Tom Haynes wrote an interesting piece in the Telegraph the other day to mark the 40th birthday of the pound coin.

“The pound in your pocket is now worth just 30p” ran the title, followed by the subhead “Some 40 years after the first pound coins were minted, their relevance is waning”.

I’ll say!

But the pound has actually lost a lot more than 70% of its value, and the article’s own statistics demonstrate that. “The average house cost £27,386, compared to £290,000 today,” says Haynes. I make that a fall of over 90% in purchasing power.

A first-class stamp was 16p. Now it’s £1.10. That’s a fall of over 85%.

A pint of London Pride cost 58p. Good luck finding it below a fiver today outside of Wetherspoons. Another c90% loss of purchasing power.

A pack of fags was £1.02. Those same B&H will cost you 14 times that today. A 93% loss of purchasing power.

A Mars Bar was 15p. Today it’s 65p. That’s a 77% loss of PP.

In general terms, as covered before in this piece on inflation, items we buy with debt, such as houses, have risen in price by much more than items we buy with cash, such as food. A dozen eggs cost 73p. Today - assuming your local store is not out of stock - they would cost between £2.50 and £4, depending how free range and organic you want to go. But even for food, the minimum loss of purchasing power is 70%. A loaf of bread, which was 38p, might be around £1.50 today.

“A weekly shop would cost a family £8.54. These days families spend £26.38 a week on food.” I don’t know about that £8.54 figure, but what family spends £26.38 on food? That’s barely enough for one family meal in my household, if fish or meat is involved.

It is, of course, increased taxes that have largely caused the 90%+ loss in purchasing power of the pound against booze and fags. Meanwhile, the massive increase in debt levels we have seen over the past 40 years has meant a massive increase in the supply of money chasing the things we buy with debt - so have house prices become so unaffordable.

The pound’s worth, says Haynes, “has been eroded by the passage of time”.

No, no, no, no, no! A thousand times no!

The pound’s worth has been eroded not by time, but by government. Inflation is not measured properly. It is not even defined properly. Money supply growth is ignored. House prices are ignored. Only the prices of certain consumer goods and services, most of which are prone to the deflationary forces of increased productivity, are measured. The result is that interest rates have been too low for too long. And don’t get me started on Quantitative Easing and all those other forms of fiscal stimulus that came with Covid. This is not erosion by the passage of time, but the incremental and compounded effects of decades of debasement.

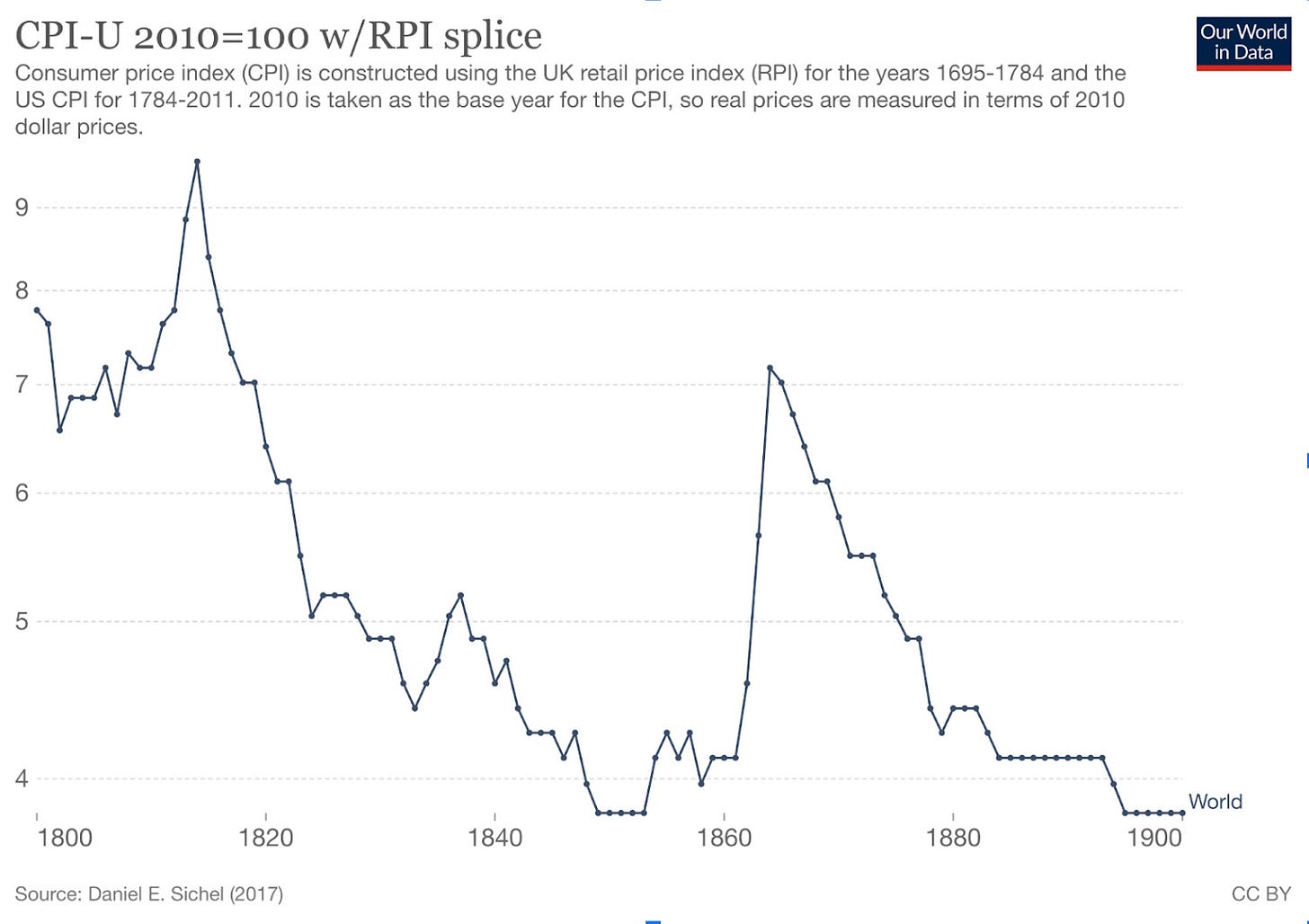

I often refer to this chart from Our World in Data which shows consumer prices over the course of the 19th century, when the world was on a gold standard. The purchasing power of money did not fall by over 90% or even 70% in forty years. It increased over time. In the 30 years from the end of the Napoleonic Wars, the purchasing power of money doubled. Prices halved.

They rose again with the effects of the US Civil War in the 1860s, but from its end to the turn of the 20th century, the purchasing power of money almost doubled again, and prices almost halved.

40 years from now, do you think your money will buy you more or less? We all know it will be less. The only question is: how much less?

But imagine if you knew that in 40 years time your money would buy you double what it buys you today. The whole dynamic of society would change.

In a way money is stored energy. You expend energy working and in exchange you receive money, which you will then spend at some later stage for the product of somebody else’s expended energy. But why should the value of your stored energy decline? It should maintain its value. It is essential to an honest society that it does.

No wonder gold standard advocates of the past considered sound money to be one of the key pillars of a free society, like property rights or habeas corpus.

The easiest way for ordinary people to protect themselves against and benefit from the explosion in money supply of the last forty years has been via real estate. That is why houses have become savings vehicles instead of just houses. Now we have an entire generation that cannot afford anywhere to live and will put off starting a family as a result.

How much better for society if houses were just houses, somewhere to live, and instead money was the savings vehicle?

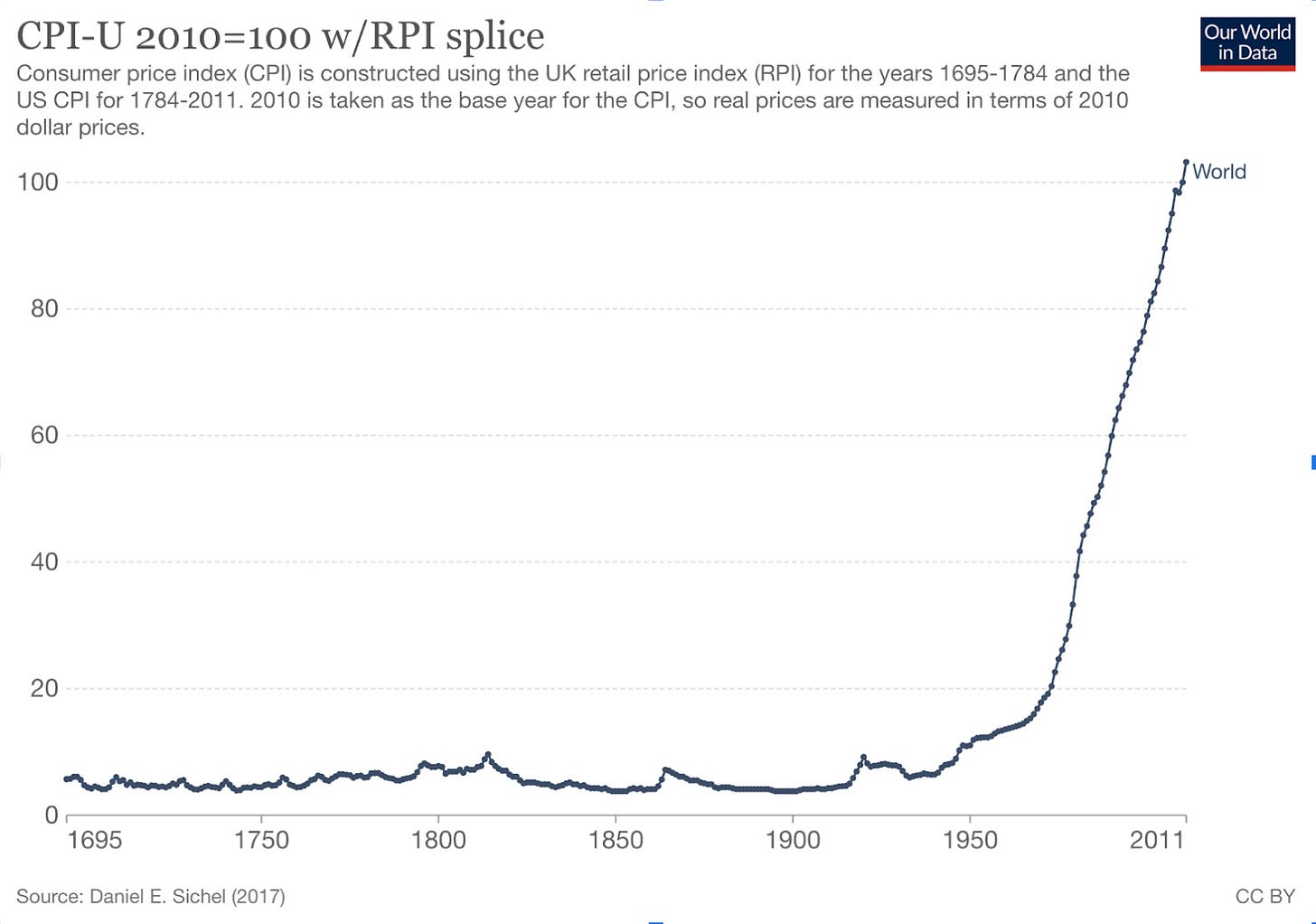

Now take a look at this chart of consumer prices since 1695 (when central banking began give or take).

Hundreds of years of price consistency, until the fiat era and price explosion.

Wages have of course increased, but to nothing like the extent that the purchasing power of money has fallen. It now takes two salaries, fewer children and a lot more debt to enjoy the middle-class lifestyle that many took for granted in the 1950s.

It has long been my contention - since writing Life After the State in 2013, Four Horsemen in 2012 and before - that, for all the battles over free speech, wokery, and any other front you care to mention in the culture wars, the Ring of Power in all of this is our system of money. Throw fiat into the fires of Mount Doom and replace it with a system of money that no single body has the power to create at no cost, and all these other battles will quickly dissipate. With the inevitable shrinkage of government, there would not be the oxygen for them to exist.

Meanwhile, the case for gold and bitcoin, money governments can’t print, remains strong.

If you’re interested in buying gold my recommended bullion dealer is the Pure Gold Co, with whom I have an affiliation deal. You can buy gold and either store it with them or take delivery.

If you need them, here are my reports on how to buy bullion and how to buy bitcoin.