I don’t normally put out market commentary on a Sunday, especially on a Sunday evening, but the events of last week were so extraordinary I feel I have to.

We are in full-on crash mode, it seems. The price action reminds me of the Covid panic or even 2008. It almost doesn’t matter what you own. Portfolios around the world have been battered.

The declines in the final two days of last week, since so-called “Liberation Day”, when President Trump announced his tariffs, are roughly as follows:

Bitcoin: -1%

Gold: -3%

S&P 500: -9%

Nasdaq: -10%

Brent Crude: -12.5%

Copper: -13% (phew!)

Magnificent Seven:

MSFT: -6%

GOOGL: -7%

AMZN: -13%

META: -14%

NVDA: -15%

TSLA: -15%

AAPL: -17%

We are, of course, very long gold and bitcoin here at The Flying Frisby, so I guess we’ve come out of this comparatively unscathed. What’s more, we have a good allocation to wealth preservation in the Dolce Far Niente portfolio. But our speculative positions, like everyone’s, have been hit, and I’m angry with myself for not getting more defensive sooner. I’ve been saying for some time I don’t like the price action one bit- eg here and here - and the words of that freaky preacher keep ringing in my ears.

In any case, there’s no point beating myself up. Life is easy in hindsight. Investing is even easier.

I spent considerable time on Friday and Saturday reading and watching interviews, trying to understand exactly what these tariffs are about and what the implications are, and I think I have come up with something of a roadmap.

We’ll start by explaining the plan. Then we’ll look at what comes next. And, finally, we’ll look at what to do with some of our recent speculations.

Why our opinion is irrelevant

I’m a free-trade guy, or at least I was. I’m not quite sure what I am any more. But I’m not going to waste my time - or yours - here with arguments about whether tariffs are a good thing or not. There’s no point. My time - and yours - would be as well spent howling at the moon. As far as I know, Donald Trump isn’t a reader of The Flying Frisby. He knows his own mind and he’s not going to turn to this Substack, or any of our social media feeds, for policy advice.

Tariffs are here, and they’re here to stay. Trump is attempting a major economic redesign - the kind of reset that those who rail against economic injustice have been calling for for years. Now it’s here, and as we look at our portfolios, many of us aren’t so sure we want it.

What I want to understand, first, is the logic behind the tariffs, then their implications, so we can best navigate them.

The first thing to note I’ve already said: Trump isn’t going to backtrack. As I watched tumbling share prices on Friday, I thought to myself—he’s going to backtrack. He has to. But Trump isn’t the Conservative Party, or indeed the Labour Party, changing tack at the slightest sign of discontent.

Critics say he’ll cave if stocks keep tanking, I’m not so sure. His track record suggests otherwise, and he’s put a loyal and strong team together to back him up and implement his plan.

He’s going to give his tariffs longer than a couple of days to have an impact.

Many say Trump hasn’t properly thought this through. Of course, he has. He’s been thinking about it night and day for years. He’ll have been thinking about little else as he wrestles with the problem of how to reinvigorate industrial America. That doesn’t mean his plan will work, but the idea he hasn’t thought about it is just a facile invention of Trump perma-critics to use against him.

Trump may be a bit of a clown - he has a comedic instinct and can’t resist a gag - but he’s not stupid. Clowns rarely are.

Why Trump’s doing what he’s doing

Trump intensely dislikes the decimation of industrial America, which began in the 1980s and still continues, with the outsourcing of manufacturing to Asia and elsewhere. Even 40 years ago , he was giving interviews about this (hence why I say he has thought it through) and he wants to restore it. That’s part of what he means when he says, “Make America great again.”

He can see that while the American coasts may have thrived, thanks largely to finance and tech, much of what is in between has not. This is the America he wants to make great again.

There are two reasons he wants to revive American industry.

First, is that he believes the model by which America takes on debt to buy cheap stuff from China is unsustainable and has to stop - and the sooner the better. So it’s for the good of the American economy.

Second, is for reasons of security. While China and the US may be trading partners now, they are also rivals, and if your rival is making your essential military and strategic equipment and components, whether it’s semi-conductors, industrial and consumer electronics, pharmaceuticals or battery and energy storage systems, you have a big problem on your hands. Covid exposed just how fragile supply chains are, and Trump has taken it as an early warning sign.

Something very similar, as readers of Daylight Robbery will know, happened in the US after its War of 1812 with the British, a war that lasted three years. The war badly exposed US over-reliance on British industrial goods, so the US introduced tariffs in 1816 to try and nurture and grow its own industry. Those tariffs ended up having grave long-term consequences (they were a major factor in the lead up to the civil war - but that was 45 years later). In the short term, they worked. (More on this here).

Coming to America

“Come and build your factories in the US,” Trump is saying. “Then you won’t pay tariffs. Relocate from China, Mexico, Vietnam.”

Here’s a case in point. Jaguar Land Rover has already announced it’s halting shipments to the US for one month. Now, this company’s management - remember its recent rebrand? (see below) - is on the opposing side of the culture war to Donald Trump and MAGA, so that is one factor at play. But when I wrote my piece about how good self-driving Teslas are, a lot of people commented that the Jags are better. I don’t know—I haven’t been in one. But for sure, Jaguar Land Rover won’t want to lose momentum or network effect in this all important arms race, particularly while Tesla is struggling: 45% off its recent highs, victim to nationwide vandalism and Elon Musk no longer the darling but the villain of the eco-warrior left. So what does Jaguar do now? Not sell into the all-important US markets? Pay 25% tariffs? Or build a factory stateside? I think the answer is fairly obvious.

Whatever it chooses to do, it’s going to take longer than a couple of days.

With DOGE and the shrinking of the US state, meanwhile, there’ll be plenty of workers to fill those new positions. As the US state shrinks, its private sector grows. That’s the idea, anyway.

His tariffs may lead to higher prices for American consumers, as many have pointed out, but not as high as widely thought, argues Treasury Secretary Scott Bessent in this recent interview with Tucker Carlson (a recommended watch, by the way). Bessent’s calculations are that tariffs won’t gouge consumers as much as feared. What’s more, the revenue from tariffs could eventually enable lower levels of taxation back home, which will further ease pressure on US citizens, those who work at least.

What about the upheaval Trump tariffs cause to the rest of the world? Not his problem. America first.

Yet he’s creating enormous uncertainty, and markets are tanking. On Friday, markets were in full panic mode, and the baby was being thrown out with the bathwater. What about that?

The amazing stat which shows why Trump won’t give two hoots about the stock market - for now

At this point, I want to press upon you one of the most telling statistics I’ve seen for some time:

The richest 1% of Americans own 50% of US stocks, worth $23 trillion.

The bottom 50% of U.S. adults hold only 1% of stocks, worth $480 billion.

If you expand to the top 10%, that group holds 87% of stocks, valued at $36 trillion.

If I’m correctly inferring Bessent’s comments, at this current point, Trump doesn’t care about Wall Street, or Silicon Valley, or the parts of the US economy that have become so rich over the past 40 years. It’s the bottom 50 - or even 80% - that Trump is concerned with. They hardly own any stocks, so the market mayhem won’t matter so much to them. Wall Street has made good for decades. It can suffer a bit of pain while Main Street gets rebuilt.

It’s worth noting, by the way, that US equities were enormously overvalued when Trump took office, so some kind of correction had to happen anyway. The Shiller price-to-earnings ratio was at its third highest level in history (the only times it was higher was 2000 and 2007, and we all know what happened next). That’s why Warren Buffett built up his enormous cash position two months ago ($330 billion). Buffett, by the way, really is a genius.

Best to get the inevitable correction out of the way early in the Presidency. What’s more, as Bessent points out, these market declines began several weeks ago with China’s AI announcement of DeepSeek, the app that can do everything ChatGPT and Grok can do with much lower power use. Prior to that, the Magnificent Seven had driven the extraordinary gains seen in the S&P 500 over the previous 18 months. Strip them out, and the picture was much less rosy. (Now the Mag7’re down 30-45%).

Trump’s announcement may have pricked the bubble, but a bubble is still a bubble and if one thing doesn’t burst it, something else will.

Trump’s plan, meanwhile, (and I’m not saying it’ll work, everyone will have their opinion) is not to boost the stock market. It is to reset the economy. The economy and the stock market are not the same thing.

Some numbers

The US is trapped in a vicious debt spiral.

$36 trillion is the current US National Debt. The US will spend $6 trillion this year, while only collecting $4 trillion in tax revenue. So there is a $2 trillion deficit. It will borrow the difference, and the debt will grow to $38 trillion.

The DOGE plan is reduce the deficit by 1 trillion by getting rid of waste, corruption and more.

The tariff plan is to raise another half trillion in revenue. Plus, as a result of tariffs, more business relocates to the US, which also increases revenue. Mass deregulation will also make doing business easier and further add to both economic growth and tax revenue.

Then there is Trump citizenship plan. According to Grok, 1 million people worldwide could realistically afford to buy a US residency for $5 million. Let’s say 10% of them did that. That’s another $500 billion and the $2 trillion deficit is eradicated.

Suddenly the US is running a surplus.

This all means the US gets in a better position to lower taxes, which will further increase revenue (the golden rule of Daylight Robbery), because trade will increase as a result. Trump could lower corporation taxes to 15% which would be a lot more attractive than the rates of 20-30% paid in Europe. So business relocates to the US. He could lower income taxes, especially for high earners, thereby attracting higher earners to the US.

Meanwhile, the cost of all that debt starts to come down, thereby freeing up even more capital.

And, suddenly, you are in a virtuous cycle.

These numbers make it look easy. But to get there takes an enormous fight - standing up to vested interests, taking on a cultural establishment that detests you, the media, the woke, Trump Derangement Syndrome and so on. It’s not easy, and it requires a lot of backbone.

The three essential keys to the Trump reset

So what fundamentals does this economic reset need, and how does the US get there?

First, it needs cheap energy. Cheap energy is fundamental to economic growth: economies need energy. That’s happening. Crude has fallen more than 10% since “Liberation Day”. Falls were turbocharged when, on Thursday, 8 OPEC nations made the surprise announcement that they were ending output cuts and increasing supply. Plus we have the domestic policy of drill baby drill. What with the plethora of natural gas and other shale energy co-products, we’re going to see a lot of cheap energy. (Which is going to make our own Ed Miliband’s high-energy-cost policies look even more deranged.)

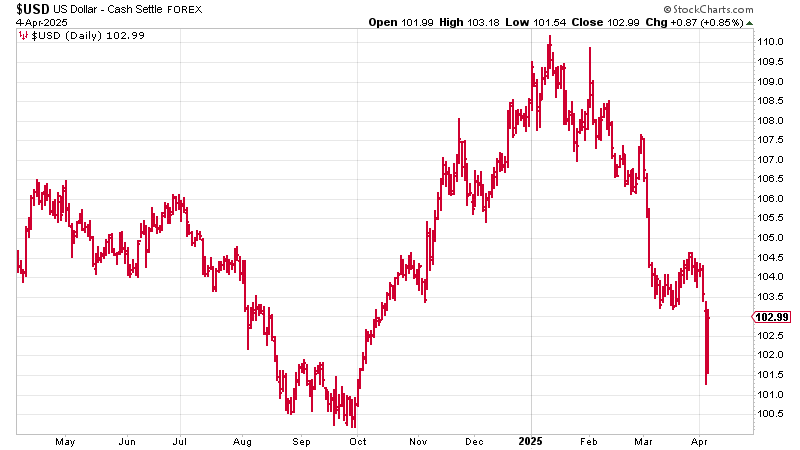

Second, it needs a cheaper dollar. A weaker dollar will encourage investment and relocation from overseas (it makes the US cheaper). That’s happening too. Indeed, what was so unique about this week’s panic is that the dollar—usually the first port of call in a financial storm—didn’t rise (at least not at first). Here is the US dollar index. It’s coming down. It’s already down almost 10% from its highs. That means America just got 10% cheaper to invest in. A move back to the low 90s, or even below, would be ideal.

What is the third component?

And what next for markets?