Please do not share, copy, reproduce or distribute any part of this report without my express permission. Thank you.

Many thanks to all the new subscribers who have joined this week, both paid and unpaid. I put this video of my recent North Sea Oil piece up on YouTube, X et al and it generated something of a flurry.

So welcome. I hope you both enjoy and benefit from The Flying Frisby.

Before we get started I just wanted to note that Comstock Lode seems to be catching a nice tail wind, which is good. Enjoy the ride. The AGM is later today for the keener of you out there.

But we are looking at bitcoin today, and exploring an alternative way to invest in it.

I’m going through one of those phases where I feel like I don’t own enough bitcoin.

So I’ve bought more.

And I’ve bought it in my SIPP - UK-speak for my retirement account.

I’ll explain how in a second.

Let’s just have a quick look at the bitcoin price, and note that we are once again breaking out to new highs.

I know it feels like you are late to the bitcoin story, and yes we all wish we bought it at $10, when we first heard about it. But we didn’t. We are where we are, and this story is a long way from being over.

The next chapter in the odyssey is corporate adoption, and that story is just getting started.

I explained the bitcoin corporate treasury model a fortnight ago here, and I’ve made the article freely available to all, so please take a look, but the TLDR is this.

Following a template set by billionaire genius Michael Saylor, more and more companies are converting their treasuries to bitcoin as a means to store value and escape currency debasement. Not only that, they are issuing paper—stock, debt, convertible notes—and using the capital raised to buy more bitcoin. In effect, they are creating fiat money from nothing—it is a debt-based system, after all—and using it to buy a finite digital resource (one that, of course, cannot be created through debt).

Many are scratching their heads and saying, “How can this be? It’s not possible! It’s a bubble.”

What Saylor is actually doing, among other things, is exposing the flaws of debt-based fiat currency. There are now some 70 companies employing this strategy. This will eventually be a stampede, which I urge you to front-run. Corporations have much deeper pockets than private investors, meaning this latest cycle in bitcoin’s mass adoption could become a mega mania.

Shareholders welcome dilution if it means more bitcoin.

The problem of corporate dilution has been flipped on its head. Once, if a company issued 20% more stock, you would expect the stock to fall by a concomitant amount to reflect the dilution. But if you’re using paper to buy bitcoin, the reverse applies. You can’t dilute enough. The purpose of a bitcoin treasury company is to acquire as much bitcoin as possible on behalf of all shareholders, by whatever means.

Here is a case in point.

Japanese hotel company Metaplanet (3350:TYO) had a small chain of low-budget hotels across Southeast Asia. Covid decimated the business, and it never fully recovered.

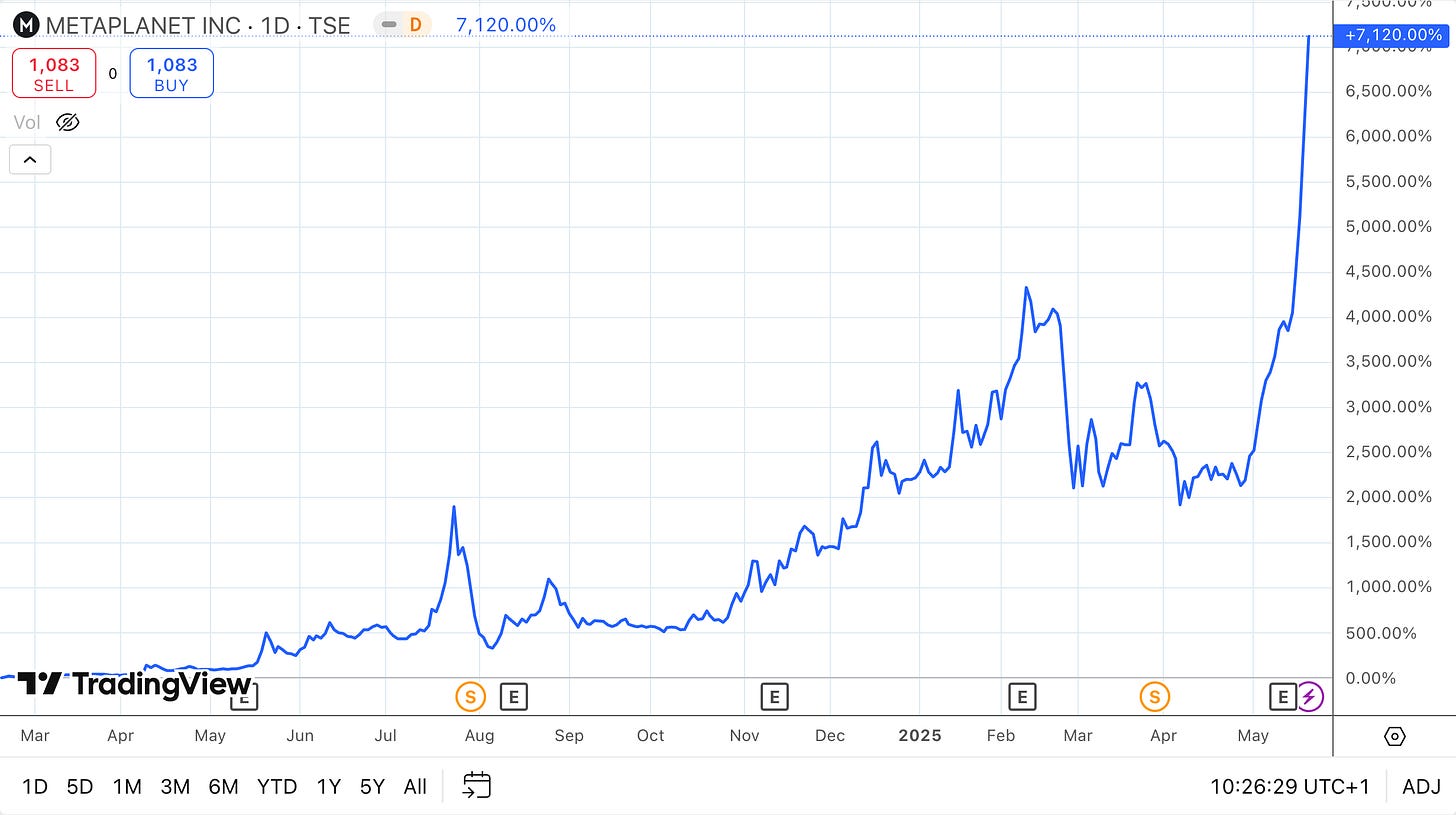

A year ago, seeking a new direction, CEO Simon Gerovich began copying the Saylor model and started using his cash flow to buy bitcoin, then he began issuing debt. Since spring 2024, when the company began its strategy, the stock has risen thousands of percent from below ¥20 to north of ¥1,000. Last year, it was one of the best-performing companies in the world, if not the best. How about this for a chart?

In the time that bitcoin has risen 60%, Metaplanet has risen more than 7,000%. (Saylor’s Strategy (NASDAQ:MSTR) has also outperformed bitcoin. Bitcoin treasury companies give you gearing).

With its crap currency and suppressed bond yields, bitcoin is an obvious place for Japanese investors to put their capital, except the government has got in the way.

As with the UK, dumb regulations make it very hard for Japanese investors to buy bitcoin directly. (This came as a result of Mt. Gox, the first bitcoin exchange, which went bust after being hacked in 2013-14). To give you an idea how ponderous things are, to register with a bitcoin exchange in Japan , regulators demand you get a letter by snail mail to verify your address. Nuts.

What’s more, when the Japanese sell, they must pay capital gains tax at 55%.

But Metaplanet is a Tokyo-listed company, so investors are buying that instead in their retirement accounts and via their brokers. Far less hassle. Just as, back in 2023, I urged UK readers to buy Strategy as a way to play bitcoin (we are up around 1,000%), Metaplanet has become Japan’s bitcoin vehicle—indeed, much of Asia’s.

For several days in a row, the company has gone limit-up, and trading has been halted. The mother of all short squeezes seems to be taking place. It’s the most shorted stock in all of Japan - and the short sellers are struggling to cover.

This bubble has, quite literally, been caused by state regulation. We wouldn’t be in this situation if it was easy to buy bitcoin. It’s enough to make you a libertarian. It’s amazing that both Japan and the UK were at the vanguard in bitcoin’s early days. Satoshi Nakamoto had a Japanese name and used British English. Now we are both retarded (in both the old sense of the word and the new).

How to profit from the mania

In the UK, Avis-listed The Smarter Web Company (ISIN: GB00BPJHZ015) is now following suit, as several readers have pointed out to me (thank you). It’s gone from 5p to 45p in a month. Currently, The Smarter Web Company has a market cap of £72 million, while it holds only £3 million in bitcoin (rounded numbers). Insane, you might think. Probably.

Bitcoin Treasury Companies are outperforming bitcoin. They are the new sh*tcoins.

So which bitcoin treasury company have I gone for?

Here is how I am playing all this.

This brings us to the question of how to value bitcoin treasury companies. We have a methodology: mNAV.

To calculate a company’s mNAV, you divide its market cap by the value of its bitcoin treasury. Thus, The Smarter Web Company has an mNAV of 24 (£72 million market cap divided by £3 million in holdings).

A higher mNAV means the company can issue new shares at a premium to its bitcoin holdings, which allows the company to raise capital more efficiently, since it acquires more bitcoin per share issued. This increases the BTC yield (bitcoin per share).

Welcome to the new normal.

Once you have established the mNAV, you have to look at the amount of time required to cover mNAV. Can the company’s BTC yield (the amount of bitcoin it is acquiring) can justify its mNAV premium?

The Smarter Web Company, I’m not sure. The company has only just listed, it’s on a tiny exchange and it’s all a bit frothy for me at this stage.

Metaplanet feels too frothy for me as well, plus, as a Japanese company, it’s not something I’m able to buy through Interactive Investor where I have my SIPP and ISA.

Strategy (NASDAQ:MSTR) has an mNAV of roughly two - it is valued at twice its bitcoin holdings - and its bitcoin yield in 2025 is roughly 16%, meaning it will take ~19 months to cover its mNAV.

The company I’ve bought is Semler Scientific (NASDAQ:SMLR). Semler Scientific’s day job is to supply technology products and services to healthcare providers. Chairman Eric Semler freely admits it had become a zombie company, though it is turning a corner, he says.

I don’t really care. I’m interested in its bitcoin.

It has a market cap of about $500 million, about $100 million in debt, and 3,808 bitcoins (worth about $400 million), so its mNAV is 1.2. It has a bitcoin yield of 22% YTD, which works out at 56% annually. Thus, it has around 5 months to mNAV cover.

(If this is all scrambling your brain, get Grok to do the work for you. That’s what I did).

Semler spells this all out very nicely on its dashboard.

I’m also tempted to go for GameStop (NYSE:GME), as previously mentioned. But for now it’s Semler.

I have to say, despite the methodology described above, I’ve gone for Semler largely because I like the chart. There’s a nice floor at $30—set during the Tariff Tantrum (across the board that panic has given us some really useful lines in the technical sand).

Now that bitcoin is breaking to new highs, I feel SMLR could catch a bid and quickly move back towards its old highs around $80, almost double where it is today, where it was last time bitcoin was above $100,000.

So that’s what I have gone for.

If you have any insights into the new business model bitcoin corporate treasury companies, please let me know in the comments.

Disclaimer:

I am not regulated by the FCA or any other body as a financial advisor, so anything you read above does not constitute regulated financial advice. It is an expression of opinion only. Tech stocks are famously risky, , so please do your own due diligence and if in any doubt consult with a financial advisor. Markets go down as well as up. I do not know your personal financial circumstances, only you do, but never speculate with money you can’t afford to lose.

Please do not share, copy, reproduce or distribute any part of this report without the express permission of the author.