NB I have further thoughts on the Semler Scientific deal (NASDAQ:SMLR) which you can read at the end of today’s piece.

It’s hard, nigh impossible to call the top in a bull market.

If you can get out within 10% of the top, you have done very well. Most don’t.

We have been waiting a long time, but we are in a bull market now: not just for gold, but for silver, platinum and the companies that mine these precious metals.

It feels very frothy.

But is this just a rush before an interim top early in a secular bull market?

Or are we nearing the top?

Where are we in the cycle now? Which innings of nine, to use the baseball analogy?

The other day I suggested we were in innings six - for gold at least. I got a lot of stick for saying that, which probably means I’m right.

But I put some polls up on my various WhatsApp chats and the general consensus was 6 for the metal, 3 for the miners.

I also have this poll running on X, so you can see current consensus. It’s far from conclusive.

It’s important to remember that a bull market in gold and a bull market in gold mining companies are not one and the same. Of course, there is a lot of crossover between the two, but it is possible to have one without the other.

From 2022 to 2024, for example, as gold climbed, mining stocks were largely flat or falling. The reverse can also happen. Gold can be going nowhere, while mining stocks can rise. In fact, this is not uncommon, because when gold is flat and volatility disappears, investors get a clearer idea of what the price of the final product is going to be, what the profitability of a mine will be, and that security can enable investment to flow.

As you know I have a target of $7,000 gold by the end of this decade, maybe even $10,000 if we get a proper blow-off top.

If you live in a Third World country, such as the UK, I urge you to own gold or silver. The bullion dealer I recommend is The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.

We’re closing in now on $4,000. But just because I have a target of $7,000 gold doesn’t mean we will get there. Anything but.

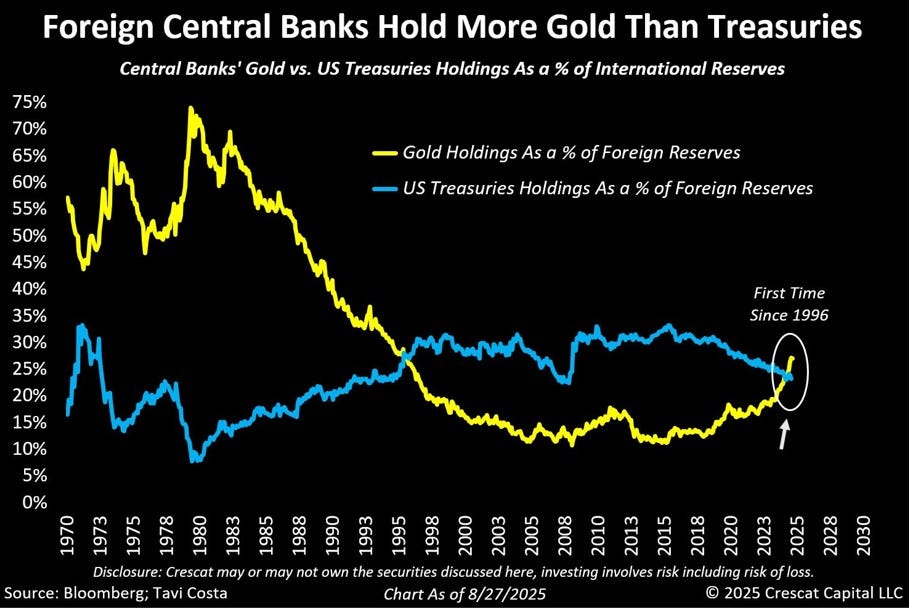

Another target I’m looking for is for central banks around the world to hold roughly 40% of their reserves in gold. We’re currently just above 25%. We were at 20% barely a year ago. A combination of higher gold prices and increased reserves through accumulation will mean we get to 40% pretty quickly.

Central banks’ total gold holdings are currently 36,000 tonnes, according to the ECB. For some context, all the gold that has ever been mined - and of course still exists - amounts to 216,000 tonnes. 36,000 tonnes is quite the share.

Central banks are currently accumulating at a rate of 1,000 tonnes per year, says Reuters, which has been the case since 2022 and the freezing of Russian US dollar assets. Annual gold supply is 3,600 tonnes or thereabouts. Given that half of that is taken up with jewellery, that doesn’t leave a lot left over for everyone else (only about 800 tonnes - hence this bull market).

Central bank holdings have already overtaken US debt, as you can see from the chart above, and the euro. Next stop is to exceed their US dollar holdings (currently 48%). We’ll get there soon enough, as they accumulate gold, the gold price rises and the relative value of the US dollar holdings recedes.

$7,000 gold would take us there near enough.

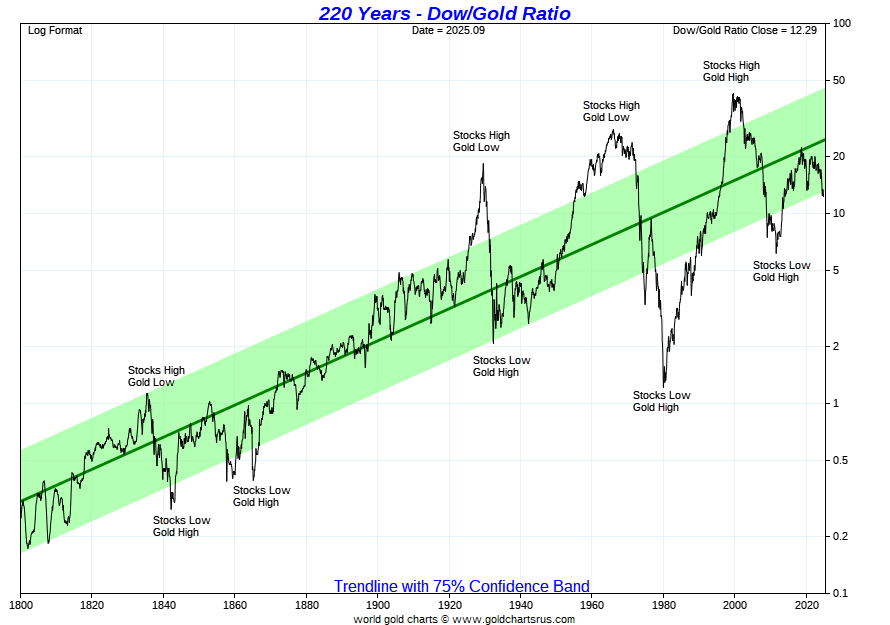

Another target is a Dow-to-gold ratio well below 10, perhaps at 5 where it reached in 2011. (Some have a target below 2 for this one, as we saw in 1929 and 1980, which would mean a gold price in the tens of thousands. Unlikely, I would have thought, but not impossible: it has happened before).

With the Dow currently at 46,400, and gold at $3,900 we are currently at 12.

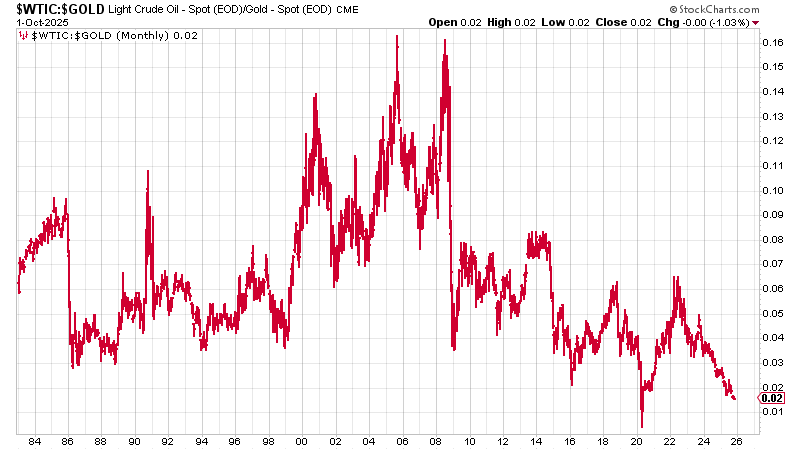

Note that the gold to oil ratio has never been this low ever, barring the insanity of Covid when oil went negative. Does that make oil a buy and gold a sell? Probably.

This is a key reason mining companies are starting to do so well. Energy is their biggest input cost. Gold is their output. If they can’t make money now, they won’t ever make money.

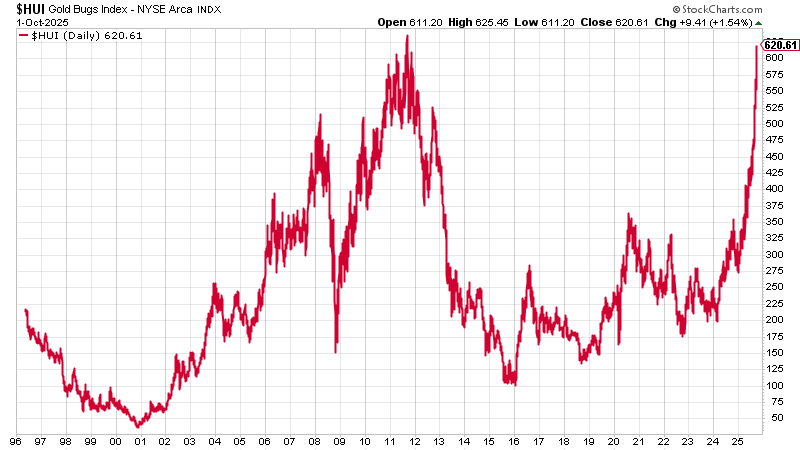

I have lived through a long and painful bear market for mining. It began in 2011. It’s been over a decade, with brief respites in 2016 and 2020, almost relentlessly down. It’s made me extremely cynical. Maybe I’ve got too much recency bias.

But the HUI, the index of unhedged gold producers, is butting up against its old 2011 highs, rather like silver, which we will come to in a moment. I know this chart is not adjusted for inflation, but even so it is a concern. Then again, if it goes through, there is no overhead resistance. It would be a proper, mega breakout.

Either way, these last few months have been nuts.

I remain of the view that for gold, the metal, as I said the other day, we’re in innings six. Mining I’m not so sure.

I stole these pictures from Winston Miles of Stifel Wealth Management. They were taken at the Denver Gold Show a few weeks ago. The place is dead. That is not end-of-a-bull-market behaviour

“There were hardly any new generalist investors” he says. “Zero retail, everyone was a specialist, and occupancy at the main stage was literally 10% full for most of the presentations.”

Then again the Munich gold show - Edelmetallmesse, which ran from 2006 but ended in 2019 with the bear market effectively putting it out of business - is reopening this year and something like 120 mining companies have signed up to attend. That’s quite the reversal.

It’s because mining companies are finding investment again. That means they’re issuing paper. Will there be buyers for it?

Capital is flowing. Share prices are multiplying in some cases. Animal spirits are high.

So many contradictions and mixed signals. Such is the bull market wall of worry. What to do? What to do?