I’ve seen what can happen - often happens - with small-cap, even mid- and large-cap mining stocks. Things go tits up very easily. Losing your shirt is not pleasant, and I wouldn’t wish it on anyone.

As a result, I have an in-built reluctance to ever mention mining companies within earshot of people who haven’t had previous shirt-losing experience in the game, even if I am invested in these companies myself. I prefer readers and listeners to have been initiated into the wealth-decimating potential of the sector and I’d rather not be the initiator.

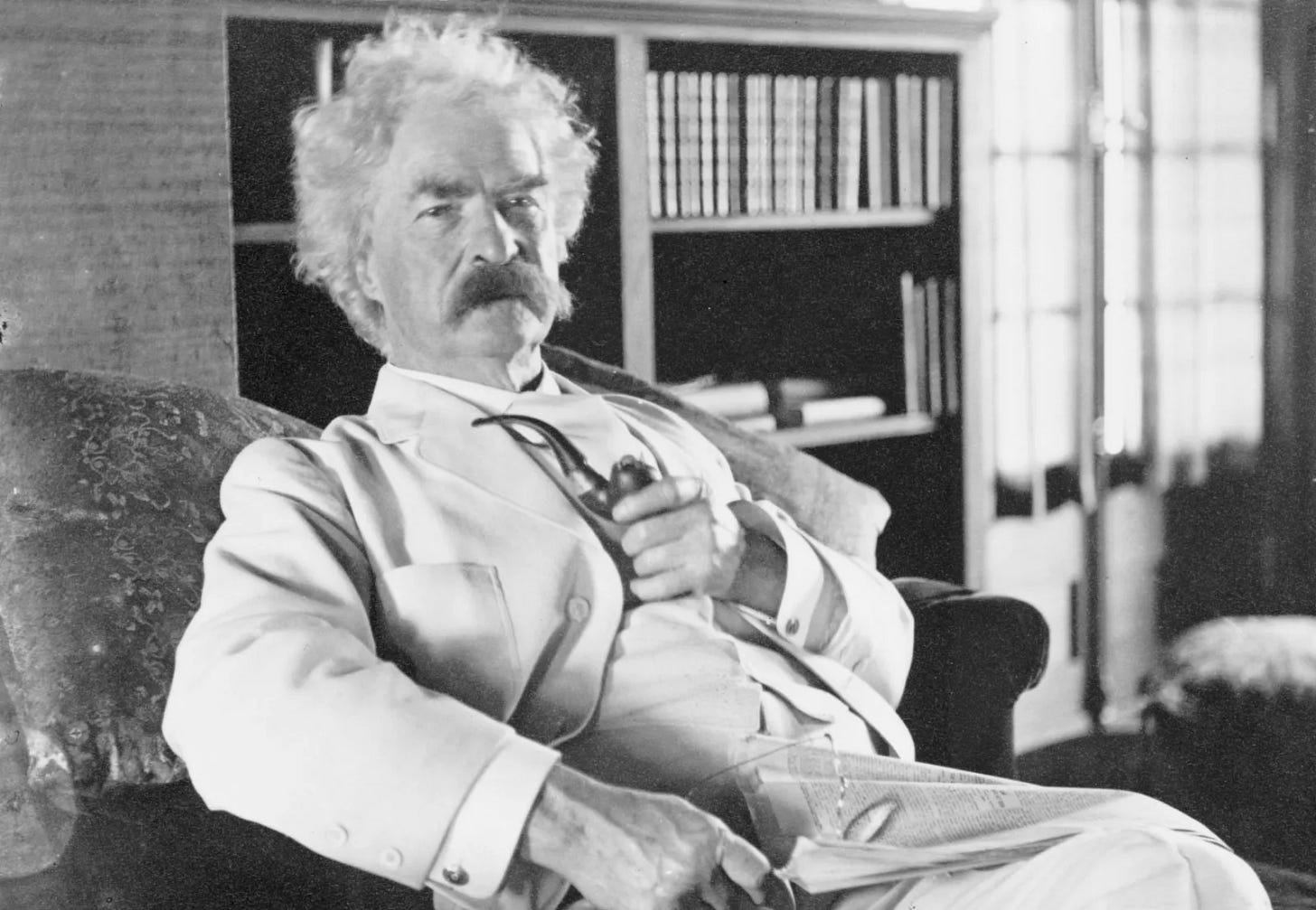

Mark Twain would know what I mean. He lost his shirt in the mining game, and so coined the phrase, “a mine is a hole in the ground with a liar standing next to it.”

I now have some kind of weird inner voice and, should I ever start talking about mining stocks to the uninitiated, I can hear a muffled scream in the distance of my mind crying, “Noooo!”

Think how long it takes to build a mine, the regulatory processes, the exploration, the development, the capital raises. It’s an incredibly slow-moving sector. And yet anything can go wrong at any moment, and the story’s over. You are constantly treading a nervous edge investing in this sector.

But when I stumbled across this story, one of my biggest personal investments, here was a company that was seemed to have such limited downside, I could actually recommend it to the uninitiated and continue to sleep at night without that muffled screaming voice keeping me up. It’s one of the reasons I launched this Substack in the first place.

I met with management last week and I thought I should report back with some of my findings. Long story short: that inner voice is not going to be keeping me up at night.