Gold Interviews and a Crypto Bloodbath

Plus a cautionary tale on leverage and risk management. Your Sunday thought piece.

Good Sunday to you,

Several interviews on gold to share with you today, plus some thoughts on the crypto flash crash.

Let’s start with this week’s commentary, in case you missed it:

Gold at $4,000, Silver at $50: The Top or Just the Beginning?

This might mark the top of the market, folks.

Turning now to various interviews, my appearance on Merryn Talks Money appears to have gone down well. Here it is:

I also appeared on the fledgling Poor Millionaires podcast with James Faulkner

Here it is on YouTube, if you prefer.

And, if you are interested in reading the book about which I am talking, here is a link to the Secret History of Gold.

Friday Flash Crash in Crypto

I wanted to briefly mention the Friday blood bath in crypto, triggered by Donald Trump’s threats on Friday to impose 100% tariffs on China (although prices had been drifting lower all week). The flash crash saw, in the space of just 25 minutes, almost half a trillion dollars evaporate from crypto markets, and the sector (excluding bitcoin, ethereum and stablecoins) fell by 33%.

I don’t dabble in sh*tcoins - largely because I don’t have time to stay abreast of what’s what, but also because I am out of my depth. I think it’s a generational thing.

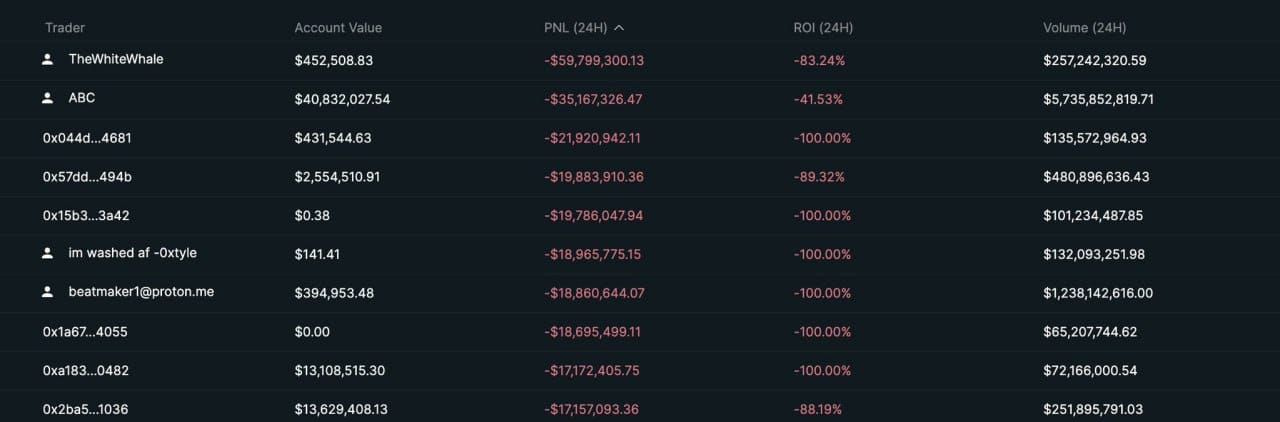

I do know, however, that absurd amounts of leverage get used, and so, without proper risk management (and so many in this sector are young and inexperienced I doubt they realise the dangers they are taking when employing such leverage), total wipe out is a real possibility. We saw it on Friday. There were something like $19 billion in liquidations.

X is awash with tweets like this.

And videos like this:

One trader here, The White Whale, lost $250 million.

Just astonishing.

I’ve been on the wrong side of leveraged trades (when younger) - margin calls, accounts wiped out and all the rest of it. It is horrible beyond words. The level of shame and self-loathing you feel is quite hard to describe. But what I experienced was just spreadbetting and nothing like the levels above.

Don’t forget position sizing is everything.

Unfortunately, these kind of losses lead to suicide, and there are going to be lots of stories like this one of Ukrainian crypto influencer Kostya Kudo Konstantin Galish, 32, who on Friday night was found dead from a self-inflicted gunshot wound inside his Lamborghini Urus in Kyiv.

It’s no wonder so many bitcoin maximalists refuse to dabble in sh*tcoins.

If you happen to be a crypto bro who has taken losses on Friday, and are contemplating similarly dark thoughts, please talk to your family, your loved ones, be open, honest. They might be angry. They might not understand. But they love you, and FOR SURE they want you alive.

What’s in Store This Week

Given Trump’s comments on Friday, and the violent market reaction to them, I think we can expect some volatility this week, so be prepared.

Gold and silver are overbought. Gold may see some roundnumberitis at $4,000, and silver is up against that technical barrier at $50.

Brace yourselves.

Meanwhile, Dr John has put his head up above the parapet, so we’ll have a piece from him this week as well. He’s worried about the brewing UK fiscal crisis, and explains how he’s diversifying away from sterling.

On which note:

If you live in a Third World country, such as the UK, I urge you to own gold or silver. The bullion dealer I recommend is The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.

Until next time,

Dominic

Was it not always said to stick only to the ‘blue chip’ cryptos of bitcoin, ethereum and solana with everything else too far out the risk curve unless you’re prepared to lose it all on the roulette table of the smoking chicken fish or something similar. Probably a lot to be said for just BTC.

Keep notes of your trades: a single sentence of why? Notes are great for later reflection and present pacing.