Greetings to you from Palm Springs, California,

Something most unusual is happening in financial markets, the like of which I haven’t seen for years.

Junior mining companies are behaving well.

Silver is going up. Platinum is going up.

It feels like a proper bull market.

These things have been utter dogs for years. So cripes — is this overdue or what. It had reached the point where I never thought I’d see a bull market in these things again in my lifetime.

It’s worth noting that this phenomenon seems largely confined to precious metals.

The base metals are not seeing the same price action.

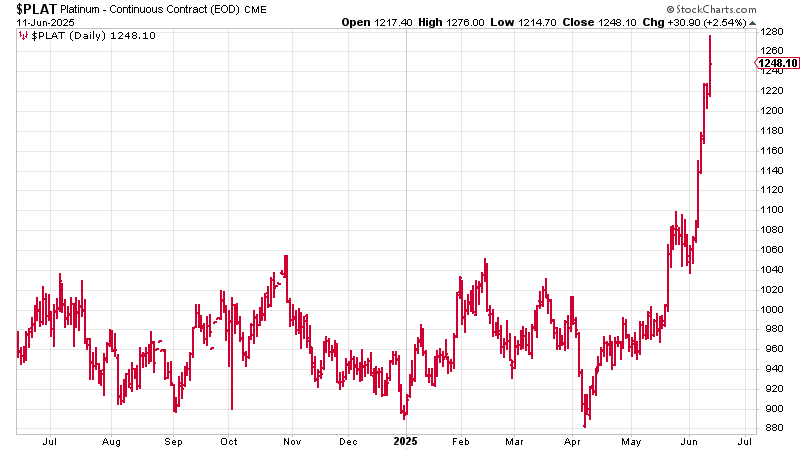

By way of reference, here is platinum. It has gone off like a rocket. Almost 40% in two months.

And long-time readers who held onto platinum pick Tharisa (THS.L) are starting to see that come back to life, thank goodness.

Typically, you would expect to see platinum trading at 1.25 times the gold price — $4,000/oz in other words. At the moment it’s $1,250, so there is plenty of future potential in that particular market.

Silver, meanwhile, if it can get above $37, where there is some historical resistance, I think goes back to $50.

Here’s the long-term silver chart, which is looking remarkably symmetrical. We’re butted up against resistance now, as you can see. After that the next line is at $44 — but if it gets to $44, I think it goes to $50.

If that happens, those who hold silver miners — particularly my favourite junior producer — are going to make a lot of money. 🙂

But, as I say, this is, for now, a precious metals thing. Copper doesn’t look too bad, but zinc, tin, lead, iron ore — they’re all either flat or falling.

If you are buying gold or silver, the bullion dealer I use and recommend is the Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. Find out more here.

Gold, meanwhile, is consolidating above $3,300/oz, while the miners and other precious metals play catch up.

How about that for a chart. Talk about trend!

Let’s take a closer look at my two largest holdings.

I think both these junior gold plays are buys by the way, one of them in particular.