I haven’t covered the perennial disappointment that is gold for a while, and I felt the metal is overdue some attention, so that will be the subject of today’s missive.

I say perennial disappointment, because gold “should” be so much higher.

In any case, it’s summer. Usually, the best time of year to buy each year is in the June to August timeframe, so perhaps it’s time to allocate some funds that way.

I stress “usually”, not always. A summer low in gold is frequent enough to be noticeable, but not consistent enough to be reliable. A bit like your errant teenager’s mood swings.

In terms of price, the high for the year was $2,080 per ounce – printed in March shortly after you know who invaded you know where.

The low for the year was $1,780 – that came in January. We also came close to that figure in May ($1,785 was the low).

And today we are meandering around the $1,820 mark, which is also where the 52-week moving average lies.

That’s actually quite a telling little fact. For all the declines we’ve seen elsewhere in stocks, bonds and crypto, and the ensuing erosion of wealth, gold sits at its one-year average. In other words, it’s done what it’s supposed to: preserved its value, and preserved your capital.

And that’s with the US dollar so strong.

Gold has been doing better than you think

Gold has actually done rather better against other currencies. The chart below shows gold in dollars (red), but also gold measured in pounds (blue), Japanese yen (green) and euros (yellow).

You can see that against all those three currencies, gold is not far off its all-time highs. If you’re Japanese, European or British - all good then.

Here’s another way of looking at the same thing. This is gold against 18 national currencies in 2021. It might be down a little against some of them – the US and Canadian dollars, the Chinese yuan, the Brazilian real, the Mexican peso and the Russian ruble (how has the ruble been so strong?!).

But it’s up, significantly in some cases, against others – the Argentinian peso, the Swiss franc, the euro, the pound, the Korean won, the Japanese yen and, of course, the Turkish lira.

Gold’s price is being determined then by the much bigger market that is the US dollar, as much as anything. Where’s the US dollar going next? Your guess is as good as mine.

Monetary policy is tighter there than elsewhere, it’s the first port of call for capital in a panic, and so the dollar keeps rising. Currently at 104 on the index, it could go all the way to 120. Unlikely, but it’s been there before.

If it does, gold almost certainly won’t be going anywhere significant.

But of course, if the dollar heads lower – and it will if other countries start to tighten as much as the Americans – then gold will make a move. I gather analysts at Goldman Sachs have just put a $2,500 year-end target on gold. That would be nice.

Is gold heading for a repeat of the 1970s?

So many comparisons are being made between today and the 1970s. Politically and economically there are parallels galore. The big differences are technological.

Nevertheless, gold had one of its best ever decades in the 1970s, going from $35/oz in 1971 to $850 (albeit briefly) early in 1980. It was bonanza time for gold mining.

But even within that bonanza decade, gold went through a near two-year bear market in 1975-76 that saw it fall by nearly half – going from around $200/oz to $100. Imagine if gold went to $1,000 now. That would be hard to swallow.

Here is gold during its glory years.

Longer term, the fundamentals of out-of-control inflation, geopolitical instability, escalating de-globalisation and weak, unpopular leadership all tend to be drivers of flight to gold. But it remains an analogue asset in a world, where all the value is digital.

It was me that first made this comparison many years ago, though I still haven’t decided what the answer is. The horse was transport for thousands of years. It was “natural transport”. With the invention of the car it became irrelevant.

Gold too was money for thousands of years, “natural money”. But with digital technology and modern communications, is it now as irrelevant to finance and the horse is to transport?

Or, like King Arthur to the English, will gold return to finance to save the people in their hour of need?

I guess, until it actually does shows up, we’ll never know the answer

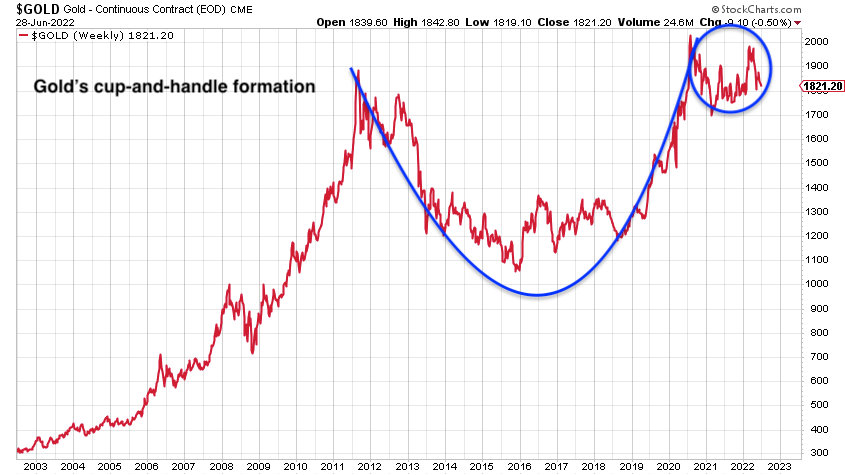

From a technical perspective, that enormous cup-and-handle formation, built up over a decade, remains in play and looks ready to propel gold higher. I’ve illustrated it here.

Cups and handles are another of those commonly observed chart patterns – like “double tops” or “head and shoulders” – which are fairly self-explanatory. This one was first observed in the 1980s. Investopedia calls it a “technical chart pattern that resembles a cup and handle”. It is considered a very bullish signal.

If it plays out, it will give Goldman Sachs their target. And some.

I own gold and I’m glad I do. I may be rude about it, but I love it. And it’s the one part of my portfolio that isn’t keeping me awake at night. In fact, it’s so boring, it’s helping me to sleep.

If you are looking to buy physical gold – coins or bars – let me recommend The Pure Gold Company in London or Goldcore in Ireland, with whom I have an affiliation deal. They are kosher, competitively priced and you get to speak to a human being. You can take delivery or store it safely allocated to you at vaults in safe places like Switzerland (Zurich), Ireland, Singapore, Hong Kong, the US or the UK.

This article first appeared at Moneyweek