If you want to listen to this article, you can via the button above.

“Look at what they do, not at what they say.”

If you are seeking truth of any kind, this is a great maxim to live by - particularly when it comes to politicians. And lovers.

And indeed mining CEOs.

My advice today is to apply the maxim to your author, because there is a marked divergence between what I say on the subject of gold mining companies and what I actually do.

We’ll start with what I say…

Here’s why everyone believes that gold miners are a leveraged play on gold

Talk to any grizzled goldbug who remembers the 1930s – there must be one or two that were there at the time – and one or two more that have read about them. In the US, the story went as follows.

After the stock market crash of 1929, the US sunk into an economic recession that became known as the Great Depression. In order to fund a government stimulus programme, the President, Franklin D Roosevelt, confiscated his citizens’ gold.

It became illegal for Americans to own gold. Like the loyal citizens they were, Americans handed their gold in and the authorities gave them dollars in exchange at the official exchange rate of $20 per ounce.

Roosevelt then devalued those dollars by 40%. The official price of gold would now be $35 per ounce.

Some moaned, while many didn’t notice, but the cannier folk thought: “We might not be able to own gold, but we can own gold mining companies – and their profit margins have just gone bananas.”

Homestake was the biggest gold miner in North America at the time. Its share price multiplied many times over. It became the investment of the decade.

Fast forward to the 1970s, a decade which policy-makers seem intent on re-living in some kind of Black Mirror parallel universe situation. Inflation was rampant, money was debased, the gold standard was abandoned and there was an energy crisis. The decade ended with Russia invading a neighbouring country, in this case Afghanistan.

Gold went from $35 to (briefly) $850 over the course of the decade. But gold miners – whoosh. They multiplied and multiplied and multiplied. They were the investment of the decade.

Thus has it been implanted in our psyche that gold miners give you leverage to the gold price. When gold goes up, gold miners go up by more.

Except they don’t.

Gold miners have been terrible investments compared to boring old gold

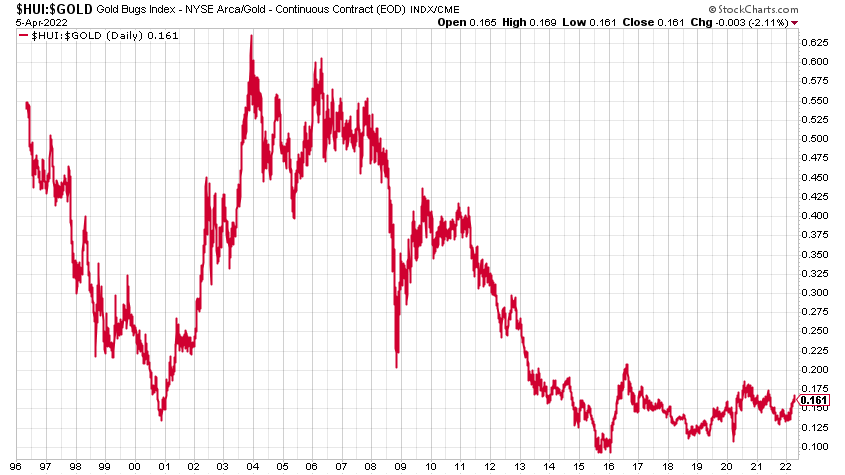

Here we now present Exhibit A, which is the ratio between the HUI, the index of unhedged gold miners, and gold since the mid-1990s.

The chart has been falling since late 2003. In other words, gold has been outperforming gold shares. Apart from odd bouts of outperformance, this has been the case for more than 15 years now.

Barrick, off and on the world’s largest gold mining company, has had a good couple of years since it changed management. Even so, it is still trading at the same price it was in 2005. Gold was selling for less than $500 an ounce in 2005. It’s $1,900 now.

In 2018, Barrick was trading at the same price it was in 2001. In 2001, gold was $250.

In other words, what has been the point of owning gold miners, when you could simply have owned gold? And some would argue what is the point of gold, when you can own bitcoin?

So how do to explain the underperformance of miners?

The reason, in my view, aside from a proliferation of incompetence among management, is that, starting in around about 2003, when that chart peaked, we saw a plethora of different ways by which ordinary investors could buy and hold gold.

Aside from taking delivery of bullion itself, we saw the rise of online storage companies – Goldmoney, Bullion Vault, Goldcore and so on. The exchange traded funds (ETFs), by which investors and institutions could buy and hold gold via a broker, came into existence. Cheap online brokers became commonplace. If you wanted something a bit racier, there were spreadbets, futures, CFDs, covered warrants, leveraged ETFs and more.

Why bother with individual company risk with some many options? They made the gold miner’s role as the levered way to play gold even more redundant.

Has that changed? No. It’s very hard to intellectually justify owning a gold miner in the face of the above.

So that is what I say.

But what do I do? I own a load of gold miners. I’m overweight gold miners.

I’ve spent a lot of time researching mining companies. I think the ones I own are really good – exceptional even. But they are still gold miners – and sector allocation usually proves more important than individual company selection.

I do look at that above ratio and suggest that it has made a low and is now rising. The low came at the end of 2015 and it was re-tested in the coronavirus panic of 2020. It looks like it’s on the rise.

I also note an odd divergence over the last month, as the chart below shows. Gold sold off. Gold miners didn’t. They actually outperformed. What gives?

Gold is in red. The miners are in blue. See the outperformance??

Gold mining companies are better run, generally, than they were. There are some real growth opportunities.

But it is still a dirty, risky business and a lot can go wrong.

So what’s the point? I don’t know. But look at what I do, not what I say.

And if you want to know what my biggest personal gold mining holdings are, take a look at my Special Reports. Here’s one pick. And here’s another.

This article first appeared at Moneyweek.