Two items on the agenda today.

First, my interview with Konstantin Kisin and Francis Foster for Triggernometry has been released. Here it is on YouTube, Spotify and Apple Podcasts

Second, using a different methodology to that which I used in Secret History of Gold (have you read it yet?), I am going to estimate China’s gold reserves.

I was planning to take a look at top silver pick, Sierra Madre Gold and Silver (TSX-V:SM) today, after my meeting with CEO Alex Langer last week, but I will leave that till tomorrow now, meaning you get an extra piece this week you lucky things.

China’s Hidden Gold Empire: How Much Does Beijing Really Hold?

I regard this as one of the most important subjects in geo-politics, which is why I repeatedly come back to it.

It doesn’t matter if you issue the global reserve currency, if you don’t make anything you are in the doo-doo, and this is something the Trump administration is attempting to address with tariffs, a weaker dollar and, more subtly, the managed decline of the US dollar as global reserve currency. It’s all part of Triffin’s Dilemma. As a result, neutral gold’s role as global reserve asset is re-surging.

History’s “golden” rule will soon apply again: he who has the gold makes the rules. (If you are interested in the origins of the phrase by the way, it’s all here).

This different methodology only came to me overnight, and I don’t know what the conclusion will be yet, though I suspect it will arrive at a figure which is more conservative than what I have argued previously. Here we go.

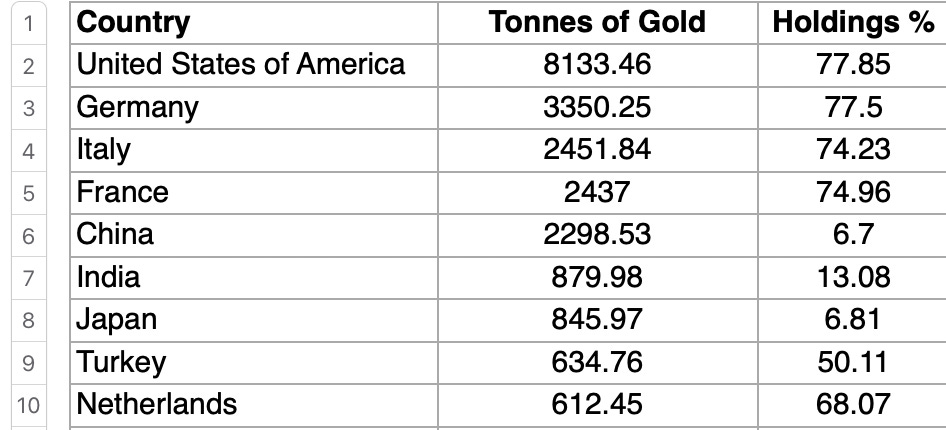

Here, for context, are world central bank holdings, as officially stated.

My argument has long been that China has considerably more than the 2,300 tonnes it says it does.

The People’s Bank of China (PBOC), by the way, is the main custodian, but other state entities, such as China Investment Corporation (the sovereign wealth fund), State Administration of Foreign Exchange and the army also own gold.

Remember China is the world’s largest importer of gold, the largest consumer and the largest producer. it’s been that since 2007 when it overtook South Africa.

I am going to use round numbers, as they are more digestible, and when there is a spread - eg 500-1,000 tonnes, take the middle number, ie 750 tonnes.

It is impossible to know just how much gold China has imported, because so many transactions are private, particularly those which go through London, Switzerland or Dubai. The Hong Kong gold is better disclosed.

However, most - though not all - of the gold which goes to China goes through the Shanghai Gold Exchange (SGE). SGE withdrawals from 2007 to mid 2025 total 29,500-30,000 tonnes, based on aggregated data from the Shanghai Gold Exchange (SGE) and World Gold Council (WGC) reports.

However, the SGE is just a flow metric. It does not represent total consumption. Some of that gold which passes through will have been double counted, either as a result of re-selling and re-cycling, or because of China’s booming money-laundering business and the circular trade with Hong Kong. Estimates for double-counting range from 10% (World Gold Council) to 30% (analyst Koos Jansen). Let’s take the middle 20% figure - 6,000 tonnes - and that leaves us with 23,250 tonnes of SGE gold.

Undisclosed gold

The PBOC likes 400oz bars, as traded in London, and these do not trade on the SGE, which uses smaller kilo bars, 3kg or 12.5kg bars. 400oz is about 12.4kg by the way. So a lot of those London imports will not go through the SGE, and so are in addition to the numbers above.

Analysts mostly concur that, while reported imports via London, Switzerland and Dubai total 3,500-4,500 tonnes, another 2,000-3,000 tonnes (mostly post-2009, accelerating since 2022) have gone unreported.

2,500 tonnes is the middle figure, then. Add that to the 23,250 tonnes of SGE and our total is now 25,750 tonnes.

If you live in a Third World country, such as the UK, I urge you to own gold or silver. The bullion dealer I recommend is The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, the US, Canada and Europe or you can store your gold with them. More here.

Chinese gold production

Around 55% of Chinese gold production is state owned, and this century China has mined roughly 7,500 tonnes.

70-80% of Chinese production is sold through the Shanghai Gold Exchange (SGE) - so we have already counted that - the other 20-30% goes to the state.

Using estimates from the mid-range. 25% of those 7,500 tonnes, therefore - 1,875 tonnes - has gone to the state. The rest has been sold through the SGE.

Add 1,875 tonnes to the total and we are at 27,625 tonnes.

By the way, I have not included overseas Chinese gold production, of which there is a lot. Some of this product is sold on international markets and never actually reaches China. But what does reach China gets sold through the SGE and so has already been counted.

Finally, we have to add in gold held in China, whether as bullion or jewellery, prior to 2000. The World Gold Council estimates a figure of 2,500 tonnes in privately-held jewellery. Added to domestic mining and official reserves, you get a figure of around 4,000 tonnes.

This brings our grand total to 31,625 tonnes of gold in China.

Putting it all together

Previously, I have argued that 50% of that gold would go to the state. That would mean roughly 16,000 tonnes. Almost twice as much as the US’s reported 8,100 tonnes! When audit?

My thinking has changed.

Let me propose another methodology. And this has come as a result of my conversation with Konstantin (see above).

Annual gold demand last year was roughly:

Jewellery 47%

Investment 25%

Central Bank 23%

Industry 6%

This obviously varies from year to year, with investment and central bank demand being the big variables. But if we assume Chinese demand roughly matches global demand (this is an easy argument to challenge), that would mean that of the 31,625 tonnes:

14,864 is now jewellery

7,910 is now bullion held by investors

1,900 tonnes went into manufacturing

And, drum roll for the Big Kahuna

The Chinese government has 7,294 tonnes.

Obviously, it’s easy to make the case that since China is such a big manufacturer, Chinese industrial demand is likely to be higher than 6%. It’s also easy to make the case that, because the Chinese like gold so much, and the state has been encouraging them to invest since 2007, that both Chinese jewellery and investment demand is higher than 47% and 25% respectively.

It’s also easy to make the case that, because of de-dollarisation, PBOC demand is higher than 23%.

In any case, I have been transparent about my methodology. You can make up your own minds. You’re all grown ups.

Maybe my 20% estimate for SGE double counting is too low, for example.

Regardless, China’s stated reserves of 2,300 tonnes are laughingly lowball.

In a funny kind of way, it’s actually better for investors if China has less gold - because it means they have more buying to do and that should help drive prices higher.

Its stated 2,300 tonnes only account for 7% of its US$3.4 trillion reserves. To get above 70% and match the US, Germany, France and Italy, at $4,200/oz gold, it would need something like 18,000 tonnes. That’s a lot of buying yet to come.

Why does China understate its reserves? Softly, softly catchee monkey, and all that: we must not shine too brightly. It doesn’t want to rock the boat, particularly while it’s still accumulating.

This is where we are going, folks.

You want to own gold.