point you want to be owning silver stocks …

It will also, at some point, revisit $15.

That’s when you don’t want to be owning silver stocks.

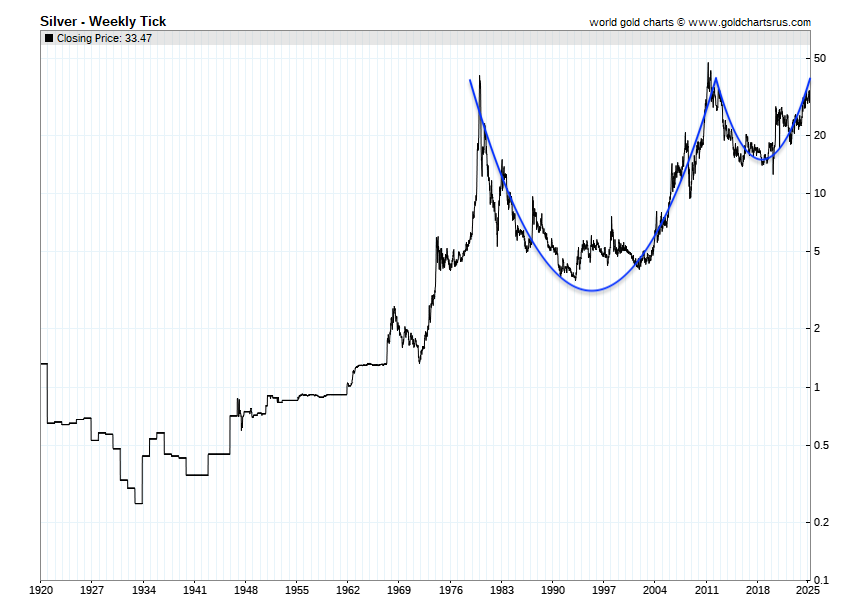

Here is 100 years of silver prices. If you give any credence to such things, there is the mother of all cup-and-handle formations appearing (that’s a super bullish pattern), which I have drawn in blue. It projects prices towards the $100/oz mark.

It’s also apparent on the 50-year chart. (I haven’t drawn it here - I’ll let you visualise).

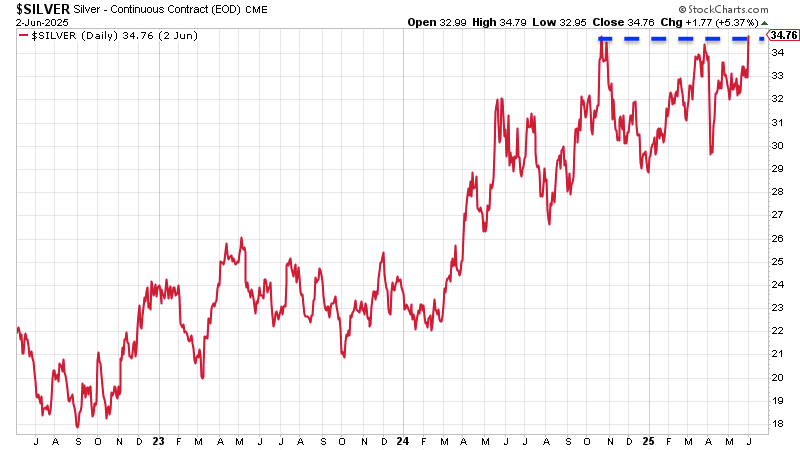

Silver has been in a bull market since summer 2022, but it has, broadly speaking, followed rather than led gold. It’s now come up against a wall at around $35.

You could say it’s a triple top.

Then again, the more times you test a level, the less likely it is to hold — particularly when each low is higher than the last, as is the case here.

But these last few weeks, all of a sudden, silver is leading gold.

What’s more, silver miners are leading silver. That’s what makes me bullish.

Here is the silver miners’ ETF, SIL (NYSE: SIL) — and you can see, just as they’re saying in my WhatsApp chats — the silver miners really have broken out.

I haven’t seen this in a long time. Miners leading!!!!! WTF?

This is why I’m saying it’s starting to feel like a proper metals bull market.

So how am I playing this?

What are the best ways to invest in silver and profit?

First up, recent acquisition Comstock Lode (NYSE: LODE) is massively geared to silver. If it gets its solar panel recycling business working, it will become the biggest silver producer in Nevada — perhaps even the entire US.

There are also its mining assets at Comstock Lode itself. There was once a silver rush here. Some 225 million ounces of silver have been mined in the region, along with 6–8 million ounces of gold. LODE has 6 million proven ounces of silver in the ground.

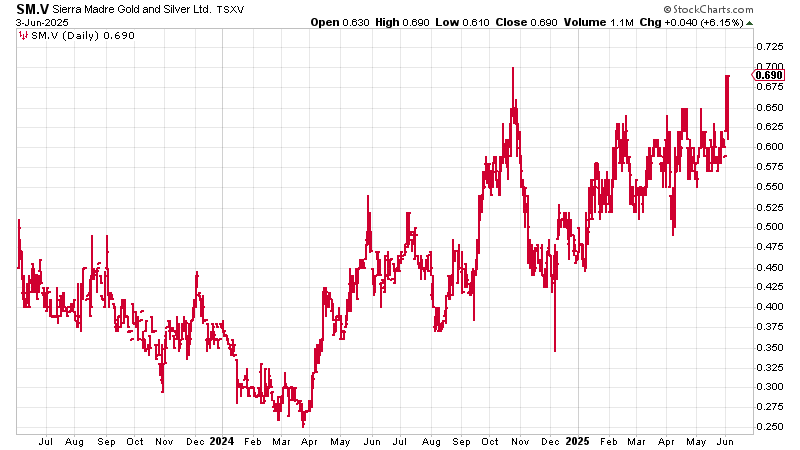

There is also Sierra Madre Silver and Gold (SM.V), with which long-time readers will be familiar. This stock has been creeping up nicely for some time. 69c today, it was 47c this time last year. I haven’t said anything because I didn’t want to jinx it.

Since we’ve owned it, Sierra Madre has gone from development story to producing mine, processing about 500 tonnes of ore each day (t/day). It should produce 60,000 oz of silver equivalent per month this next quarter. It has made this transition ahead of schedule and beaten expectations in doing so. It’s almost tripled since the lows of 2024, when it hit 25c.

It now has a market cap of roughly C$100 million.

Looking forward, the company now needs to improve its operations, and that is its focus.

Its all-in costs (including Vancouver G&A) are quite high at $29/oz. CEO Alex Langer thinks he can get these down by $4–5 with some equipment purchases. (Renting is expensive.)

There is some improvement work on the crushers to be done. Processing should increase to 600–800 t/day. With some improved equipment, this can get to 1,500. (They might need to raise a bit of money to do that and accelerate the process- it will take longer to get there from cashflow. When I spoke to CEO Alex Langer yesterday, he had just come from a meeting with potential investors in Palo Alto, so I guess this was being discussed.) But if they can get to 1,000 t/day, this should also help costs come down.

We want to see some underground development too.

Plus, an exploratory drilling campaign of the outer zones — probably next year — would make the whole thing a lot more attractive, assuming the results are good.

If they can get the stock to a US$100 million market cap, they qualify for inclusion in the ETF SIL — which could turbocharge liquidity and trigger institutional buying.

In short, this is a producing mine with exploration upside. It’s cheap for what it is, and it is starting to make good money. A number of analysts have placed targets of C$1.10 to C$1.30 on the stock. These are all quite realisable if the silver price holds, and operations improve.

I see plenty of upside left in this one. I’m a happy holder.

There are many simpler, lower-risk ways to play the silver theme - you can find them all in my silver report here.

Thanks for reading. Please like, share etc.

Until next time,

Dominic

PS To buy Sierra Madre, you will need a broker who deals in Canadian stocks. I use Interactive Investor. If you open an account with them, tell them frizzers(at)gmail.com sent you. I’ll get a reward and you’ll get a year’s free subscription.

Disclaimer:

I am not regulated by the FCA or any other body as a financial advisor, so anything you read above does not constitute regulated financial advice. It is an expression of opinion only. Tech stocks are famously risky, , so please do your own due diligence and if in any doubt consult with a financial advisor. Markets go down as well as up. I do not know your personal financial circumstances, only you do, but never speculate with money you can’t afford to lose.