This might mark the top of the market, folks.

The BBC just invited me on to talk about the gold price.

Though it was the World Service, not BBC 1, so maybe this is just an interim top.

Here’s the interview, in case you want to listen:

Another danger sign. Jim Cramer, the world’s greatest contrarian indicator, to everyone’s surprise, is all of a sudden a “confirmed gold bug.”

Gold is at $4,000. Silver is at $49.

Many of the miners are spiking. Capital, so hard to come by for a mining company barely six months ago, is now being thrown at them. And it’s being taken. Who is going to buy all this paper in four months’ time when it comes free trading?

‘The whole population are going crazy . . . Old as well as young are daily falling victim to the gold fever.’

That was an old man in 1849 talking, quoted in the Secret History of Gold. It could just as well be now.

By the way, folks, with gold at record highs, The Secret History of Gold should surely should be the next book you read.

I must confess, folks. I am torn.

There is just too much hot money sloshing about. Everyone’s talking gold. That is usually time to take cover.

Then again, this market has the potential to go a lot higher. There is a very real chance both the silver and gold price could double before this is over. What that would do to the mining companies …

Today we offer eight reasons this market could go a lot higher.

And, in the interests of balance, we offer five reasons it is peaking right here, right now.

We will start with eight reasons it is going higher.

1. Institutional Money Is Still on the Sidelines

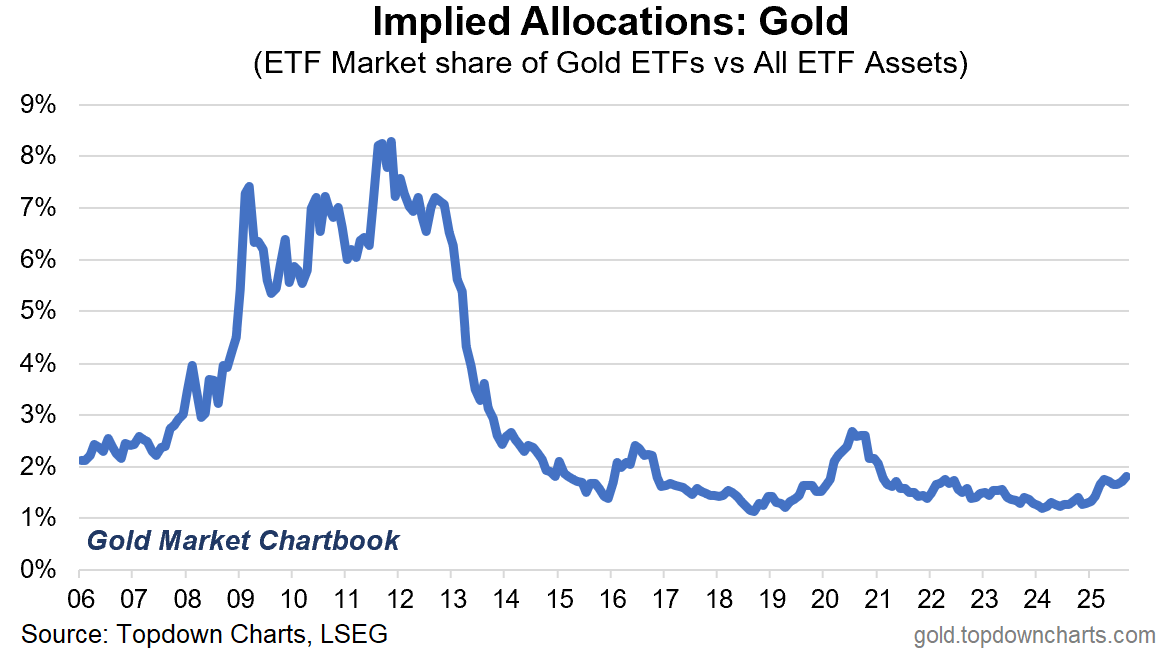

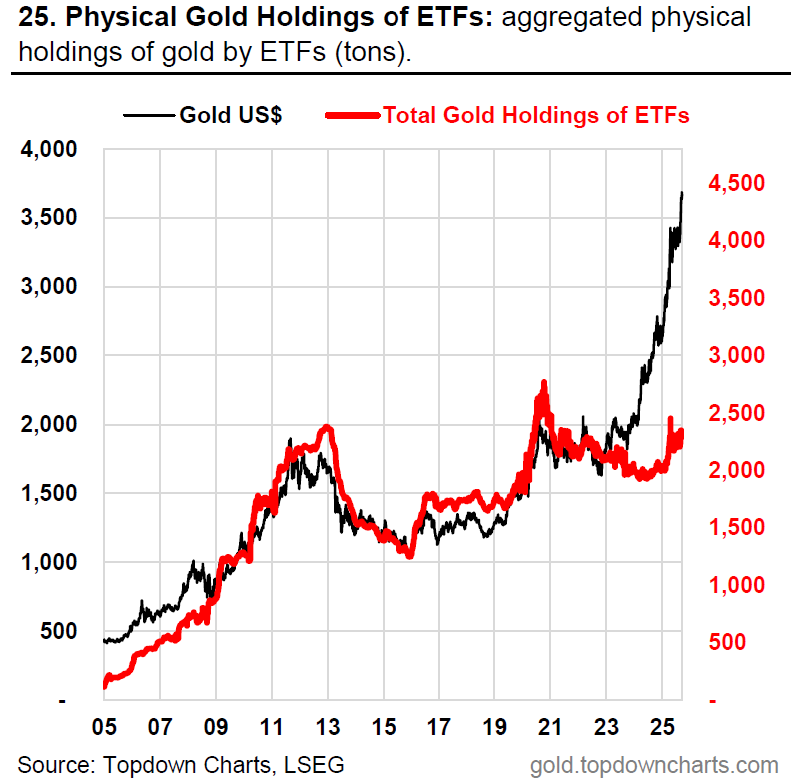

The investment world is under-allocated to gold. In the last bull market we reached 8% allocation. Today we are only at 2%.

Even gold ETF holdings themselves are below 2021 levels.

We are even more under-allocated to miners.

2 The 60/20/20 Revolution: Gold Gets Equal Billing with Bonds

Traditional portfolio allocation Is m hanging. It used to be 60:40 equities to bonds. But, with the generational secular bull market in government bonds now over, Morgan Stanley’s Chief Investment Officer, Mike Wilson is advocating instead for a 60/20/20 mix. Where one leads, others follow. Gold would have equal status to bonds, as it should. Funds the world over 20% allocated to gold! This one is potentially huge.

3 Bull Markets Last a Decade -We’re Only a Few Years In

1971 to 1980, 2001 to 2011. When did this one start? Late 2018? Late 2022?

We might only be three years into this one.

Higher prices beget higher prices.

4 The Debt Monster Has Barely Woken Up

This debt crisis has barely got going. Further fiat debasement is inevitable. Your pound, euro or dollar is going to buy you a lot less 10 years from now. That is INEVITABLE. It’s inherent to the system.

You don’t want to be storing your capital in fiat.

If you live in a Third World country, such as the UK, I urge you to own gold or silver. The bullion dealer I recommend is The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.

That’s four strong reasons already - and we have another four to go. Followed by five warning signs we could be at the top right now.