Good morning to you,

We are talking Japanese currency today.

First, in case you missed them last week, check out:

The story of my pilgrimage got a big and positive response from readers.

This piece on the true value of UK housing also got a big response.

If you haven’t already, and if speculative silver mining stocks are of interest: watch this interview with Alex Langer of Sierra Madre Gold and Silver.

And, finally, a big thank you to all who came to my gold lecture on Thursday. What a great night. A reminder that due to sell-outs, we have added some extra London dates - February 14th and 15th. You can get tickets here.

Right, the yen. I can’t help thinking there are some real opportunities coming …

The currency has been weak as hell for a long time.

Against the US dollar it is at lows not seen since this century. We all know what a rotten currency the pound has been. It has lost a third of its purchasing power just since 2020. A third! Against the constant that is gold, it has lost 90% of its purchasing power since 1999.

And yet against the yen, the pound is at seven-year highs, not far off the pre-2008-financial-crisis levels. In those days a pound got you two dollars, instead of the $1.21 it gets you today.

In terms of trading volume, then yen is the third most important currency in the world, after the dollar and the euro, accounting for around 17% of global daily forex turnover. Given that is thought to be $7.5 trillion, we are talking about around $1.3 trillion of daily trading volume. No small beer.

Why has the yen been so weak?

The main reason is that, while other central banks, especially the Federal Reserve, have raised rates, the Bank of Japan (BoJ) has not. It has ignored rising inflation (perhaps because Japan has had issues with deflation for so long). Indeed the BoJ has been creating digital money and buying extraordinary amounts of government bonds with it in order to cap rates. The BoJ now owns over half of Japanese national debt. My mind boggles when I read stuff like that. How can it be possible to print so much money and buy so much debt without apparent consequence? This is BoJ’s so-called yield curve control.

I wish they’d print money and buy me a mansion. Or even just a nice car.

Suppressed rates lead to the yen carry trade - borrowing yen at a cheap rate and holding other currencies that pay a better yield. But when the carry trade reverses, as in 2007-8, it tends to reverse very quickly.

The yen, as a result, also tends to act as a safe haven currency: during times of panic, such as we saw in 2008, there is rapid flight to the yen in a rush to unwind the carry trade.

Here is a very long term chart of dollar-yen going all the way back to 1987. (When the chart is rising, so is the US dollar).

The dollar made its low - or the yen its high, depending on how you view things - in late 2011 and 2012. Since then the yen has halved. 50% declines for a major currency is kind of a big deal.

Look at the speed at which that thing came down between 1990 and 1995, between 1998 and 1999, from 2007 to 2011 and in 2015-16. When that thing moves, it moves. (We’ll come to another yen currency pair that moves even faster in just a moment).

Here’s the last three years zoomed in. Kind of very double toppy.

I’m not going to pretend to be any kind of an expert on Japanese policy, plans or goals, but I ask, at a certain point, if the BoJ will step in to shore up the currency? Surely they must. Everything I read tells me they will. If so, at what point?

The 150 level is one commonly cited number. 150 is where we are now. But I stress this is only rumour.

A related question is: how long will so-called yield curve control go on for? Indeed, how long can it go on for?

Again, I can’t pretend to know the answer. Little old me is struggling to get his head around the fact that it has even been able to go on at all, let alone this long.

So to that yen currency pair that really moves. Ooof, take a look at this one. This is where I think the money is going to be made.

The British pound and the Japanese yen

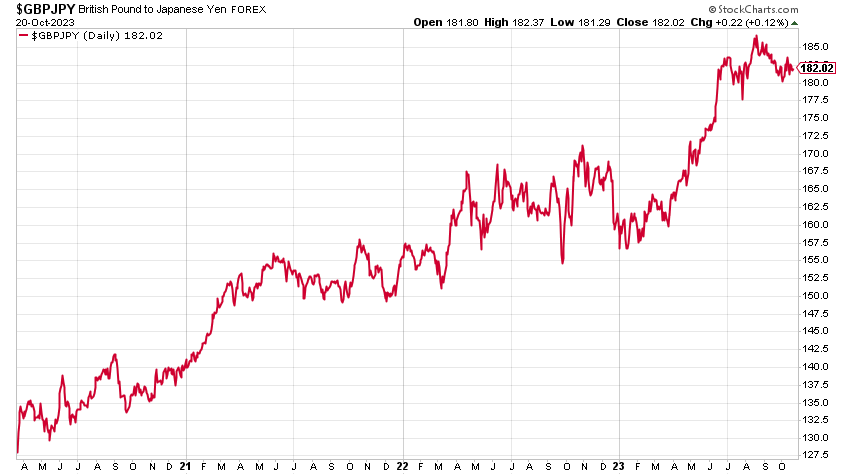

Here’s a long term chart. (When the red line is rising, the pound is rising and the yen is falling. And vice versa).

Again, during those periods of yen strength, this thing came down like a stone. Between 1990 and 1995 (especially 1992 - that was Black Wednesday in the UK). From 1998 to 2000. 2007-8 - Gosh! it really came down then. And then 2015-16.

It also ties in with my 8-year cycle of the pound: it is even more apparent when viewed in yen.

As so much of the British economy is built on finance, sterling tends to be strong when financials are strong. It sells off during market panics - which is when money flees to the yen. Thus the pound and then yen are inverted.

Sterling has been weak against most currencies since the summer. Cable (pound-USD) has gone from $1.31 to $1.21. The 8-year-cycle in the pound seems to be playing out again. But against the yen it has hardly moved. It’s the same price it was in June-July.

Here is pound-yen since Covid. Does this trend continue? Or is it exhausted?

Most of the 2020 Covid trades - the boom in tech, in commodities, in bitcoin - have played out and unwound. But not the decline of the yen. It is still going strong. There is some catch up to be had.

When does it end? That’s the question. There may still be some gas in the tank, but I’m starting to think sooner rather than later - if only because so few people are talking about it. I asked three different finance WhatsApp chat groups that I’m on if anyone had any decent yen material. Nobody came back with anything. Such things are often a good, contrarian sign. Nobody rings a bell at the top of the market, unfortunately. But this is one to watch.

Forex trading is extremely difficult. There is so much that can go wrong, especially to do with risk management, position sizing and timing. I don’t recommend it unless you know what you are doing. But I feel there could be an opportunity here.

Thank you for reading. Thank you for being a subscriber. Until next time …

Disclaimer:

I am not regulated by the FCA or any other body as a financial advisor, so anything you read above does not constitute regulated financial advice. It is an expression of opinion only. Please do your own due diligence and if in any doubt consult with a financial advisor. Markets go down as well as up. I do not know your personal financial circumstances, only you do, but never speculate with money you can’t afford to lose.