Money evolves constantly.

Every day there is some tiny new fintech development, but it’s only when you take a step back and look at the ten-, twenty- or thirty-year picture that you realise just how much things have changed.

What is money today is a far cry from what was money when I was a child. Digital technology barely existed back then. We used cash and these things called cheques. You’ve probably heard of them.

It’s not just what we use as money that evolves. How money is created - that changes too. And just this decade there has been a major evolution. That’s what I am going to talk about today.

The creation of money and debt

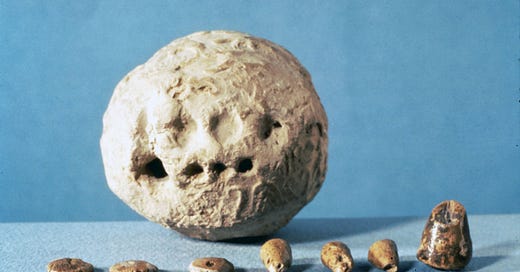

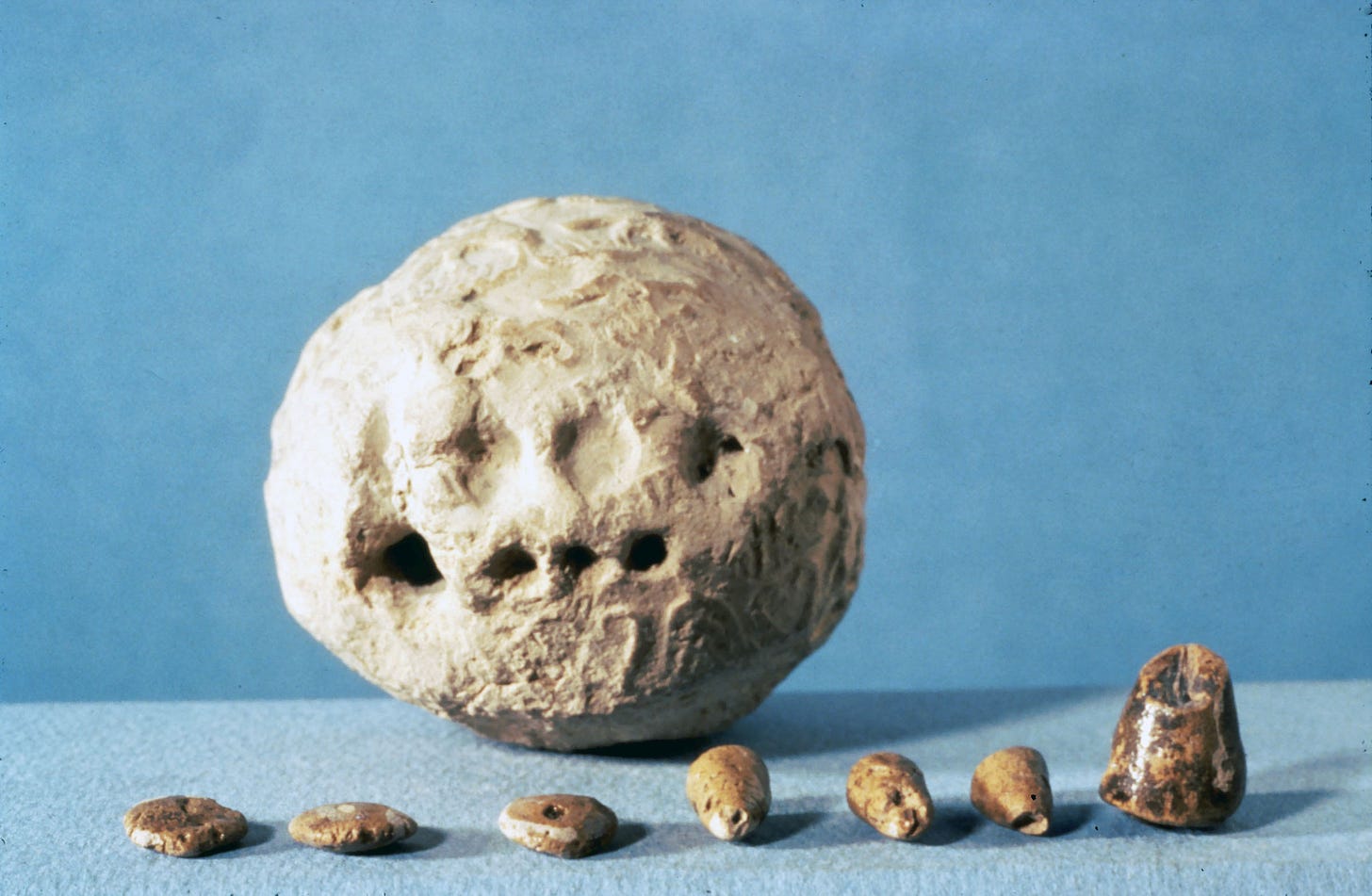

Once upon a time you would create money by mining gold and silver. But debt-based money systems have also existed since the dawn of civilization, when clay tokens representing valuable items such as barley or sheep would be baked inside clay balls. When the debt was settled the clay balls would be smashed open.

Humans, being the ingenious folk they are, especially when it comes to money, soon found that it was quicker to simply inscribe the clay with pictures of said items and so did the first systems of writing develop - hieroglyphics.

Coins came along, and then the printing press, both remarkably long-lived technologies, but behind it all there was always metal.

Western Europe abandoned gold in 1914 so it could print the money to pay for the First World War, and the United States did the same in 1971 amidst spiralling welfare costs and the conflict in Vietnam. Both years were landmarks in the evolution of money creation.

This became the fiat era, when money became debt. Some physical cash was printed or minted, but money for the most part was created when loans were made. You borrow a thousand pounds to buy a house, the bank created that thousand pounds using the house as collateral and suddenly there was a thousand pounds in the housing market that wasn’t previously there. That’s why houses kept on rising in value - the constant introduction of newly created money through mortgages. Introduce debt into a market and prices rise. If houses were cash based, they’d be a lot cheaper.

Something similar happened in the bond markets and the financial markets with the use of leverage. Leverage is just a fancy term for debt.

There were occasional moments of credit tightening, but the broader trend, especially as economists and governments became obsessed with what they call growth, was for ever expanding credit.

Human beings, being the greedy folk they are, especially when it comes to money, took the whole thing too far, 2008 came along and the bubble went pop.

Then a whole way new to create money was invented: Quantitative Easing. Central Banks now started creating money, and they bailed out the financial system with it.

Then they started using the money to buy government bonds - so they effectively printed money to pay for government spending. They also bought other financial assets. And so lots of newly created money went into the financial system and from there to the expensive houses in which many of those who work in finance live, and we got another decade or more of rising prices.

But because all this newly created money went into financial assets and housing, it didn’t show up on the inflation numbers. Central bank inflation measures don’t include houses or financial assets. So they said there was no inflation.

Then Covid came along.

Central banks could now print money and it doesn’t create inflation, they thought. They forgot about the sleight of hand that was their inflation measures. So they printed more money and the government handed it out to people. That money made its way into the real economy and now we have inflation. And they are all scratching their heads and blaming Vladimir Putin.

But the nature of money creation has changed. Now money is not just debt. Governments are creating it to fund their activities. And when central bank digital currencies come along, they are going to do that even more. As a result governments, are going to play far greater role in where capital gets allocated.

We turn to the wise old owl that is financial historian Russell Napier. “By issuing state guarantees on bank credit during the Covid crisis, governments have effectively taken over the levers to control the creation of money”.

They said it was temporary, but, to quote the great Milton Friedman, “nothing is so permanent as a temporary government programme”.

We now have the War in Ukraine and with it spiralling energy costs - another emergency. How to deal with it? Keep with the programme. Lend money and guarantee loans.

Russell Napier again: “By telling banks how and where to grant guaranteed loans, governments can direct investment where they want it to, be it energy, projects aimed at reducing inequality, or general investments to combat climate change. By guiding the growth of credit and therefore the growth of money, they can control the nominal growth of the economy.”

It’s a huge win for the unelected technocrat.

Nobody designed this, nobody planned it, they have just discovered they can do it. And who was at the heart of it all in the UK? Our new Prime Minister.

Perhaps, among other things, it means that the age of the all-powerful central bank is coming to an end.

“This is a shift of power that cannot be underestimated,” says Napier. “Our whole economic system of the past 40 years was built on the assumption that the growth of credit and therefore broad money in the economy was controlled through the level of interest rates – and that central banks controlled interest rates. But now, when governments take control of private credit creation through the banking system by guaranteeing loans, central banks are pushed out of their role. We are moving from a mechanism where bank credit is controlled by interest rates to a quantitative mechanism that is politicised. This is the politicisation of credit.”

Inflation is often accompanied by high unemployment. It was in the 1970s. But we are in an era of low unemployment. Many are struggling to get the staff (at the price they are prepared to pay) - this isn’t a Brexit thing. It’s happening across Europe and the US.

Many government spending programmes will be popular. They’ll create a lot more employment. We’ll probably get a load more “growth”, which means higher levels of inflation will be more acceptable (and long-lasting).

Government is about to get a whole lot more involved in the economy - and in our lives. It ain’t getting smaller.

How to navigate it all?

We turn to our man Russell once more. “First of all: avoid government bonds. Investors in government debt are the ones who will be robbed slowly. Within equities, there are sectors that will do very well. The great problems we have – energy, climate change, defence, inequality, our dependence on production from China – will all be solved by massive investment. This capex boom could last for a long time. Companies that are geared to this renaissance of capital spending will do well. Gold will do well once people realise that inflation won’t come down to pre-2020 levels but will settle between 4 and 6%.”

Gold is in a downtrend. But we like it. It’s even more permanent than a temporary government programme.

But the nature of money creation has evolved once more.

Interested in buying gold? Check out the Pure Gold Company.

If you are in or around London on November 24, wearing my comedy hat, I’m doing a gig with the Gilets Jaunes - that’s my band - at Crazy Coqs in Piccadilly Circus underneath Brasserie Zedel. It’s a fantastic venue for this kind of thing. It’s going to be a great night. Please come on down.

This article first appeared at Moneyweek.

Share this post