There is a video version of this article to view here:

There is a shift of enormously significant proportions taking place. In magnitude it will prove as significant as Bretton Woods in 1944, when the dollar became the de facto global reserve currency, and the Nixon Shock of 1971, when the US abandoned the last vestiges of its gold standard.

This shift is going to shape the global financial landscape over the next few years. You need to understand what is happening, so that you can position yourself and your family.

You may even be able to profit handsomely from the transition.

Today we explain US dollar policy: what is going on and, more importantly, where it is all going.

Ready? Here goes.

The Manufacturing Imperative and The Curse of the Reserve Currency

America wants to bring manufacturing back on shore. We all know this. US President Donald Trump has said it repeatedly, his VP JD Vance has said it, and so has his Treasury Secretary Scott Bessent, who keeps reminding us that it is now time to prioritise Main Street over Wall Street.

Part of the reshoring of US manufacturing involves tariffs, as we know all too well. Part of it involves weakening the US dollar to make US exports more competitive. Again Trump, Vance and Bessent have all said it.

However, there is a problem, and that problem has a name: Triffin's Dilemma.

You might think it's an advantage to issue the global reserve currency. You can issue dollars. Everyone else has to work for them. The French called it "America's exorbitant privilege." But this was a status the US engineered for itself during the Bretton Woods Agreement that determined the monetary order at the end of World War Two.

What has happened, however, is that it has made the US fat and lazy, especially since 1971 when the US abandoned the ties of the dollar to gold.

To supply the world with dollars, the US must run trade deficits. That is to say it must buy more than it sells. Persistent trade deficits have, over time, eroded its industrial base. Factories and jobs have gone offshore. Foreign nations have used their profits to invest in US capital markets and its debt. Meanwhile financial markets - aka Wall Street - have grown and grown, as America financialized.

The Trump administration gets it in a way its predecessors did not. Vance has actually called the dollar's reserve status a "tax" on American producers.

What's more, as this process has continued, the credibility of the dollar itself is being called further into doubt.

Trump wants to revitalise America's Rust Belt. But there is more to it than that. As the curtains pulled back with Covid, the extent to which the US has been operating with its trousers down was exposed: an excessive dependence on China and its supply chains for too many strategically essential products, especially related to health, tech and the military.

Then, during the Ukraine conflict, NATO found itself unable to match Russian production. The US, in short, is struggling to produce critical goods. It's why Trump keeps harping on about rare earth metals. It is vulnerable.

The answer is to engineer a "managed decline" of the dollar as global reserve asset.

The Golden Exit Strategy

This was already happening organically. China, for example, has been reducing its holdings of US treasuries for ten years now - quite gradually - although its US dollar holdings remain above $3 trillion.

Meanwhile, China - and many other countries along the Silk Road besides - have been increasing their gold holdings, and quite dramatically. (In my view China has at least four times as much gold as it says it does. You can read more on this in my book). The process is known as de-dollarisation. Just a few months ago gold overtook the euro to become the second most held asset by central banks, while the dollar itself fell beneath 50% for the first time this century.

We are not seeing a move towards any other national currency as global reserve, but towards the neutral but universal asset that is gold, as analyst Luke Groman points out. That suits all the main players. Gold is neutral, and both the US (supposedly) and China have lots of it.

Indeed, a gold revaluation would be a "win-win" for both. A higher gold price would strengthen US fiscal flexibility while boosting Chinese consumers' wealth, encouraging domestic consumption and reducing trade imbalances.

There is the potential to leverage the US's 261 million ounces (8,133 tonnes) of gold reserves, currently marked to market at just $42/oz. There are two ways this might be done. Economist Judy Shelton has proposed issuing Treasuries that are in part backed by gold to offset the inflation/debasement risk to make them more attractive to buyers. The other possibility (which has gone from, as Bessent put it, "we are not doing this" to "we are not doing this yet") is to revalue the gold from $42 to the current price of $3,300/oz, which would create over $850 billion of reserves without having to incur any extra debt. That would help with the US's current fiscal challenges: true interest expenses (including entitlements and veterans' affairs) currently exceed 100% of Treasury receipts.

If you buying gold or silver coins to protect yourself in these “interesting times” - and I urge you to - as always I recommend The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.

In short, the US administration is leaning into a weaker dollar and neutral reserve assets like gold to rebalance trade and rebuild domestic industry, even at the cost of short-term economic pain.

Bitcoin's Digital Advantage and The Stablecoin Bridge

Bitcoin, as the world's best neutral digital currency, is going to have a role to play in all of this as well.

The US is quite happy with that, as evidenced by its pro-bitcoin rhetoric. At the national, corporate and individual levels the US has a lot of bitcoin. The US itself has 198,000 coins, the most of any nation, Strategy (NYSE:MSTR) has 630,000 and many other companies besides also hold, and at least 15% of US citizens own bitcoin. Of the eventual 21 million supply, of which probably 15% has been lost and another 1.3 million are locked up by Satoshi Nakamoto and will likely never appear (he is almost certainly dead), the US has a hefty chunk.

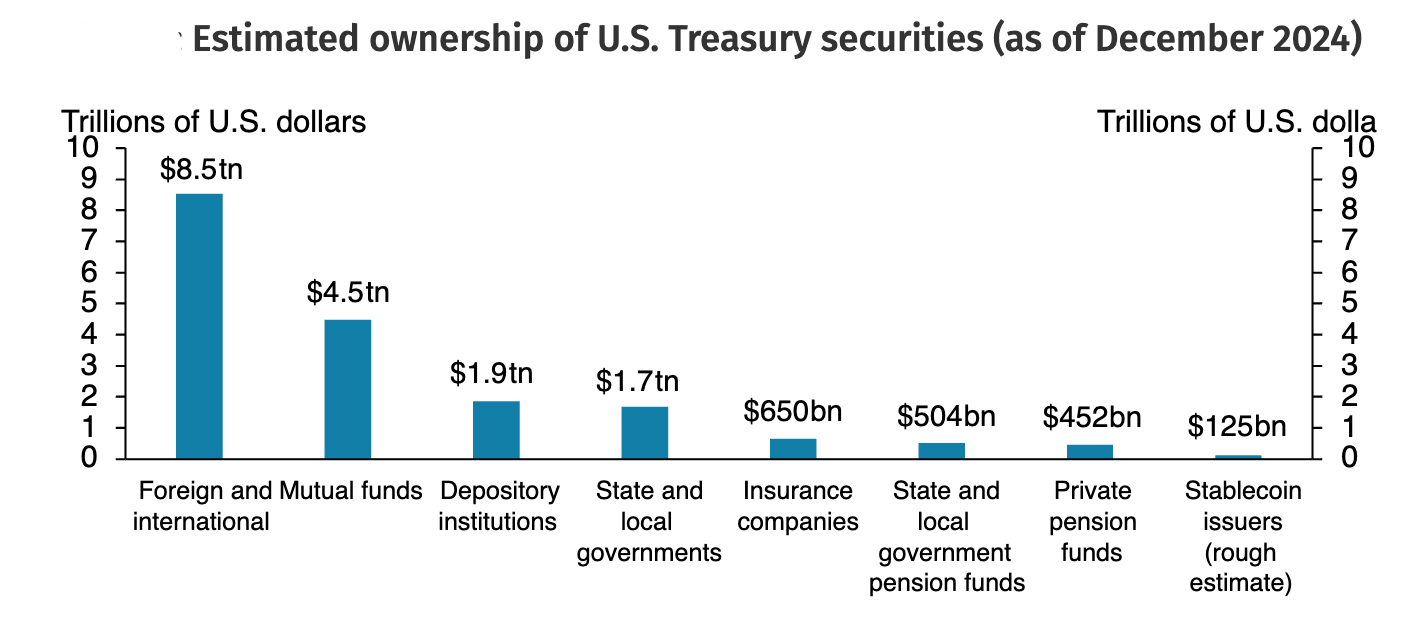

Which brings us to the recent Genius Act. This effectively nixed CBDCs just as the EU's Christine Lagarde was planning to phase them in (LOL). However, it supported stablecoins (that is coins backed by dollars). The more bitcoin grows the more the stablecoin market will grow. As the stable coin market grows so will its demand for treasuries. Today, roughly half the entire US dollar stablecoin market, estimated at $250 billion, is invested in US treasuries (maybe 2% of the overall treasuries market). Tether is the world's 7th largest buyer.

The market is small, but growing rapidly. 2035 projections include $500 billion (J.P.Morgan's projection) to $2 trillion (Standard Chartered) and $4 trillion (Bernstein) by 2035.

"If the stablecoin market meets these growth projections," says the Kansas City Fed, "it could lead to a substantial redistribution of funds within the financial system."

In other words the stablecoin market is going to help the US fund its debt, just as other nations move away from treasuries to gold and bitcoin.

Gold might suit the US, but bitcoin suits it better, especially if there are complications surrounding the Fort Knox gold, which it seems there are. Why no audit yet?

Gold vs Bitcoin, Analogue vs Digital: The Coming Showdown

It's likely a few years from now there is going to be some sort of showdown between gold and bitcoin in the battle for primary reserve asset status. It's unlikely to be both. Governments will favour gold, as they have lots of it. Tradition is on their side. Eternal gold has a track record that is unrivalled. But it is an analogue asset in a digital world. Bitcoin is much more practical. Which will win out? Practical digital or impractical analogue?

This is a contest that is still a way off. For now all roads lead to gold and bitcoin as the world de-dollarizes.

Own both is what I say.

Needless to say the UK is absolutely clueless in all of this, having sold two-thirds of its gold in 1999, made it near impossible for UK citizens to buy bitcoin, now planning to sell its bitcoin holdings, now the largest holder of US treasuries in the world after Japan and making no attempt to buy any gold.

With the threat of AI and automation to America's jobs - especially in driving where millions work - there is the risk of mass unemployment coming quite quickly, and with it plentiful defaults on mortgages and loans. This could force the U.S. to print money, driving inflation and providing yet another reason to own gold and bitcoin, which cannot be debased.

From October 8th, UK citizens will finally be able to buy bitcoin ETNs.

I was lucky enough over the weekend to find myself as a house guest under the same roof as Interactive Investor CEO Richard Wilson. We talked a lot. He knows how landmark the date October 8th is for UK investors and has made sure II are well positioned in a way that other brokerages are not. You might not be able to buy the US ETFs due to FCA nonsense, but anything listed in the UK will be available. So if you don't already have an account at II you might do well to open an account now. Click this link and the first year is free.

In short, the dollar will weaken significantly over the next three years. The pound is a basket case. National currencies are not stores of wealth. Gold and bitcoin are. Own both as the Trump administration addresses Triffin's Dilemma through a managed dollar decline. They will use gold and potentially bitcoin to restore US industrial and military strength.

You have been warned.

Watch your inboxes. Tomorrow I’ll be putting out a 15-minute film all about gold called The Eternal Metal. On which note, The Secret History of Gold is out now. Got yours yet?

The Secret History of Gold is available at Amazon, Waterstones and all good bookshops.

Amazon is currently offering 20% off.

Watch the video version of this article here:

The End of Dollar Dominance

A shift on the scale of Bretton Woods (1944) and the Nixon Shock (1971) is happening.