If you would rather watch this piece go here:

IMPORTANT: somebody has been impersonating me on Substack, on Instagram and on YouTube. Please don’t engage. Report and block. And please DON’T send any money.

Thanks to all who came to see Shaping The Earth up in Edinburgh. The show got incredible feedback. I am doing it in London October 9th and 10th at the Museum of Comedy. Please come if you fancy a bit of “learning and laughter”.

House prices have to come down some time. But when exactly? That’s what we all want to know.

So here’s your answer.

The declines start in the US and Canada in 2025, followed by the UK, Europe and Australia in 2026.

That’s what the 18-year property cycle says, at least.

Today we explore that cycle and what it says about house prices.

18 Years of Boom and Bust

Economist Fred Harrison, who first covered the theory in his 1983 book, The Power in the Land, is very much the Godfather of the idea that real estate follows a predictable pattern over an 18-year period.

I first stumbled across Harrison in 2005, when so many were sure house prices had to come down (needless to say they didn’t), on reading his brilliantly prophetic article for MoneyWeek, arguing that we were two or three years from the top. Wasn’t he right.

Today, by most accounts, property should have already crashed. Real estate prices bear little resemblance to earnings. With the rise in interest rates that followed Covid, mortgage-holders found themselves with higher costs. Some were forced to sell, while prospective buyers could no longer afford to borrow as much as before. Increased taxes - I’m looking at you, Stamp Duty in the UK - have only added to the unaffordability.

And yet, while the market may be slow and stagnant in many parts of the country and indeed the world, it is not exactly crashing.

There was one school of thought that was steadfast in all the house-price bearishness which followed Covid, saying property’s time to crash had not yet come. They were the acolytes of the 18-year cycle in real estate. Yet again they’ve been proved right.

Real estate peaks in 2026, they said. After that we get four years of decline.

You know my views on cycles.

We have the seasons, days and nights, the moons, menstruation, the cycle of life - cycles are turning all around us. There are economic and investment cycles too: bull markets and bear markets, commodities super-cycles, Gordon Brown was always blathering on about the economic cycle, mining is cyclical. New technology goes through a clear cycle as it evolves and is adopted.

On the other hand, it’s easy to look back at the past, find some random pattern and declare it a cycle. Actually trading them in real time is a very different matter. In fact, the human need for narrative and the fact that cycles make for good copy mean it’s very easy to get wedded to the idea of a cycle, when a very different reality is staring you in the face. After 2008 many got it stuck in their heads that this was Kondratiev Winter and the next Great Depression, and, as a result, missed one of the most rip-roaring bull markets in history.

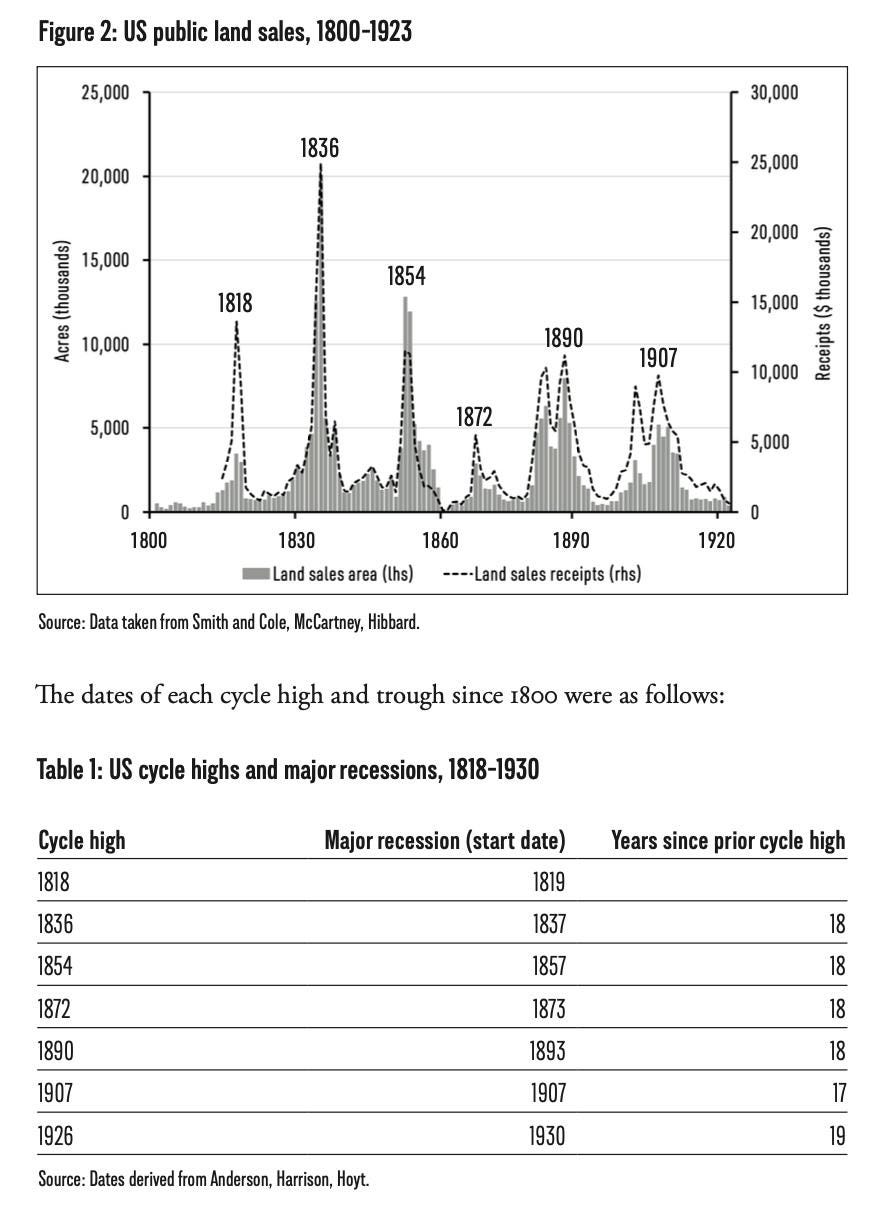

With all that said, the 18-year cycle in real estate has proved remarkably reliable, and, says Akhil Patel, author of The Secret Wealth Advantage, and one of Harrison’s great disciples, it goes all the way back to the turn of the 19th century. (I’ll show you that data in just a sec).

Looking to buy gold in these uncertain times? Check out my recent report, and look no further than my recommended bullion dealer, the Pure Gold Company. Premiums are low, quality of service is high, and you get to deal with a human being who knows their stuff.

Broadly speaking, there are four phases to the cycle - and it actually lasts about 18 and a half years.

Years one to seven. A silent rally followed by …

A mid-cycle slowdown or dip at around the seven year mark.

The explosive phase. That’s when house prices really get on the map. Think 1983 to 1989 or 2002 to 2007. In the last couple of years you get a classic blow-off top - the winners’ curse.

Finally, the correction which lasts around four years. Think 1989 to 1993 or 2008-2011. Then the cycle starts again.

Here it is, illustrated.

This is, says Akhil, “primarily a North American phenomenon, though Britain and Europe follow the US and, increasingly, emerging markets do as well.”

Here, for the historians out there, is a table from Akhil’s book that shows the data in the US going all the way back to 1800.

Recent turns of the cycle

There is no doubt the cycle has played out in the UK over my lifetime. (The US is typically 6 months to a year ahead of the UK ). From the mid-1970s through to 1989 there was an extraordinary boom in the UK, followed by that infamous crash from 1989 to 1993 and negative equity so bad that thousands simply posted their keys in the letter box and walked away from their homes. Prices peaked in the third quarter of 1989 at £63,000, before falling to £51,000.

But in 1993 things got going again. By the turn of the 20th century property erotica was all over the television, houses had become financial assets and today’s intergenerational wealth divide was just beginning to show its face.

The market peaked in Q3 2007, and declines followed, though it wasn’t such an out and out crash as 1989-93, largely because there were few forced sellers with the slashing of interest rates. The average house price then fell from £183,000 in Q3 2007 to £149,000 in Q1 2009. They fell by a lot more than 18% if you were a foreigner, however, as the pound lost a good 30% in the foreign exchange markets

It would be 2012 before the market properly got going again. We saw the mid-cycle dip around about Covid time, and now we are in the explosive phase, though in many parts of the country this is one helluva limp explosive phase. While prices are rising in some areas, the market is stagnant in many others.

It’s clear from all the leaks that Labour are looking at ways to extract some of the wealth tied up in housing. Whether that’s going to come from increased council taxes (0.5% levy of the value of the property - a number that will only go one way), capital gains tax on the sale of your main residence, increased attacks on buy-to-let landlords, increased Stamp Duty or by some other means, we do not yet know. (Labour are doing what the Tories used to do: leaking and then seeing what the reaction is).

None of that bodes well for house prices. Nor do their plans to increase housing supply via new builds, or indeed the mass exodus of people with money.

On the other hand, lower interest rates, which are coming, should give the market a boost.

Overall, my advice to any prospective buyers is to wait. I think this market is primed for big falls, but, like the 18-year guys, I don’t think these falls come for another couple of years. That said, often not buying a home means putting the rest of your life on hold, which is not a good thing to do.

If there’s a place you’ll be happy in, and you can afford it now, then do it. Cost is not always the main priority. And, of course, there’s always the possibility the 18-year-cycle guys have got it wrong.