A cock-up at HQ some of you didn’t see Sunday’s piece about a scam in the gold bullion markets. Here it is ICYMI:

Also in video format if you prefer.

Now we look at what must be the most important price in the world: that is the price of the global reserve currency, the US dollar.

Does it go up or down from here?

There is probably no more important question in global finance to know the answer to.

If the dollar is falling, it usually signals boom times for assets: equities and commodities especially. The US prints and spends, and then exports the inflation. Money gets loose and the party rocks.

But when the dollar is strong, everyone gets the jitters.

Today the US dollar is seriously oversold.

Conversely, the inverse trade—gold—is at all-time highs. US equity markets are flirting with all-time highs, while the euro and the yen, even the pound, have been soaring.

What’s more: the US General Election is coming.

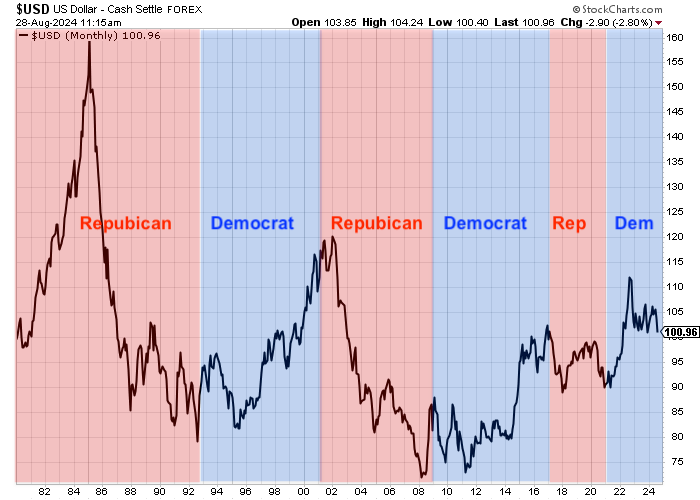

On which note, how about this for a chart?

Since 1985, the dollar has declined with the Republicans - Reagan, Bush x2 and Trump - and rallied with the Democrats - Clinton, Obama, and Biden.

Who wins in November has a big impact on the price

But there’re several months to go till November, and a lot can change in just a few weeks.

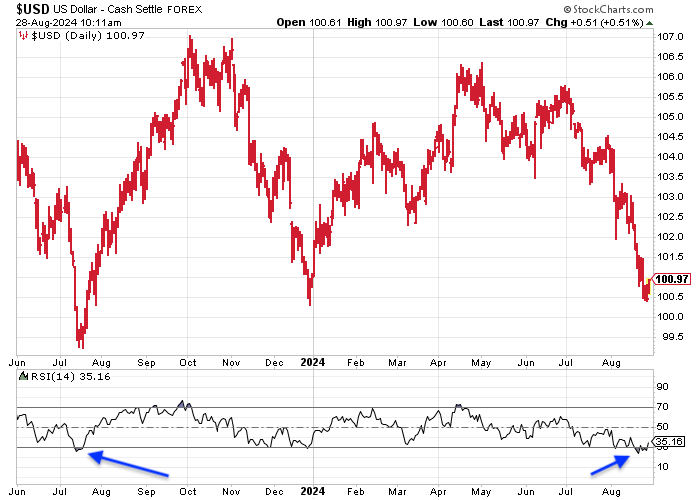

Let’s start with US dollar index, which tracks the dollar against the currencies of the US’s main trading partners', over the past year.

Look at the RSI.

The RSI has gone beneath 30 for the first time in over a year. You would typically expect a reversal from these levels.

Look at the 3-month rally the dollar had starting in July 2023, the last time it was this oversold, it was quite something.

In fact, based on this, I have taken a small short position in cable, betting that the dollar will rise against the pound.

Last week, Fed Chief Jerome Powell indicated that the Federal Reserve is now ready to start cutting rates, which should be bearish for the dollar. However, oversold is oversold.

"The time has come for policy to adjust." he said. "My confidence has grown that inflation is on a sustainable path back to 2%."

The market is somewhat divided as to whether that cut will be 0.25% or 0.5%, but lower rates go. The inflation—by their definition—monster has been tamed.

“The 2-year yield has fallen to 3.9% compared to base rates at 5.5%, which is the bond market’s way of pricing in future rate cuts,” says Charlie Morris at Bytree. (Have you subscribed to his letter? You should.) "The difference, at -1.6%, means that a full rate-cutting cycle lies ahead. Indeed, this reading is more pronounced than seen in 2001 and 2008, implying the cuts could come thick and fast."

2001 and 2008 were major turning points in the US dollar.

What about sentiment?

To gauge this, I ran some polls on various WhatsApp chats and Twitter/X. What did they show?