After the Silver Shock

Silver’s violent week and a round-up of articles and interviews

Good Sunday to you,

I have a couple of interviews to share with you today.

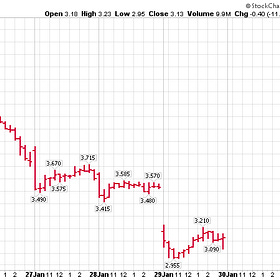

But my goodness me Friday in silver was like nothing I have ever seen. An intraday high of $118 to an intraday low of $73.

It’s not like it hasn’t been coming, but you can see why I am so ambivalent about this lunar metal.

We’ll see in due course how low this correction goes, and how long it lasts. Most of the mining companies will be quite profitable at $50 silver. We just need these higher prices - say $4,000 gold and $50 silver - to stabilise and become the new normal. Investment and profitability will soon follow.

It might be Game Over for the time being. But I don’t think it’s Game Over.

The latest edition of Charlie Morris’s monthly gold report, Atlas Pulse came out on Friday. If you want a level-headed perspective of what is going on with gold and silver, take a look. It’s the best gold and silver newsletter out there in my view. Get your copy here - it’s free.

This week’s articles

ICYMI, here are this week’s articles - two this week.

The first, covered silver and gold.

Genius or Madman?

I am rotating some of my gold and silver profits into oil and gas, as I think energy is next. I will have more on this very soon. I promise. But we need to talk gold and silver today, plus we have an update on top pick Metals Exploration (MTL.L)

The second looked at the disappointing Comstock financing. I still think Comstock can work, by the way, but I am reducing my position because I no longer feel this management can be trusted. I would urge any of you in the stock to listen to the call with CEO Corrado de Gasperis on Tuesday - details and registration here. Then decide for yourselves if I’ve overreacted or not.

We need to talk about Comstock

Somebody is impersonating me again on social media. If anyone DMs you, trying to solicit your money for something, it is not me. Please don’t engage.

Interviews

I am deep in the screenplay of Kisses on a Postcard at the moment, so I am trying to avoid interviews and podcasts. However, I ended up doing two this week because they were for buddies.

Here I am talking to the legend that is Tom Woods - via Apple podcasts, Spotify or YouTube below:

And here I am on State of the Markets with the equally legendary Tim Price and Paul Rodriguez.

Enjoy.

Until next time

Dominic

If you live in a third world country such as the UK, I urge you to own gold or silver. The pound will be further devalued. The bullion dealer I recommend is The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.

PS Oh, yes, and somebody is impersonating me again on social media. If somebody DMs appearing to be me, it isn’t me.

My totally non expert take on this week’s silver action: 1. the move went too far too fast and a puke inducing pull back was on the cards. I’m glad I resisted buying any more (for now). 2. Silver is still back to a level at which most of us would have given our right arm for 12 months ago. 3. It gave up more in one day than it cost per ounce not that long ago. 4. It ain’t over til it’s over and I don’t think silver is anywhere near done yet. It might even take a few years, but prices stabilising at a significantly higher level would bode well for the future. 5. At some stage I need to sell up, take the profits and be done with it…but not yet.

Thank you Dom. It was indeed a violent move not helped by:

1. End of month profit taking after an extraordinary January

2. CME raising margins (again)

3. The new Fed Chair pick seen as being more hawkish

However, fundamentally I feel like not much has changed. Silver is still a 'strategic metal', US defense spending is increasing by 50% and supply is still very limited.

For me it's not over, buying on further weakness