You probably saw my post from ten days ago in which I argued that the vast numbers of people queuing up outside bullion stores in Singapore and Sydney to buy gold and silver were not a good sign.

As it turns out, they were not.

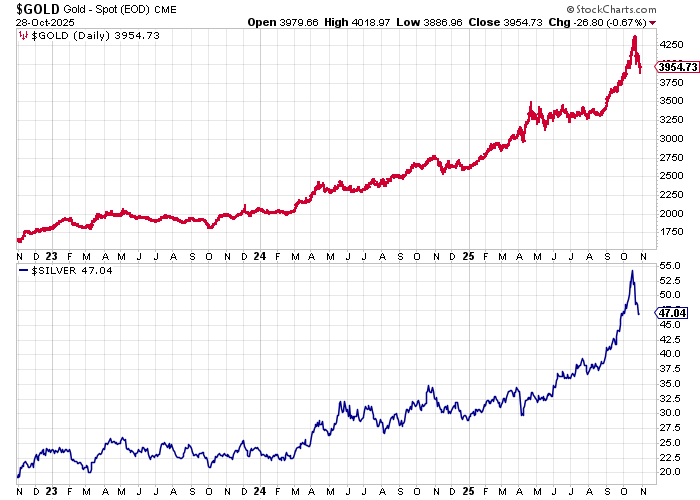

Gold and silver have put in a top - an interim, mid-cycle top, in my view, not the top - and we can now expect many months of sideways, shake-out, frustrating consolidation to generally piss everyone off.

It’s important, in such times, to keep your eye on the bigger picture, which in this case is the inevitable debasement of currency, so as not to lose your position.

You’ll know, I’m sure, the story of Joe Kennedy’s shoe shine boy. In 1929, so the story goes, the boy who was polishing the celebrated investor’s shoes started giving him stock tips. If the shoe shine boy has bought in, thought Joe Kennedy Snr, who else is left to buy? That persuaded him that the top was close and he famously sold just before the crash.

That story is often cited to illustrate the idea that retail investors are sheep. They’re stupid. You should do the opposite to what retail is doing and so on.

I don’t think it’s anything like that simple.

There are some retail investors who are stupid. There are plenty who are rookies and naive. But there are plenty who are thoughtful, wise and, as a result, very good investors.

By the same token, I have met many fund managers, analysts and more from respected institutions who are thick as pigshite. (I have met plenty of geniuses too).

Give me the choice between some blogger and an institutional research report, you’ll often get far more insight from the former. I frequently read bulletin boards, or chats on Twitter, as part of my research into a company.

It wasn’t institutions who got into bitcoin early, it was retail. Even now many institutions shun it, particularly in bureaucratic banana republics such as the UK. Who were the smart guys? The people that bought earliest. Retail.

Obviously, if you start getting investment tips from a shoe shine boy/taxi driver/barber (my Albanian barber is forever shilling me shitcoins) or your nan’s carer’s mate, that is usually a bad sign, but it doesn’t mean that ordinary folk are stupid.

With the above in mind, I stumbled across this video from another legend of American investing, Jim Simons. At the time of his death in 2024, the hedge fund manager’s net worth was north of $30 billion, making him the 55th-richest person in the world.

He describes January 21, 1980, when, at the afternoon fix, gold went to $850 /oz - a blow-off top that would not be seen again for almost 30 years.

I write about that 1980 blow-off top, by the way, and how it was “illusory” in the Secret History of Gold (BTW the audiobook is getting barnstorming reviews).

The point I draw from the Simons talk is that retail was selling gold. People were not buying, they were selling.

In other words, retail nailed the top of the market.

My mum remembers the gold fever - and indeed the silver fever (silver spiked to $50 three days earlier on January 18). Even today, 45 years on, the silver price is lower than it was then - that’s how insane that spike was.

She recalls people queuing up to sell their family silver. Not to buy it. To sell it.

So that is something I am looking for to tell than this bull market is close to an end: when retail, ordinary people, start selling their physical in droves.

We are not there yet.

Even towards the end of the last bull market which peaked in 2011, everywhere you went, there were signs saying, “We buy any gold”. Retail was selling.

Comedian Gary Delaney and I even wrote a sketch in which a wizard (Gandalf) pulls a ring from the fire, reads the inscription, hands it to a hobbit (Frodo), who nods thoughtfully and says something along the lines of, “I understand what I must do.” We then cut to him going into a shop with a sign outside that says, “We buy any gold.”

I still think that sketch is funny, but of course TV didn’t want it. Wrong age, wrong sex, wrong colour - never mind wrong views.

Until next time,

Dominic

If you live in a Third World country, such as the UK, I urge you to own gold or silver. The bullion dealer I recommend is The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.