If you missed last week’s special report, I urge you to take a look. Some of these are already starting to move, and fast .

And so to today’s piece. Tesla .

I am just back from a two-week trip to the States, and what a time I had.

I felt so privileged to be there at what feels like the dawn of a new golden age for this most amazing of countries.

The first week I spent in Palm Springs, California, visiting my mum, and the second in Naples, Florida. Quite the contrast. One was Meltdown Central, the other was in a state of jubilation. Everyone everywhere was talking about the USAID revelations.

I did not know Naples. What a stunning place. Hot, sunny, green, humid, beautiful (the architecture is lovely, even the newbuilds—that’s traditional measures for you), polite, safe, cultured, healthy, delicious food. Life seems to slow down as soon you arrive. What’s happening elsewhere no longer seems to matter. Were I to go there and settle, I think I would lose all ambition.

The problem with settling there, though, is price. It has the most expensive real estate in the US. One house was for sale for $295 million. Even Satoshi Nakamoto would wince at paying that.

“I told my kids, when they were growing up,” said Mike, who I was having dinner with, “this is not the real world. Naples is not reality. It’s something else. They needed to know that.”

I turned to his son—Matty Ice—the man who had brought me to Naples to talk tax, bitcoin, and other such things on the Runway Pod, an entrepreneur and family man in his early 30s. “Well, I’m not leaving. Why would I?”

It turns out lots of people come to Naples on a temporary basis, then decide to stay.

It’s not just Naples real estate that is expensive, by the way. The whole of the US has got super dear. I paid $18 for a pint of beer in Miami airport. I had dinner at a friend’s—he paid $60 for three steaks for the barbeque. I thought steak was cheap in the US. In a Palm Springs supermarket, I paid $4.99 for three organic onions. They saw me coming.

In general, I would say food is twice the price it is here in the UK. And that’s with a strong dollar. The country has got very expensive. Inflation is a big, big issue.

My eldest son works in recruitment—in the chemicals industry—and most of the time he is recruiting in the US. He says US workers get paid three times the money for doing the same job as a UK worker - in that industry at least,

But, whether it’s Naples, neighbouring Fort Myers, or Miami, Florida; or Los Angeles or Palm Springs, California, there is also a lot of money in America. You can see it everywhere. It is several standard deviations of wealth up from the UK. The wealth is visible in the houses—even the middle-class houses—in the cars, in the clothes, in the prices. We in the UK have been left behind. It was not always like this.

That wealth gap is only going to get bigger, as the UK continues to pursue high taxes, big regulation, mass migration, and zero growth, while the US goes in the other direction. The place is full of opportunity.

Go to the US. Move there if you can, especially if you are young. The US was already something special, but something really special is happening there: the Washington purges are cleaning the place up. You’ve read the news, you’ve been on X, you’ve seen what’s going on. You really don’t need me to tell you.

But watch what you eat.

I put on 5 pounds (2 kilos) in just two weeks. Mind you, I couldn’t stop eating. The food is yum. (People in the gym kept asking me how I got to be so lean - “by not living in America, and not eating American food” I explained).

I don’t believe this level of political reform would have happened to anything like the same extent without the involvement of Elon Musk. He really is doing God’s work rooting out all that corruption. What emerges will be so much cleaner, more efficient, more honest, and more united.

But of all the things I actually witnessed in person, do you know what most blew my mind?

I did not expect this.

It wasn’t $295 million dollar houses. It wasn’t all the private aircraft in Naples airport next to where we were recording.

It was driving in a Tesla on autopilot. I’d never done it before.

I know I am late to this, but OMG.

Matty typed our destination into his computer, put the car into self-driving mode. Off it went.

The Tesla was a noticeably better driver than I am. It positioned itself on the road well, staying in the middle of the lane at all times. It cornered beautifully. It maintained the exact right distance to the car ahead. It knew the speed limits of all the roads we drove on. It knew when the lights were changing and set off straight away. It has a 360-degree awareness—a human can only look in one direction—and knew exactly what other cars nearby were doing. It didn’t get impatient and start doing silly things like jumping lights.

With machine learning, each Tesla is feeding info back to HQ, so that every car is learning from the others’ experiences. Teslas know the roads - every inch of them - better than you, even the local roads. They are learning how to deal with every conceivable traffic incident. This data-driven driving constantly updates.

I am a backseat driver. I often push my foot down on the imaginary brake. As I was getting over my control issues, I did this at a red light in the distance. Turns out it was miles away. The Tesla braked at exactly the right time.

It got us to our destination and then reversed and parked with precision into a tight spot. I’m a good parker. The Tesla was better. Of course it was. It has 360-degree vision, and my neck is getting stiff.

The driving conditions were good. But how much better would it be in rain, fog or ice, I wondered.

Tesla, Matty pointed out, is as much a software company—a platform like Airbnb, Facebook or TripAdvisor—as it is a car company.

The next day, I had an Uber drive me from Naples to Miami airport.

The Uber driver was good, but sometimes he was doing things on his phone—changing the podcast he was listening to, updating the map. “Look at the road,” I found myself thinking. Sometimes overt the 2-hour journey he strayed from the centre of the lane. One time he braked sharply. No such imperfection in the Tesla.

Transport as we know it is about to change

The main barriers to Tesla’s self-driving progress are regulatory, but a certain Elon Musk is now in a position of influence. One of the reasons he is doing what he is doing is to clear out the regulators and bureaucrats who were so biased against him and blocked his progress—whom he came to despise.

I think the regulatory barriers to self-driving vehicles start to come down quickly. Self-driving vehicles will soon be a feature on US roads. Then what happens?

“I will have my car drop me at the office,” said Matty, “instruct it to pick me up at five, and then in the meantime I’ll put it to work”.

In other words, his car will not be idly parked all day. It will spend the day ferrying other people about. It will earn him money.

Other Tesla owners will do the same. Suddenly owning a Tesla will become potentially profitable. A car will not be quite such a depreciating asset. No doubt some will buy fleets of them. Like any platform, Tesla itself is going to take a cut of the profit.

Just to get the self-driving capability added to the software of the vehicle, you must pay another ten grand. Then comes the rent.

Leaving your car parked 95% of the time, as most of us do—my car in London can stay parked for weeks at a time—is so inefficient. Not for much longer. At least, in the US. It’ll be years before we allow it here in the UK or Europe. Of course, it will.

What happens to American roads in the meantime? Fewer people are going to own cars, especially in cities. They won’t need to. They can just call a Tesla. What happens to the rest of the auto industry? Fewer car sales.

The cost of taxis though comes down.

Drivers lose their jobs to robots. I guess something similar happens to the trucking industry too.

The roads themselves are used more efficiently, as robots drive demonstrably better, leading to better traffic flow and less congestion.

Public transport will see fewer users. Why use such a smelly system when you can travel privately in a Tesla?

Self-driving cars were a pipe dream. That is about to change. American roads are about to change.

There are other self-driving operators - Waymo, Cruise, or Mobileye - which are already fully operational in limited areas (ie driverless). They have partnered with the likes of Jaguar, Mercedes, Volvo and Hyundai, but they do not have Tesla’s end-to-end autonomy. Nor do they have Tesla’s immense network effect.

The network effect is an incredibly powerful force in the evolution of a business. It’s often more important that the tech itself (why, for example, VHS beat Betamax or CDs obliterated minidisk). It’s why I advocate bitcoin ahead of other sh*tcoins.

Tesla’s dominance of roads could be on a par with Apple’s dominance of the smartphone market. It is ahead of the pack.

So should we all be buying stock in Tesla Inc (NASDAQ:TSLA)?

Let’s take a financial overview.

Phew! It’s an expensive company. A lot of what I’ve already described must already be priced in.

With a market cap now over $1 trillion, it is among the world's most valuable companies.

Annual revenue in 2024 was $98 billion, with minimal growth on the previous year. The pro-electric narrative of a few years ago has dissipated over the last couple of years.

EBITDA for the twelve months ending in December 2024 was $15 billion. The EV-to-EBITDA, which compares the company's enterprise value to its EBITDA, stands at around 72, indicating a “premium valuation” relative to its operational earnings.

Its trailing P/E ratio is high, high, high at 177, as is its forward P/E of 124. A lot of earnings growth is expected. This could reflect anticipation of Tesla’s expansion into new markets, battery technology, and/or the self-driving revolution I have described, but it also points to a richly priced stock, for which investors are paying a substantial premium. The Price/Earnings to Growth (PEG) ratio, at 8.5, also implies Tesla is overvalued.

Any setback—some kind of bad accident, a large insurance claim, a rival technology becoming suddenly competitive—and this stock can take a big hit.

Turning to the company’s financial health and profitability, Tesla's Return on Equity (ROE) is 10.4%—I’ve seen worse—and its Return on Invested Capital (ROIC) is 6%, which denotes an efficient use of capital, something Musk is known for.

Tesla maintains a relatively low Debt/Equity ratio of 0.18, suggesting a conservative approach to leverage, which should reduce volatility. The current ratio of 2.02 indicates good short-term liquidity, allowing Tesla to meet its short-term liabilities comfortably.

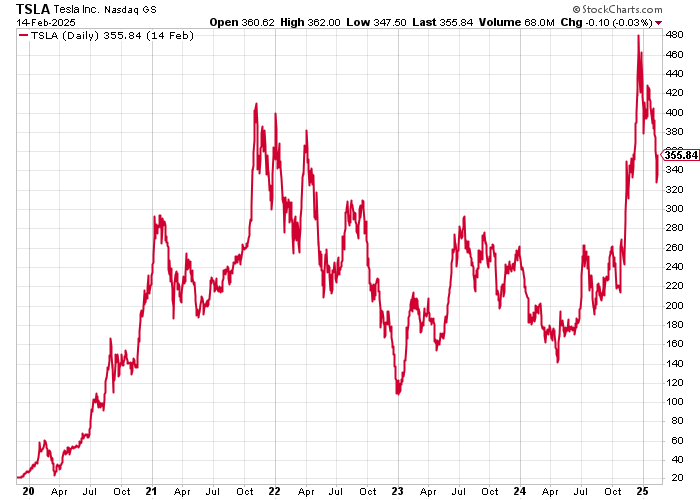

But it is a volatile stock—so perhaps one to buy on weakness. The 52-week high is $488, the low $139. You can more than double your money if you buy this well. Currently at $350 we are in the middle of the range—well up from the lows, but also well off the highs—and in a downtrend.

Analysts, meanwhile, are divided. Predictions range from $115.00 to $550.00. reflecting a wide range of expectations.

Tesla is unique. It has the potential to transform transport as we currently know it. It could have enormous first-mover advantage and a near monopoly on roads, as more and more people “put their car to work,” and what is currently an expense becomes a secondary source of income. It is the market leader, it is the technological leader, it could enjoy something of a monopoly on roads as it drives ahead of its competitors.

To maintain and grow this valuation, it needs to stay ahead of rivals, it needs to overcome the regulatory barriers it faces, and it needs to manage the many inherent risks of the automotive and tech industries.

But one thing Elon Musk has is vision. He will have seen all of this and be working towards it.

I can quite easily envisage a scenario where Tesla’s dominance of roads is near monopolistic—like Apple’s dominance of phones or something.

In such a scenario, its valuation will be a lot higher.

It’ll make money on the car, on the software, then on the rental.

It will also be the most common car on the roads.

Transport is about to change.

Disclaimer:

I am not regulated by the Financial Conduct Authority (FCA) or any other regulatory body as a financial advisor. Therefore, any information provided in this newsletter does not constitute regulated financial advice. It is solely an expression of opinion. Stocks are inherently risky. Please conduct your own due diligence and consult with a financial advisor if you have any doubts. Remember, markets can both rise and fall. I am not aware of your individual financial circumstances, so only invest money that you can afford to lose.