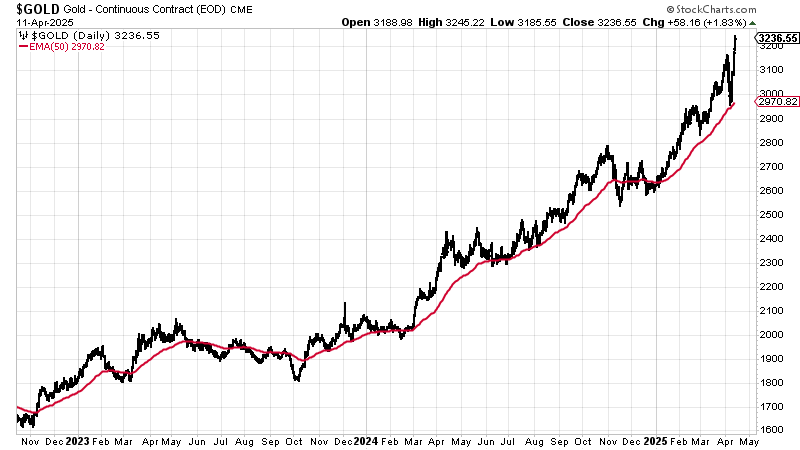

Gold broke out to new highs on Friday: $3,237/oz. It is proving one of the prime beneficiaries of all the market mayhem, and no surprise.

Gold is your hedge against government, and this is all a creation of government.

Where to park capital? Equities are all over the place and will continue to be for the foreseeable future. With US authorities transparent about wanting it lower, the US dollar is not the safe haven it’s been since 2007 in market sell-offs. As for treasuries, they’ve become a weapon in the trade wars.

Inert gold, on the other hand, is neutral. It doesn’t care which side of the trade wars, the culture wars, or any other wars you’re on, and at the moment, it seems everyone wants a piece.

China, we learn thanks to the sleuthing of analyst Jan Nieuwenhuijs, bought another 570 tonnes in 2024. Who knows how much more it has bought in 2025? To put that 570-tonne number in perspective, the UK’s total holdings are 310 tonnes.

What’s driving it all?

This move in gold started shortly after the US confiscated $300 billion in Russian state holdings after Russia’s invasion of Ukraine. It hasn’t been driven by retail. Central bank buying has pushed up the price.

If you’re not on Team US or Team G7, why own assets they can confiscate, like dollars or treasuries?

Own gold instead. The US would have to invade you to take your gold—or send in Kelly’s Heroes.

In 1950, gold made up 70% of international reserves. In the noughties, it was just 10%. The dollar, meanwhile, reached 60%, with the euro at another 20%.

Now gold is at 20%, the dollar at 45%, and the euro at 15%. The trend is clear, as this cool little video from Nieuwenhuijs and Money Metals shows:

In my opinion, we’ll be at 40% five years from now.

Here’s gold since late 2022. Every pullback has been bought. It’s as though someone with deep pockets is saying, “Buy the pullback every time it hits the 50-day moving average (red line).”

The UK seems to have been forgotten in this global rout, but I have little doubt the chickens of our shocking national finances and woeful productivity will soon come home to roost in the form of a sterling crisis. That’s when we overlooked Britishers will be mighty glad we have our gold.

Gold is now £2,475/oz. Another year of this, and we’ll be north of £3,000.

Summer is approaching, and May to August is typically when gold is weakest. Take advantage of pullbacks, is my advice. Do what the Chinese are doing. They’re smarter than we are (when it comes to gold, at least).

With oil having cratered, we should finally see gold miners fetch a proper bid. (They are already moving a little). Energy can represent 15% to 40% of mining costs. Lower costs and a higher price for the final product should mean they make more money, and thus higher share prices. (I’ll cover miners again soon, I promise, though I am worried I’ll jinx it)

Here’s something Charlie Morris observed—and you really should subscribe to his gold newsletter, Atlas Pulse; it’s top dog in a crowded field - it’s free. GDX is the largest gold mining ETF by far. Despite higher gold prices, it’s seen outflows of 25% over the past year. When inflows start, these things will rocket. The sector is tiny relative to the capital out there.

Here’s three years of Brent, FYI. It’s almost the reverse of gold. Good for mining.

If you’re interested in buying gold, by the way - and you should own some, if you don’t already, given everything that is going on - the bullion dealer I recommend is the Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.

A 2-minute video for your Sunday entertainment

I’ve got lots of content coming up over the next fortnight. I’ve just returned from two days of bitcoin conferences, so I’m fired up about that. I’ve got that gold mining piece to write. I have a lot more to say about gold. I have a fab video to share with you which I will send out tomorrow. And I want to explore where we should deploy capital in all this market mayhem: which sectors will do well in tariff wars, and which won’t. So, plenty to come.

In the meantime, as it’s the weekend, enjoy this silly little 3-minute vid I put together for my comedy Substack - not to be taken seriously - about alien invaders on planet Earth stealing our gold at the dawn of civilization. (Click the image below)

Finally, if you’re interested in gold and haven’t already seen it, here’s my guide to investing int he shiny stuff.